Retailers and distributors are shifting away from national names as store-brand hygiene products claim an all-time high 21.2% dollar share of the market. This migration is no longer just about offering a budget alternative; it is a strategic move to capture a segment of the US private label market that is heading toward a $280 billion valuation by 2026. Buyers who can balance consistent quality with efficient supply chain control stand to gain the most from this growing consumer preference for value-driven essential goods.

This guide details the steps for building a profitable brand, from choosing between sustainable bamboo and traditional wood pulp to navigating the technical side of custom embossing. We break down the logistical trade-offs between paper and plastic packaging, explain how to manage standard MOQs of 30,000 to 50,000 rolls, and analyze the cost differences between FOB and CIF pricing models. You will also find a breakdown of international safety standards like REACH and FDA compliance to ensure your product meets global regulatory requirements.

The Growth of Private Label Hygiene Brands

Private label hygiene products are outperforming national brands, reaching a record 23.2% unit share by 2026. This shift is driven by a 4.4% growth rate in store brands compared to just 1.1% for name brands, as consumers prioritize value and quality consistency in essential paper goods.

Market Penetration and Consumer Value Shifts

Retail data shows a significant migration toward store-brand hygiene solutions, with private label dollar share hitting an all-time high of 21.2%. This movement reflects a broader shift away from premium-priced national brands as shoppers seek comparable quality at lower price points. The momentum is particularly visible in volume metrics, where unit sales for store brands grew by 4.4% in the first half of 2025, effectively quadrupling the 1.1% growth rate observed in traditional name brands.

The personal hygiene segment plays a vital role in the expanding US private label market, which is on track to reach a $280 billion valuation by 2026. This expansion demonstrates that store brands are no longer viewed as mere budget alternatives but as primary choices for household essentials. Retailers are successfully capturing market share by maintaining tight control over supply chains and pricing structures that national competitors struggle to match.

Regional Demand and Category Projections

The global landscape for personal hygiene is projected to reach $808.12 billion by 2033, maintaining a steady compound annual growth rate of 3.15%. Regional performance varies, with the Asia-Pacific territory leading the surge at a 4.3% growth rate. Meanwhile, the European market remains a powerhouse for private label adoption, with valuations expected to hit $276 billion as consumers across the continent increasingly favor retailer-owned hygiene lines.

Specific categories within health and beauty are sustaining positive momentum, with growth rates of 0.3% and 0.4% respectively. These figures support the continued expansion of household paper goods and bath products. As the global private label market moves toward a 2034 projection of $1.62 trillion, hygiene brands remain a cornerstone of this growth, fueled by consistent demand for daily necessities and improved manufacturing standards that align with consumer expectations for performance.

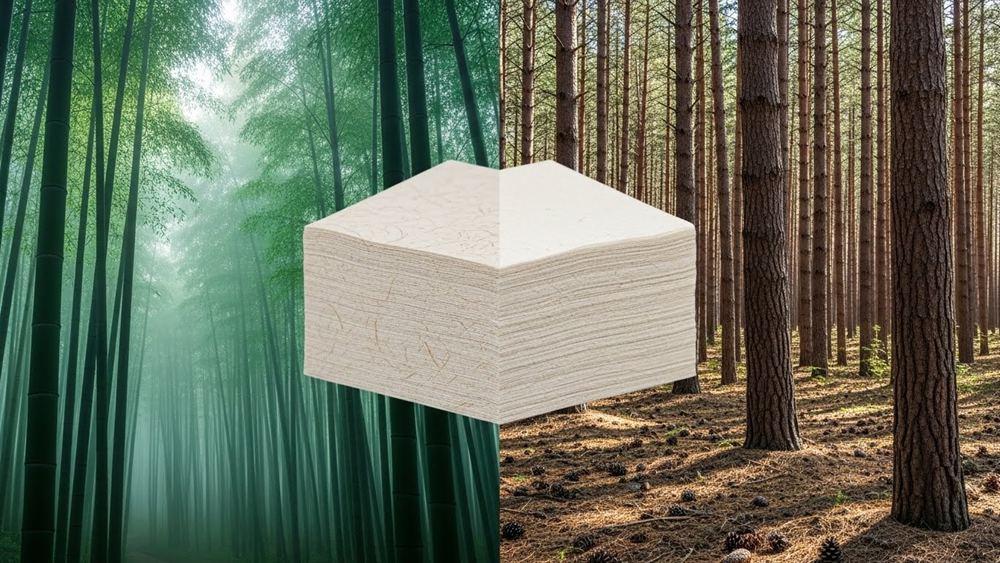

Selecting the Right Base Material (Bamboo vs. Wood)

Bamboo offers a superior sustainability profile with a 3-5 year regrowth cycle and 45% lower carbon emissions compared to traditional wood pulp. While virgin wood pulp remains the industry standard for soft, affordable 2-5 ply tissues, bamboo provides higher tensile strength and appeal for eco-conscious markets.

Environmental Performance and Growth Cycles

Bamboo matures for harvesting in 3-5 years, which creates a rapid renewable cycle compared to hardwood trees that require decades to reach production size. This efficiency allows for a continuous supply without the long-term land commitment associated with traditional timber. Production data shows that bamboo toilet paper generates 45% less life cycle carbon emissions than the global average for recycled alternatives, helping brands meet strict environmental targets.

The natural cultivation of bamboo requires zero pesticides or supplemental irrigation. Crops rely entirely on rainfall, which preserves local water tables and prevents chemical runoff into surrounding ecosystems. Manufacturers use mechanical pulping for bamboo to support chlorine-free bleaching processes, ensuring the final product remains free from harsh chemical residues that often accompany industrial wood pulp processing.

Fiber Durability and Technical Specifications

Bamboo fibers are naturally longer and smoother than wood fibers. This physical structure reduces dust accumulation between paper layers, providing a cleaner experience for the end user. While 100% virgin wood pulp provides maximum softness for 4-ply and 5-ply luxury retail products, bamboo excels in structural integrity. Its superior wet strength and absorbency suit commercial applications like jumbo rolls and kitchen towels where durability is a priority.

Septic safety tests indicate that bamboo disintegrates efficiently without the need for chemical additives. It breaks down quickly once saturated, which minimizes the risk of clogs in older plumbing systems or low-flow toilets. This balance of high tensile strength during use and rapid degradation after disposal makes bamboo a versatile choice for private label brands targeting both performance and utility.

Custom Embossing: Branding Your Paper

Custom embossing uses engraved steel cylinders to press 3D patterns into tissue webs, enhancing both brand visibility and physical properties. In 2026, brands use this technology to improve liquid absorbency, ply bonding for 2–5 ply products, and perceived softness while creating a distinct shelf presence through unique logos and motifs.

Mechanical Branding and Aesthetic Patterns

Manufacturing facilities use chemically or mechanically engraved steel cylinders from specialized providers like CFZG or Roll-Tec to produce high-definition 3D relief on the tissue surface. These systems typically employ a male and female roller pair that creates consistent impressions as the paper web passes through high-pressure nips. This process transforms a standard commodity into a branded asset by applying specific textures that consumers associate with quality.

Standard pattern options for private label runs include panda motifs, wave dots, and straight dot textures, which are frequently applied to 100% bamboo or virgin wood pulp substrates. For brands seeking deeper differentiation, full customization allows for logos and mascots to be repeated across the standard sheet dimensions, which generally range from 104 mm to 138 mm in length. Modern automated embossing units now allow for rapid pattern changeovers, making it feasible for manufacturers to offer low minimum order quantities and support small-batch custom production without sacrificing line speed.

Functional Performance and Technical Specifications

Embossing serves a critical technical role beyond visual appeal by facilitating ply bonding for configurations ranging from 2-ply to 6-ply. The mechanical interlocking of fibers at the nip contact points ensures the layers remain fused during use, preventing ply separation. This mechanical deformation also increases the surface area and bulk of the sheet, which directly correlates to higher liquid absorbency and a softer tactile feel for the end user.

Engineers must carefully calibrate embossing depth to match the specific substrate, as bamboo fibers and wood pulp react differently to compression. Proper calibration maintains the structural integrity of the web and prevents fiber damage that could compromise tensile strength. From an investment perspective, brands can opt for proprietary 180 kg rollers to secure exclusive rights to a specific pattern, treating the engraved hardware as a discrete capital asset in their private label partnership. This ownership ensures that the unique physical and aesthetic signature of the product remains exclusive to the brand.

Scale Your Brand with China’s Premier OEM Toilet Paper Manufacturer

Packaging Options: Paper Wrap vs. Plastic Bag

Plastic packaging remains the cost-effective and durable choice for bulk private label hygiene products due to its moisture resistance and lower transport emissions. While paper wrapping appeals to eco-conscious markets with high recycling rates, it requires significantly more energy and water during production and lacks the waterproofing necessary for long-term storage.

The Environmental and Functional Trade-offs

Selecting the right material involves balancing waste management goals against resource intensity. Paper bags boast a 66% recycling rate, far exceeding the 5% average for plastic films. However, the manufacturing process for paper requires 20 times more water and five times more energy than its plastic counterparts. This high resource consumption means a paper bag needs at least three uses to achieve the same carbon footprint as a single-use high-density polyethylene (HDPE) bag.

Functionality plays a critical role in preserving product integrity. Transparent polyethylene wrap serves as a superior moisture barrier, shielding toilet paper from humidity and liquid damage during storage. This transparency also allows for quality control inspections where workers verify roll symmetry and sealing accuracy without opening the pack. Since paper lacks inherent waterproofing, it often needs additional chemical treatments or thicker fibers to maintain hygiene standards, which can further complicate its lifecycle impact.

Cost Analysis and Logistics Efficiency

Economic factors heavily favor plastic for large-scale distribution. Plastic bags cost approximately 3 cents per unit, while paper alternatives range between 7 and 10 cents. These margins significantly influence the final retail price of private label hygiene goods. Furthermore, plastic remains resilient through the supply chain, as the polymer can undergo up to 10 recycling cycles before the material quality begins to degrade.

Logistical weight and volume create a stark contrast in carbon emissions. Shipping 2,000 paper bags requires seven trucks because the load weighs 280 pounds. In contrast, 2,000 plastic bags weigh only 30 pounds and fit into a single truck. This weight difference contributes to the lower carbon footprint of plastic packaging, which stands at 1.58kg CO2e compared to 5.52kg CO2e for paper. Brands must weigh these shipping efficiencies and cost savings against the visibility of plastic waste in consumer environments.

MOQ Strategies for New Brand Owners

Standard MOQs for private label toilet paper generally range from 30,000 to 50,000 rolls, typically filling a 20′ or 40′ HQ container. New brands can optimize costs by selecting standard 3-ply 150g rolls or leveraging modular production for smaller custom batches starting at 5,000 units.

| Order Type | Typical MOQ | Container Equivalent |

|---|---|---|

| Private Label (Standard) | 30,000 – 50,000 Rolls | 20′ GP to 40′ HQ |

| Branded Custom Run | 1,000 – 5,000 Units | LCL (Less than Container Load) |

| Bamboo/Specialty Pulp | 50,000 Rolls | 40′ HQ |

Container-Based Volume and Production Efficiency

Standard private label runs require 30,000 rolls for a 20′ container or 50,000 rolls for a 40′ HQ to ensure production line efficiency. High-speed conversion lines and 2,860-ton monthly capacities favor full container loads to minimize setup downtime and technical waste during the embossing process.

Custom branding for 2-ply to 4-ply rolls often necessitates higher volumes to offset the cost of unique embossing plates and specialized packaging. FOB pricing, often around US$0.18 per roll, remains most competitive when orders align with standard shipping volumes from ports like Qingdao, allowing manufacturers to maximize the physical space of the shipping vessel.

Low MOQ Options and Modular Customization

Semi-automated lines and modular scheduling allow for smaller custom runs of 1,000 to 5,000 units for basic branded products. Flexibility exists for specific regions, with manufacturers offering adjusted terms for emerging markets in Africa and South America where logistical networks are still developing.

New brands can utilize stock materials like 100% virgin wood pulp or 3-ply bamboo to bypass the higher MOQs required for custom pulp blends. Lead times for standard 40′ HQ orders typically range from 20 to 25 days, while custom samples for smaller batches require approximately 10 days for approval before the full production run begins.

Pricing Models: FOB vs. CIF Cost Analysis

FOB involves the seller loading goods onto the vessel, after which the buyer manages freight and insurance. CIF requires the seller to cover these costs to the destination port. Data shows CIF/FOB margins typically range from 6% to 10% of the product value in 2026 global trade lanes.

| Incoterm Metric | FOB (Free on Board) | CIF (Cost, Insurance, Freight) |

|---|---|---|

| Cost Responsibility | Buyer pays ocean freight and insurance | Seller pays ocean freight and insurance |

| Margin Allocation | Buyer captures logistics margins | Seller embeds logistics markups |

| Average Margin % | 0% (Base Export Value) | 6% to 10% above FOB value |

Understanding Risk and Cost Allocation under Incoterms 2020

Operational boundaries for toilet paper procurement depend on where the transfer of liability occurs. Under FOB terms, Top Source Hygiene fulfills its obligation once the containers are loaded onto the vessel at origin ports like Tianjin. From that point, the buyer assumes all costs and risks, including ocean carriage and insurance. While this requires the buyer to manage their own logistics network, it offers the highest level of transparency regarding transport costs.

CIF mandates that the seller procures main-carriage freight and at least minimum cargo insurance to the destination port. Although the seller pays for these services, the risk of loss or damage transfers to the buyer as soon as the goods are loaded on board the vessel. This model suits buyers seeking a predictable landed cost, though it often limits their ability to negotiate better freight rates directly with carriers.

Quantifying the CIF/FOB Margin and Landed Cost Metrics

Data from the OECD ITIC and CEPII datasets indicate that global seaborne trade margins for 2026 average between 6% and 10% of the FOB value. This margin represents the combined cost of marine freight and insurance premiums. In trade between contiguous countries where ocean transport is not required, this margin effectively drops to 0%, as the valuations converge at the shared border.

Calculating the total landed cost requires accounting for potential hidden markups. CIF invoices frequently contain unobservable commercial spreads that exceed the pure transport costs measured by customs databases. Procurement teams must also factor in production lead times of 20 to 25 days for 40’HQ containers to accurately model the supply chain timeline from the factory floor to the destination port.

Compliance: FDA, REACH, and GRS

Global toilet paper trade relies on specific safety certifications: FDA Good Manufacturing Practices (GMP) ensure sanitary production for North America, while EU markets require REACH and EN 12625 compliance to guarantee biodegradability and chemical safety. These standards verify that products are free from harmful whitening agents and heavy metals.

International Safety Standards and Chemical Restrictions

The regulatory landscape for hygiene paper centers on preventing contamination and restricting hazardous substances. For North American markets, manufacturers follow FDA 21 CFR Parts 110 and 117. These guidelines focus on Good Manufacturing Practices (GMP) to ensure raw materials remain free from pests and microbial growth during the production cycle. While toilet paper is not classified as a direct food-contact substance, these facility hygiene standards prevent the migration of deleterious substances into the finished product.

European Union markets demand strict adherence to REACH protocols and EN 646 standards. These regulations prohibit the use of fluorescent whitening agents and verify that no harmful chemical residues remain in the pulp. Safety benchmarks for 2026 also emphasize heavy metal restrictions, requiring raw materials to be free of lead and other toxic elements to protect consumer health and environmental integrity.

Physical Performance and Environmental Verification

Technical compliance extends beyond chemical safety to include physical performance metrics defined by EN 12625. This standard sets specific requirements for wet strength, absorbency, and dissolvability. Products must balance structural integrity during use with the ability to break down quickly in water to prevent plumbing blockages. Automated production lines utilize real-time testing to maintain batch uniformity and ensure every roll meets these regional performance markers.

Sustainability remains a core driver for global distribution. To meet green consumer demands in Oceania and North America, sourcing often requires FSC-certified virgin wood pulp or high-quality recycled fibers processed without chlorine bleaching. These certifications provide a verifiable chain of custody, confirming that the paper meets both the ecological and hygiene expectations of professional B2B buyers.

Final Thoughts

Success in the private label hygiene sector depends on balancing material performance with efficient logistics. By choosing between bamboo and wood pulp based on target market values, and utilizing custom embossing to build brand identity, businesses can move beyond selling a commodity to offering a distinct product. The data shows that store brands are capturing significant market share because they match the quality of national names while maintaining better control over pricing and supply chain stability.

Establishing a profitable brand requires careful attention to international safety standards and shipping terms. New owners who align their order volumes with container capacities and choose packaging that balances cost with environmental impact position themselves for long-term growth. As the global market for hygiene essentials continues to expand, those who prioritize manufacturing transparency and consistent product quality will find the most success in securing loyal household customers.

Frequently Asked Questions

What is the standard MOQ for private label toilet paper in 2026?

The industry-standard MOQ for private label programs typically starts at one 40GP/40HQ container, which equals approximately 50,000 rolls. Some manufacturers offer flexible entry points at 10,000 rolls for trial orders or specific regional markets.

Can I request a custom embossing pattern for my brand?

Yes, manufacturers use custom-engraved steel cylinders to create unique patterns. These engravings usually maintain a depth of 0.3–0.8 mm to balance paper softness and bulk without compromising the mechanical strength of the tissue web.

What are the primary differences between paper and plastic packaging?

Brands often choose paper-based cardboard for sustainable, plastic-free positioning, which generates about 1/3 of the carbon emissions compared to virgin pulp production. Conventional options use #4 plastic film, which remains a standard for high-volume retail protection.

How does private label pricing compare to wholesale branded products?

Private label toilet paper generally costs 20–25% less per unit than comparable national brands at equivalent quality levels. While these programs offer significant savings over branded wholesale, they typically price 5–10% higher than generic, no-name bulk goods.

What technical requirements are needed for custom packaging artwork?

Design files must be submitted in Adobe Illustrator (AI) format using CMYK color mode at 300 PPI. Critical specifications include a 3-5mm bleed beyond the dielines, outlined text, and embedded images to ensure high-quality printing without edge defects.

How is quality consistency maintained across different production batches?

Manufacturers follow GB/T 2828.1 sampling protocols and verify products against GB/T 20810-2018 standards. Each batch undergoes testing for tensile strength, brightness, and microbiological limits, and must receive a qualification certificate before shipping.