Taking a tissue brand from a rough concept to a retail-ready roll involves much more than simply selecting a softness level. For procurement managers and brand owners, the real challenge lies in translating marketing ideas into precise manufacturing metrics that factories can execute without error. Misalignment at this stage often leads to costly production delays or products that fail to meet consumer expectations on the shelf.

This guide details the technical engineering required for successful Private Label Customization, from defining core specifications like 12–20 gsm density to navigating artwork constraints with mandatory 3–5 mm bleed areas. We analyze the end-to-end OEM process, covering bursting strength validation, 3D CAD simulation for embossing rollers, and the strategic trade-offs between BOPP and paper packaging materials.

Step 1: Defining Your Product Specs (Ply, GSM, Sheet Count)

Product specifications rely on three core metrics: Ply (layer count, typically 1–3), GSM (Grams per Square Meter, defining density), and Sheet Count. While marketing emphasizes softness, manufacturing requires numeric baselines—such as target basis weights (often 12–20+ gsm for tissue), bursting strength (11–25 lb/in²), and opacity percentages—validated via TAPPI or ASTM test methods to ensure consistency.

| Specification Metric | Engineering Definition | Typical Industry Range |

|---|---|---|

| Ply (Layer Count) | Number of distinct sheets laminated into the web. | 1–3 Ply (Commercial Standard) |

| GSM (Basis Weight) | Mass per unit area (Density); validated via TAPPI/ASTM. | 12–20 gsm (Light) to >20 gsm (Standard) |

| Bursting Strength | Minimum force required to rupture the paper web. | 11–25 lb/in² |

| Surface Quality | Cleanliness audit limiting dirt count and defects. | ≤250–650 specks/m² |

The Specification Matrix: Ply, GSM, and Sheet Count

To move from a concept to a manufacturing order, you must define the core variables that determine product tier and performance. Ply Dynamics refer to the number of distinct sheets laminated together, typically ranging from 1-ply to 3-ply for standard bath tissue. Higher ply counts generally allow manufacturers to use a lower GSM per individual sheet while increasing the overall bulk and perceived softness of the final product.

GSM (Basis Weight) serves as the fundamental measure of density, calculated using the TAPPI or ASTM framework. For tissue products, lightweight grades often fall within the 12–20 gsm range, while standard bath tissue webs exceed 20 gsm. This metric directly influences the tensile strength and absorption capacity of the paper, making it a critical numeric baseline for quality control.

Sheet Count and Dimensions define the total surface area per roll. Variations in sheet size (e.g., 4.0″ x 4.0″ versus 4.5″ x 4.0″) directly impact the final roll diameter and shipping density. Specifying exact dimensions ensures the product fits standard dispensers and meets consumer value expectations.

Technical Validation: Engineering Standards and Tolerances

Beyond physical dimensions, engineering metrics audit quality to prevent operational failures. Strength and Durability are validated through bursting strength tests. Depending on the grade, tissue must often withstand 11–25 lb/in² of pressure. This standard prevents web breaks during high-speed converting processes and ensures the product does not tear during end-use.

Surface Quality protocols ensure a premium visual appearance by strictly limiting defects. Government and industrial specifications often cap dirt counts at ≤250–650 specks per square meter. These audits filter out impurities that could affect the paper’s aesthetic or sanitary perception.

Physical Tolerances control consistency across production runs. Manufacturers monitor thickness (measured in mils or microns) and opacity (targeting an 88–96% minimum). These controls ensure that every roll performs reliably in dispensing equipment and maintains a uniform look and feel, regardless of the production lot.

Step 2: Designing Your Core & Individual Wrap Artwork

This step bridges creative design and factory production by adapting artwork to specific dielines. It involves setting correct bleeds (3–5 mm), ensuring high resolution (300 dpi), and defining color modes (CMYK or Pantone) to prevent registration errors on the final product.

| Specification Parameter | Standard Requirement | Technical Impact |

|---|---|---|

| Print Resolution | 300 dpi at 100% scale | Prevents pixelation in images and jagged edges in line art. |

| Bleed Area | 3–5 mm beyond trim line | Compensates for mechanical cutting shifts to avoid white gaps. |

| Color Mode | CMYK (Process) / PMS (Spot) | Ensures accurate reproduction; RGB colors will shift significantly. |

| Barcode Dimensions | X-dim ~0.33 mm, Height 18–22 mm | Maintains scannability standards for retail checkout systems. |

Optimizing Brand Assets for Print-Ready Dielines

To maintain visual consistency and prevent manufacturing errors, packaging artwork must adhere to universal print standards. High-quality reproduction requires all images and vector line art to be set at 300 dpi resolution at full size. Color settings must be strictly defined as CMYK for process printing or Pantone Matching System (PMS) for specific brand colors. Using RGB modes will result in unpredictable color shifts when the file is converted for the printing press.

Structural layout is equally critical. A standard bleed area of 3–5 mm must extend beyond the cut line to account for minor shifts during die-cutting. Similarly, all critical text and logos should remain within a safe zone positioned 3–5 mm inside the trim line to prevent them from being inadvertently sliced off. Final files should be saved in PDF/X format, with separated layers for cuts, creases, glue flaps, and regulatory marks—such as recycling symbols and country-of-origin labels—to align perfectly with the converter’s tooling.

Substrate-Specific Technical Constraints (Carton vs. Flexible Film)

Designing for rigid cores versus flexible wrappers requires adjusting artwork to match the physical properties of the material. For core and carton board, ink absorption and surface texture dictate minimum line weights. Designers must use at least 0.25 pt for positive lines and 0.5 pt for reversed lines to prevent ink fill-in or cracking across folds. Typography should not drop below 6 pt for positive text or 8 pt for reversed text to ensure legibility on porous surfaces like recycled board.

Flexible wraps, such as Tyvek® or PE films, introduce thermal and elasticity constraints. Artwork for these materials must withstand the heat-sealing process; for example, Tyvek® has a maximum web temperature limit of 118–121 °C, meaning graphics must be placed away from seal zones to avoid distortion. Additionally, barcode placement on flexible packaging requires careful planning. Standard EAN/UPC barcodes need an X-dimension near 0.33 mm and a height of 18–22 mm, positioned on a flat section of the filled pack to ensure the code remains scannable without wrinkling.

Step 3: Custom Embossing Roller Engineering (3D CAD)

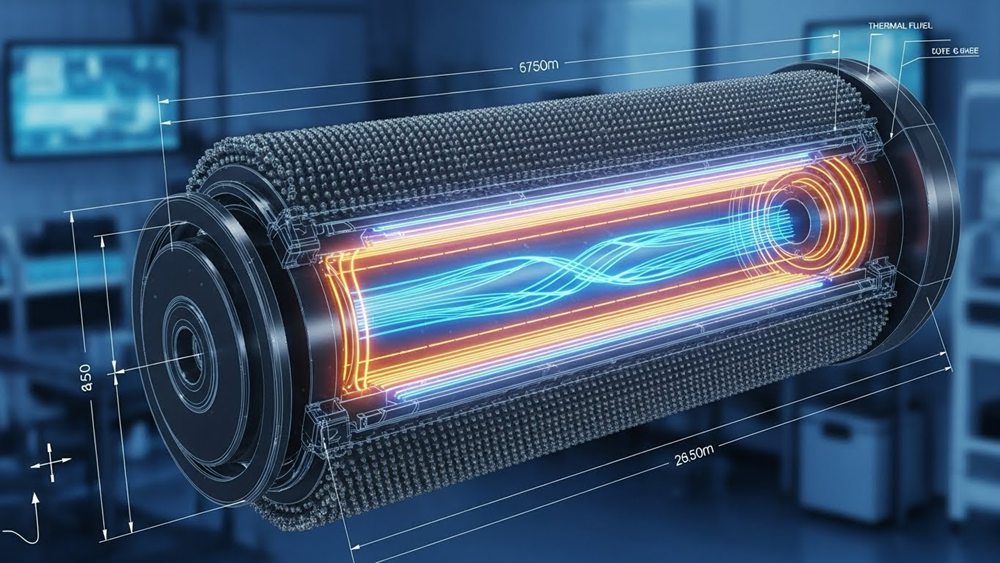

Engineers utilize 3D CAD simulations to predict thermal performance and structural integrity before fabrication begins. This step ensures the roller can handle high-speed production up to 1500 CPM, utilizing features like Double-Shell Duo-Flow for heat management and ASME-compliant construction for safety.

Predictive Thermal Simulation and Structural Design

Engineers run comprehensive 3D CAD simulations to model both ‘hot’ and ‘cold’ energy generation dynamics. This predictive modeling allows the design team to anticipate how the roller behaves under significant thermal stress before physical production begins, minimizing the risk of deformation during operation.

To manage these thermal loads effectively, designs frequently incorporate Double-Shell Duo-Flow systems. These configurations utilize spiral baffles on the inner shell to optimize the input and output of heat transfer fluids through rotary unions. Structural integrity is rigorously verified against the ASME Boiler and Pressure Vessel Code, specifically Stamps U, UM, and R, to ensure the vessel maintains safety standards under high pressure.

Material Science and Surface Precision Specifications

Material selection focuses on the balance between durability and rotational inertia. High-strength carbon fiber composite tubing is often selected for high-speed applications because it can support twice the load of aluminum while weighing only one-third as much. This reduction in weight is critical for maintaining stability at production speeds reaching 1500 CPM.

Surface finish quality directly impacts print fidelity. Manufacturers achieve mirror superfinishing levels of 0-1 Ra, often utilizing micro-precision shims to create nano-scale patterns greater than 70nm. To ensure longevity, rollers feature tungsten carbide plasma coatings that provide surface hardness levels up to 65 HRC, protecting the intricate patterns from wear.

Build Your Unique Toilet Paper Brand with Expert OEM Solutions

Step 4: Prototyping and Physical Sample Approval

Prototyping serves as the final quality gate, typically requiring 4-8 weeks for standard private label products. This step verifies that physical specs—such as 300px artwork resolution, GSM weight, and embossing depth—match the approved design, allowing brands to correct errors before committing to Minimum Order Quantities (MOQs) of 500-1,000 units.

Development Timelines and Cost Structures

Standard industry lead times for private label prototyping range from 4 to 8 weeks, whereas complex custom formulations often require 12 to 24 weeks. Top Source Hygiene compresses this timeline, shipping stock samples within 2-3 days and producing custom samples in approximately 10 days.

Initial development for complex projects involves costs between $5,000 and $25,000 to cover engineering and mold fees. To reduce entry barriers, many OEM partners, including Top Source Hygiene, provide free samples for quality verification, leaving only shipping costs to the buyer. Approved prototypes establish the production parameters for Minimum Order Quantities (MOQs), which usually start at 500 to 1,000 units for private label orders.

Technical Evaluation and Quality Metrics

Visual inspections focus on print readiness, verifying 1/8″ margin bleeds and a 300px x 300px artwork resolution for label clarity. Innovation labs apply full-color CMYK prototyping to guarantee color consistency across specific packaging materials, such as BOPP or paper.

Tactile evaluation confirms that physical specifications like Grams per Square Meter (GSM), ply count, and embossing depth align with approved CAD designs. Simultaneous functional testing measures absorbency and wet strength against ISO 9001 and FDA standards. This process concludes with a validation of unit economics to ensure custom features remain within the agreed production budget.

Step 5: Packaging Material Selection (BOPP vs. Paper Wrap)

Choosing between BOPP and paper wrap involves balancing durability against eco-friendly perception. BOPP (Biaxially Oriented Polypropylene) is the industry standard for retail due to its high tensile strength (>300 MPa) and superior moisture barrier (3-5x better than PET). While paper appeals to niche green markets, it lacks the puncture resistance required for global logistics, making BOPP the preferred choice for protecting premium customized hygiene products.

Comparative Analysis: Durability, Aesthetics, and Protection

BOPP film functions as the primary defense for retail tissue products because its manufacturing process aligns polymer chains to achieve exceptional puncture resistance. This structural integrity prevents package rupture during transport, a common failure point for paper wraps which are prone to tearing and moisture absorption. For brands prioritizing product safety throughout the supply chain, BOPP minimizes the risk of stock loss due to handling damage.

Retail shelf appeal relies heavily on print quality and finish. BOPP offers an optical gloss of 85-95% at a 45° angle, creating a smooth canvas for high-definition, vibrant branding. This contrasts sharply with the matte, porous finish of paper, which often absorbs ink and dulls graphic impact. While BOPP carries a 2-3x cost premium over basic wraps, manufacturers justify this investment through significantly reduced product failure rates in humid or high-traffic retail environments.

Technical Specifications: Tensile Strength and Barrier Metrics

Engineering data supports the dominance of BOPP in the hygiene sector. The material exhibits machine-direction tensile strength exceeding 300 MPa and transverse strength greater than 150 MPa. These figures vastly outperform plain polypropylene (35.7 MPa) and standard paper fibers, ensuring that packaging remains intact even under mechanical stress.

Maintaining dryness is critical for tissue products, and BOPP provides a moisture barrier 3-5 times more effective than equivalent thicknesses of PET. This barrier performance protects the integrity of the hygiene product inside against humidity and accidental spills. Alongside moisture resistance, excellent dimensional stability allows for ±0.125mm register control, ensuring that complex private label logos are printed without distortion.

On the production floor, BOPP enhances processing efficiency. High-speed packaging lines benefit from its heat seal initiation range of 120-140°C with short dwell times of 0.5-1.0 seconds. This thermal characteristic consumes 30-40% less energy than PET alternatives, streamlining operations while maintaining seal integrity.

Managing Plate Charges and Color Separation

Plate charges are driven by the number of color separations required, where each process color (CMYK) or spot color needs a discrete thermal or photopolymer plate. To optimize costs without sacrificing brand fidelity, manufacturers use Computer-to-Plate (CTP) technology and specific screen angles, limiting plate counts to 4–8 per SKU while adjusting for ink expansion on porous tissue substrates.

Optimizing Plate Counts: CMYK vs. Spot Colors

Standard process printing relies on four primary plates—Cyan, Magenta, Yellow, and Black (CMYK)—to reproduce approximately 16,000 distinct colors. While this spectrum covers many design needs, private label packaging frequently demands higher precision for brand assets. Consequently, designs often incorporate 1–8 additional spot color plates to achieve exact logo fidelity that standard CMYK builds cannot replicate.

To balance cost and quality, extended-gamut systems (CMYKOGV) utilize 6–7 plates, adding Orange, Green, or Violet to the standard set. This approach reduces the reliance on custom spot inks, though a dedicated Black plate remains essential to stabilize neutrals and prevent brownish composite tones. Modern Computer-to-Plate (CTP) systems further streamline this process by using thermal or violet lasers to expose plates directly. This technology eliminates traditional film steps, providing predictable per-plate costs and sharper imaging for complex SKU variations.

Technical Engineering: Registration and Screen Rulings

Achieving clean print quality on soft paper or tissue substrates requires precise prepress engineering. A critical factor is the offset of halftone screen angles for each separation; distinct angles prevent dot screens from overlapping periodically, which avoids the creation of distracting moiré patterns in the final image. Furthermore, strict registration tolerances are enforced using asymmetric fiducials (e.g., a left “+” and right “X”) to prevent reversed plate mounting and minimize material waste caused by mis-registration.

Substrate characteristics also dictate plate specifications. For textured tissue or foam ink applications, separations must include specific relief allowances—typically 0.5–1.0 mm for low foam and 1–2 mm for high foam—to accommodate ink expansion during the curing process. Screen rulings are adjusted accordingly, generally kept between 35–60 lines per inch (lpi) for water-paste or hot-melt inks. These coarser screens ensure adequate ink coverage and adhesion on porous fabrics where finer screens might fail to deposit sufficient pigment.

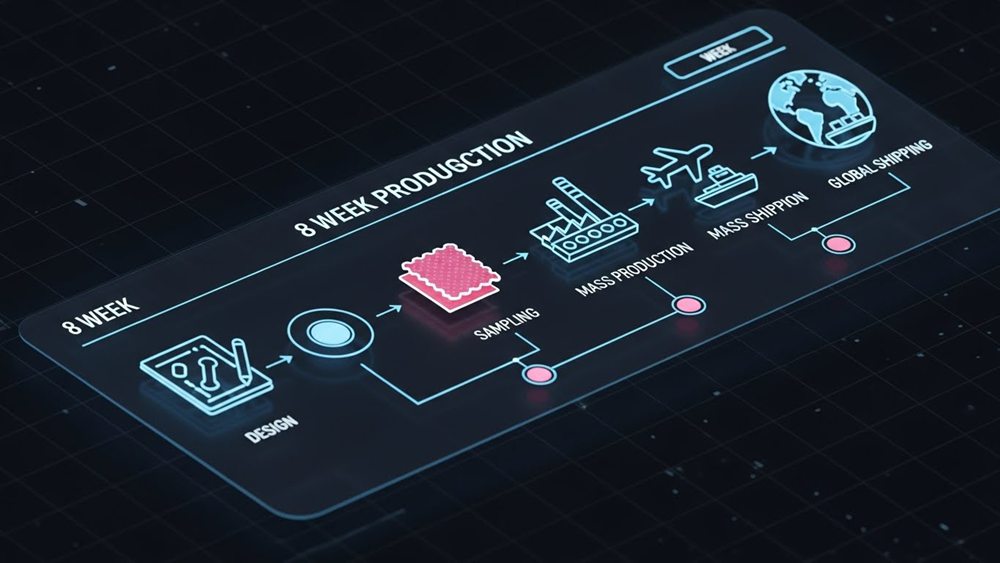

Timeline: How Long Does Customization Really Take?

A typical custom paper product project spans 4 to 8 weeks from concept to delivery. This includes 1–10 days for design and custom sampling, 15–25 days for bulk production of a standard 40-foot container, and 7–25 days for ocean freight depending on the destination region.

The Pre-Production Cycle: Design, Sampling, and Approval

The initial phase of a private label project focuses on technical preparation before machines begin running. This starts with the design and tech pack stage, which typically requires 1 to 7 days. During this window, you finalize the artwork for packaging and approve specific embossing patterns to ensure the factory understands the exact requirements.

Once specifications are clear, the process moves to material sourcing and physical proofing. Securing specific raw materials, such as virgin wood pulp and packaging films, generally takes 3 to 10 days. Parallel to this, the factory produces physical prototypes for quality verification. Custom sampling usually spans about 10 days, though reviewing stock samples can compress this step to just 2 or 3 days.

Manufacturing Lead Times and Global Shipping Estimates

Mass production begins immediately following sample approval and deposit confirmation. For a standard order volume filling a 40-foot high-cube (40’HQ) container, the bulk production cycle lasts between 15 and 25 days. This duration accounts for the high-speed conversion of paper rolls, cutting, packing, and final quality control checks.

Logistics play the final role in the total timeline. Shipping durations depend heavily on the destination port. For major markets in North America and Europe, ocean freight transit times are relatively fast, ranging from 7 to 14 days. Shipments to emerging markets in Africa and South America typically require 15 to 25 days on the water.

Final Thoughts

Building a successful private label tissue brand requires more than just selecting a softness level; it demands the strict alignment of material science with converting logistics. The distinction between a generic commodity and a premium product lies in technical execution—validating tensile strength, ensuring accurate plate registration, and simulating thermal stress on embossing rollers. Manufacturers that prioritize these engineering metrics prevent costly production errors and ensure the final output matches the initial design intent.

Mastering these variables, from the micron thickness of BOPP film to the specific X-dimension of a barcode, directly safeguards supply chain efficiency. A manufacturing strategy grounded in precise tolerances allows brands to scale production without sacrificing quality or durability. Rigorous attention to these numeric baselines transforms a raw concept into a consistent, market-ready product that performs reliably from the factory floor to the retail shelf.

Frequently Asked Questions

How long does the private label process take from start to finish?

For standard consumer goods like skincare or paper products, the typical timeline is 2–6 months. Apparel is faster (5–9 weeks), while complex electronics can take 9–12 months.

What are the setup costs for custom toilet paper branding?

Expect a setup fee between $25 and $60 for new orders, which covers design preparation and plate setup. Repeat orders with the same design usually drop to $0–$12.50.

Can I get a 3D prototype of my customized packaging?

Yes. Suppliers often provide digital 3D renders within 24–72 hours. Physical prototypes (via 3D printing or thermoforming) take about 3–10 business days.

What file formats do factories need for custom printing?

Factories generally require a master PDF (PDF/X-1a or X-4). Logos and dielines should be vector files (AI or EPS), while images need to be high-resolution (≥300 DPI) TIFF or JPEG files.

Should I choose scented or unscented for my private label product?

Choose scented if targeting mainstream retail for higher perceived value (costing 15–20% more). Choose unscented for sensitive skin markets or healthcare settings to minimize allergen risks.

Can the factory handle multiple languages on the packaging?

Yes, factories can accommodate multilingual labels. Design layouts must budget approximately 35% more space for text expansion in languages like German or Italian.