Sending a significant deposit to an overseas manufacturer requires more than just trust; it demands a legal framework that protects your capital before a single roll of paper leaves the factory. Procurement teams often struggle to balance securing production capacity within a factory’s monthly limits while mitigating the risks associated with upfront payments and shifting global market conditions.

This guide explores the mechanics of the standard 30/70 payment structure and the use of UCP600-compliant Letters of Credit for large-scale tenders. We detail the technical requirements for enforceable sales contracts, explain how to manage USD/CNY exchange rate targets near 6.95, and show how NCUA-insured escrow accounts provide up to $250,000 in protection for your investment throughout the manufacturing cycle.

The Standard 30/70 Payment Structure: Risk vs. Reward

The 30/70 payment structure splits costs into a 30% deposit at order placement and a 70% balance before shipment. This standard protects the manufacturer’s startup costs while giving the buyer leverage until production ends. It remains the most common agreement for paper product procurement in 2026.

Capital Allocation for Production Startups

Suppliers utilize the 30% deposit to procure raw materials like 100% virgin wood pulp and fund initial labor costs. This upfront remittance secures a specific production slot within the factory’s 2,860-ton monthly capacity, ensuring the order moves forward without resource competition. The initial payment also confirms the buyer’s commitment to the standard 15-25 day production lead time, allowing the manufacturer to lock in the necessary shipping logistics early in the cycle.

Balance Settlements and Quality Verification

Procurement teams typically schedule third-party inspections to verify ISO 9001 and FDA compliance before they release the 70% balance. ERP platforms such as SAP B1 and ERPNext track these split payments using A/R Down Payment workflows to maintain accurate cash flow records for both parties. Buyers remit the final 70% via TT wire transfer once they receive the Bill of Lading or formal pre-shipment verification. This workflow protects the buyer’s capital by withholding the majority of the funds until the supplier provides proof of quality and shipment readiness.

When to Use Letters of Credit (L/C) for Large Tenders

Large tenders require Letters of Credit to mitigate financial risk by replacing personal credit with bank-backed guarantees. This setup proves vital for multi-million dollar shipments where revolving limits and strict documentation standards like UCP600 ensure both manufacturers and buyers meet complex delivery and payment milestones.

Bank Credit Substitution in High-Value Procurement

Large-scale paper product tenders often involve multi-million dollar transactions that exceed the standard credit limits of a buyer. Banks replace the buyer’s credit risk with their own payment guarantee, which provides the manufacturer with the liquidity needed to start production. These projects often generate over 1,000 pages of technical documentation, including complex purchase orders and shipping manifests. Most government and global corporate RFP rules mandate the use of UCP600 standards to govern these documents. In regions where the issuing bank’s stability remains uncertain, confirmed Letters of Credit provide a second layer of security by involving a confirming bank.

Revolving Structures and Performance Documentation

Recurring bulk shipments rely on $50M revolving L/C structures to support continuous installment payments. These arrangements reinstate the full credit amount after each draw, allowing the supply chain to move without interruption. Procuring entities typically require issuing banks to hold at least an S&P ‘A’ or Moody’s A rating to ensure financial reliability. To verify paper quality and contract specifications at the load port, neutral engineers from firms like SGS or Lloyd’s issue Surveyor’s Certificates. Beyond simple payments, Performance Standby L/Cs back non-financial obligations, such as meeting equipment repair timelines or adhering to construction specifications.

The Essential Elements of a Sales Contract (PO/PI)

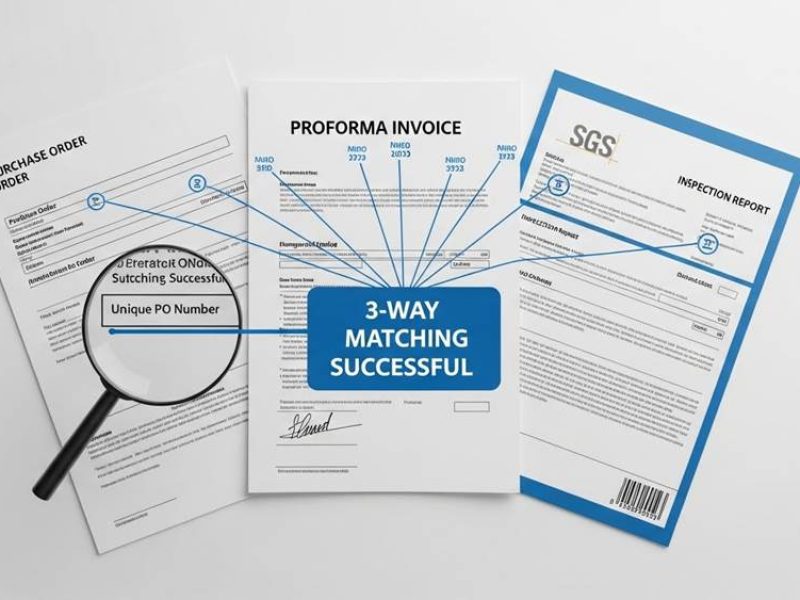

Valid sales contracts in 2026 require unique PO numbers, detailed buyer-seller data, and explicit itemized descriptions. These documents establish legal obligations, lock in pricing, and define the 30/70 payment terms necessary for manufacturing household paper goods like jumbo rolls and facial tissues.

| Contract Element | Technical Specification | Operational Function |

|---|---|---|

| PO Number | Unique alphanumeric identifier | Enables 3-way matching and reconciliation |

| Party Details | Verified buyer/seller contact info | Establishes legal accountability |

| Product Specs | GSM, ply count, pulp material | Ensures manufacturing accuracy |

| Payment Terms | 30% deposit / 70% balance | Aligns cash flow with production |

Core Identifiers and Party Accountability

Unique PO numbers drive 3-way matching across procurement workflows and bank reconciliations to eliminate billing errors. Verified contact details for both parties establish the legal foundation required for contractual recourse if disputes arise. Authorized signatures transform a standard PI or PO into an enforceable commercial agreement under international trade laws. Specific issue dates and validity periods also regulate inventory schedules and payment triggers for 2026 production cycles.

Technical Product Specs and Commercial Schedules

Technical descriptions define order quality, covering GSM, ply counts from 2-ply to 5-ply, and 100% virgin pulp standards. Fixed unit pricing and calculated total amounts protect buyers from overbilling during the 15-25 day production window. Defined 30/70 payment terms sync cash flow with manufacturing milestones and container loading schedules. ISO 9001 and FDA compliance markers confirm that the goods meet global hygiene and safety requirements before shipping.

Scale Your Brand with Expert OEM Toilet Paper Manufacturing

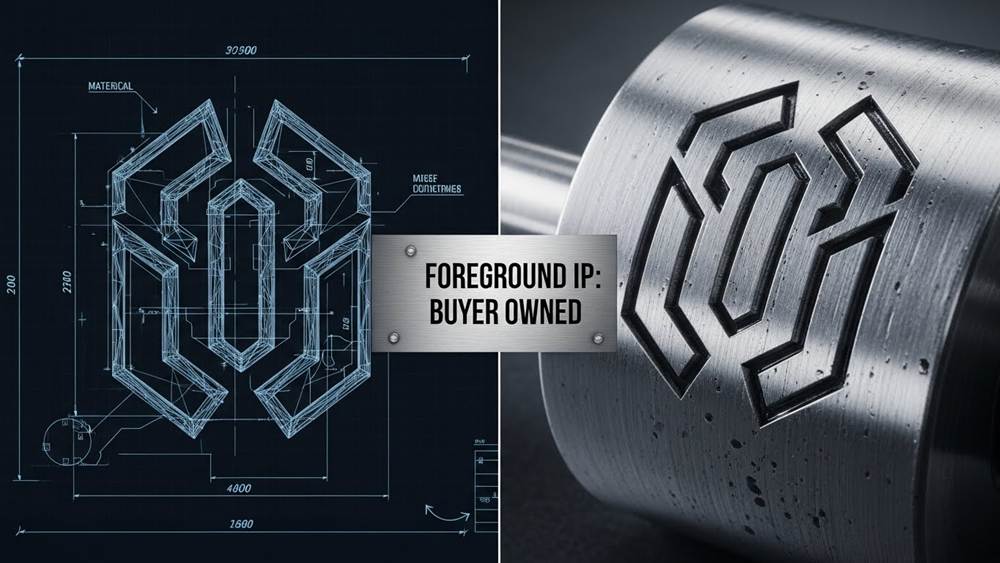

Intellectual Property (IP) Clauses for Custom Embossing

Contracts for 2026 must separate Background IP, such as the supplier’s engraving methods, from Foreground IP, which includes the buyer’s unique brand patterns. Securing rights to ‘tangible embodiments’ like embossing cylinders and enforcing indefinite confidentiality for trade secrets prevents competitors from using your custom-developed branding assets.

Ownership of Brand Assets and Manufacturing Know-How

Contracts should assign Foreground IP ownership to the buyer for all custom logos, unique patterns, and brand-specific trade dress developed during the manufacturing term. This legal distinction ensures that the buyer maintains full control over the visual brand identity. Suppliers typically retain their pre-existing engraving libraries and production methods as Background IP. Explicitly defining these boundaries prevents ownership disputes over generic assets while protecting the factory’s internal production expertise.

Effective agreements also use exclusive licensing terms for specific territories. These clauses stop the supplier from legally producing similar embossed products for regional rivals. By narrowing the field of use, the buyer creates a protected market space for their unique aesthetic. Research from the American Intellectual Property Law Association shows that precise ownership language reduces the risk of business litigation significantly.

Control Over Physical Tooling and Confidential Data

Managing the rights to physical assets requires “tangible embodiments” clauses. These provisions maintain legal control over physical embossing cylinders, plates, and dies, regardless of whether they stay at the supplier’s plant. This bridge between intellectual property and physical hardware ensures the buyer can reclaim or destroy tools if the partnership ends. Without this language, a supplier might argue that physical ownership of the tool permits them to use it for other projects.

Confidentiality standards for custom embossing must exceed the typical two-year window. Digital toolpaths and proprietary engraving files often function as trade secrets, requiring indefinite protection as long as the information remains economically valuable. Procurement teams should also insert explicit assignment and change-of-control provisions. These sections allow for the seamless transfer of IP rights if manufacturing moves to a different facility or if the company undergoes an acquisition in 2026.

Dealing with Exchange Rate Fluctuations (USD/CNY)

Buyers manage USD/CNY risk by monitoring the People’s Bank of China (PBOC) daily midpoint fixings and CFETS weighted averages. We recommend using currency adjustment clauses in contracts to account for the 2026 stability target of approximately 6.95 to 7.04, shielding both parties from sudden volatility.

Central Bank Protocols and Market Volatility Drivers

The People’s Bank of China (PBOC) determines the daily midpoint fixing rate through the China Foreign Exchange Trade System (CFETS). This mechanism uses a weighted average of market maker quotes while excluding extreme high and low offers to reflect actual transaction volumes. To maintain stability, the PBOC applies counter-cyclical factors that dampen sentiment-driven volatility. This approach ensures the Yuan aligns with broader economic fundamentals rather than speculative market shifts.

Monetary policy divergence between the U.S. Federal Reserve and the PBOC acts as the primary driver for capital flows and rate movements in 2026. Buyers should also watch for seasonal exporter conversions and trade balance shifts, as these events create predictable windows of currency strength or weakness. Recent data shows the onshore CNY strengthening from roughly 7.15 in August 2025 to a spot closing rate near 7.04 by December, reflecting shifting market expectations and central bank signals.

Technical Benchmarks and Contractual Hedging Strategies

Financial models for 2026 project a 12-month forecast of 6.95, identifying a technical pivot point at 7.1807. Resistance levels between 7.1811 and 7.1822 function as critical markers for procurement teams when timing bulk deposit payments or final balance transfers. Monitoring the PBOC midpoint fixing—which recently stood at 7.0550—provides a clearer picture of the government’s comfort zone compared to volatile spot market rates.

Protecting profit margins requires including currency adjustment clauses in the Sales Contract (PI/PO). These clauses trigger price renegotiations if the exchange rate fluctuates beyond a pre-defined buffer, typically set between 2% and 3%. Utilizing forward contracts or fixed-rate agreements with manufacturers helps maintain price consistency despite spot market movements. These tools prove essential for B2B transactions where the gap between order placement and final delivery spans several months.

Dispute Resolution: Arbitration and Legal Recourse

Contractual disputes follow a tiered resolution process that starts with mandatory mediation or Dispute Resolution Boards. If these fail, parties move to expedited arbitration where rules from ICC or UNCITRAL mandate final awards within three to six months. Expert arbitrators with ten years of experience ensure technical accuracy and legal finality.

Tiered Escalation and Neutral Dispute Boards

The American Arbitration Association (AAA) defines specific protocols for resolving technical disagreements through a three-member Dispute Resolution Board. In this structure, the owner and contractor each nominate one member, and those two select a third neutral chair to oversee the process. These boards provide non-binding written recommendations that resolve issues during contract execution, keeping the project moving without immediate legal intervention. Standard clauses require parties to complete formal mediation under Commercial or Construction Industry Mediation rules before they can initiate arbitration. This sequence prevents premature litigation and filters out technical disputes through expert review.

Expedited Arbitration Timelines and Expert Qualifications

Speed remains a priority in trade and technology disputes, with UNCITRAL draft provisions requiring evidence exchange within five days of the initial case management conference. International standards like the ICC and UNCITRAL Expedited Rules enforce a six-month deadline for final awards, while the German Institute of Arbitration shortens this window to three months. JAMS maintains high standards by requiring arbitrators to hold at least ten years of active practice in specialized fields such as construction or computer technology. For efficiency in large-scale operations, NAM Universal Agreements allow the consolidation of 25 or more similar claims into a single procedural calendar. JAMS also streamlines the appeal process by requiring decisions within 21 days of oral arguments and limiting briefs to 25 double-spaced pages.

Protecting Your Deposit: Escrow and Insurance Options

Buyers protect deposits using escrow accounts and pass-through insurance. Regulatory standards from the NCUA provide coverage up to $250,000, while FFIEC and CFPB guidelines mandate fund segregation and regular verification to prevent loss from vendor failure or mismanagement.

| Regulatory Standard | Financial Safeguard | Compliance Timeline |

|---|---|---|

| NCUA Part 745 | $250,000 pass-through insurance per client | Per fiduciary account |

| FFIEC Protocols | Deposit confirmation and system testing | Quarterly / Annual review |

| HUD & CFPB | Fund segregation and escrow advances | 60-day audit window |

Deposit Insurance and Fiduciary Coverage Limits

NCUA Part 745 provides pass-through share insurance coverage up to $250,000 for each client within fiduciary accounts. These rules protect escrow accounts held by lawyers or agents, ensuring coverage remains active even if the individual clients are not members of the specific financial institution. Procurement teams utilize fiduciary-held funds to secure capital throughout the manufacturing cycle, which reduces direct exposure to vendor insolvency or financial instability.

Fannie Mae and USDA standards reinforce these protections by requiring specific funding structures. For instance, USDA HB-1-3550 dictates that initial escrow deposits cover anticipated payments while maintaining a buffer of no more than two monthly payments at the account’s low point. This precision prevents over-funding while maintaining enough liquidity to cover tax and insurance obligations without putting the buyer’s principal at risk.

Escrow Verification and Fund Segregation Standards

FFIEC protocols establish a rigorous schedule for account oversight. Financial managers perform basic deposit confirmations every quarter and conduct documentation reviews semi-annually. Full build testing for critical transaction systems occurs annually to verify that the escrow infrastructure can withstand operational disruptions. These steps ensure that funds remain accessible and verifiable throughout the procurement timeline.

HUD regulations mandate the strict segregation of escrow funds for insured transactions. This requirement prevents manufacturers from commingling buyer deposits with their own operational accounts. Under CFPB §1024.17, servicers must use escrow advances to maintain insurance coverage rather than allowing policies to lapse. Auditors confirm these insurance records within 60 days of account establishment to meet 2026 compliance standards, providing a transparent audit trail for all stakeholders.

Final Thoughts

Procurement teams navigate a complex landscape of financial and legal requirements when sourcing paper goods. Success depends on balancing capital protection with manufacturing needs through 30/70 payment terms and precise contract language. Integrating intellectual property safeguards and currency adjustment clauses creates a stable framework for international trade. These steps transform a standard order into a secured investment.

Setting up clear dispute resolution paths and verified escrow accounts prevents common pitfalls in high-volume orders. Detailed sales contracts serve as a reliable reference point for quality standards and delivery timelines. These professional strategies ensure that every shipment meets technical specifications while minimizing exposure to market volatility. A disciplined approach builds long-term reliability in the global supply chain.

Frequently Asked Questions

What are the most secure payment methods for sourcing paper products?

Letters of Credit (L/C) provide the highest security for large transactions, while escrow services like Alibaba Trade Assurance protect smaller orders. A milestone structure involving a 30% deposit, 40% mid-production payment, and 30% pre-shipment balance further reduces financial exposure.

How does the 30/70 T/T payment schedule operate in 2026?

Buyers wire a 30% deposit to initiate production. Buyers then pay the remaining 70% balance either before shipment or against the Bill of Lading (B/L). While standard in the industry, this carries risk because full payment occurs before the buyer receives and inspects the goods at the final destination.

Can I use a Letter of Credit for a single 40’HQ container?

Yes. UCP600 standards permit L/Cs for single container shipments. These documents typically include ‘Shipper Load and Count’ clauses and allow for a 10% value tolerance to account for variable paper weights during the loading process.

What specific details must a Proforma Invoice (PI) include?

A professional PI requires 6-digit HS codes, detailed product specifications like GSM and ply, Incoterms, and full banking details. It serves as the foundational document for customs clearance and international payment processing.

How do I prevent competitors from using my custom logo?

Register your trademark with the USPTO and use AI-powered monitoring tools to scan global marketplaces. These tools detect unauthorized use or stylized variants in real-time, allowing for immediate takedown requests and brand enforcement.

What happens if the delivered paper products do not match the approved sample?

Buyers can file product liability claims for full refunds or replacements. Suppliers face significant penalties for labeling violations, such as the $157,683 civil penalty for ‘Made in USA’ rule breaches, along with potential punitive awards in legal judgments.