Bamboo vs. Recycled sourcing puts your brand on two opposite risk paths: chemical contamination, freight volatility and septic failures that erode gross margin and spike warranty returns.

This analysis benchmarks top factories against OBA-Free and GSM 13–22 g/m² per ply standards. We evaluate supplier traceability, PFAS/BPA testing and MOQ (1×40HQ) to help you secure a scalable, verifiable supply.

Is Bamboo Fiber Genuinely Greener Than 100% Recycled PCW?

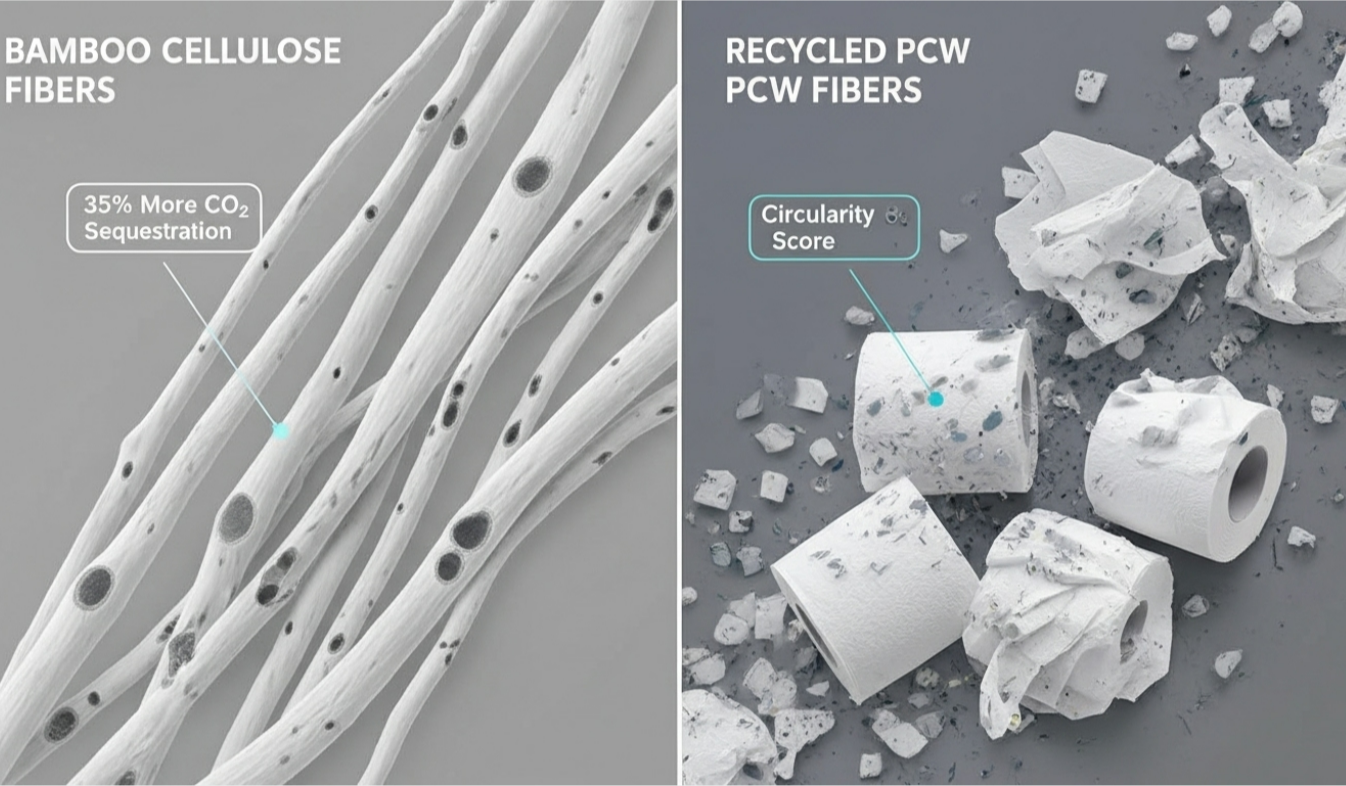

Bamboo often beats recycled PCW on CO2 and water use; recycled PCW wins on circularity and landfill diversion when de-inking is well controlled.

| Impact category | Bamboo fiber (typical) | 100% Recycled PCW | What flips the outcome |

|---|---|---|---|

|

Carbon balance |

Strong advantage from rapid growth and sequestration — studies cite ~35% higher CO₂ uptake versus trees, lowering lifecycle CO₂e when mechanical processing is used. |

Recycled PCW reduces virgin-fiber demand and diverts landfill carbon. But de-inking and extra sorting can raise energy use and CO₂e. |

If bamboo is shipped long distances or viscose-processed, transport and chemicals can erase its CO₂ edge. If recycled feedstock requires heavy de-inking, its carbon rises. |

|

Water & agro-inputs |

Bamboo typically uses ~30% less water in cultivation; mechanical processing further cuts chemical-related water demand. |

Recycled PCW uses less water than virgin pulp overall, but de-inking stages produce high-COD wastewater unless treated. |

Closed-loop or mechanical processing (for bamboo or recycled feedstock) controls water impacts; viscose and chemical de-inking raise water pollution risk. |

|

Chemical risk & product safety |

Mechanically processed bamboo avoids heavy solvents; finished tissue is typically chlorine- and BPA-free when certified. |

Recycled PCW can carry BPA, PFAS, inks and residues from thermal papers unless the mill applies strict screening and testing. |

Rigorous feedstock control and certification (e.g., Green Seal limits, fluorine testing) tilt recycled PCW to safe status; weak controls expose contamination risk. |

|

Processing emissions & fiber quality |

Mechanical bamboo routes emit less process CO₂ and preserve fiber length; viscose routes use solvents and add emissions. |

De-inking reduces fiber strength by about 5–10% and consumes energy and chemicals, increasing emissions per usable fiber. |

If mills use efficient de-inking and energy sources, recycled PCW’s footprint drops. If bamboo uses viscose, its processing emissions rise sharply. |

|

End-of-life & circularity |

Bamboo is biodegradable and septic-safe when engineered correctly; it sequesters carbon during growth but enters the waste stream after use. |

Recycled PCW scores higher on landfill diversion and circularity by keeping material in use longer. |

Priority on recycling infrastructure and source separation strengthens recycled PCW’s advantage; poor collection weakens it. |

|

Logistics & freight efficiency |

Typically grown in Asia; transport emissions matter. Higher bulk density and coreless formats cut per-roll shipping CO₂. |

Local sourcing often lowers transport footprint for recycled PCW, improving its lifecycle performance. |

Container packing strategy (e.g., 40HQ payloads ~7–9 tons) and high-density bundles change per-roll transport impact for either material. |

Lifecycle trade-offs: how bamboo and recycled PCW differ environmentally

Compare the real drivers you can measure: carbon sequestration, water and chemical inputs, processing emissions, and what happens after use. Below are the core factors that determine which fiber is greener in practice.

- Carbon balance: Bamboo sequesters about 35% more CO₂ than trees and produces roughly 30% more oxygen. That gives bamboo an appreciable lifecycle GHG advantage when growth and land-use are counted and processing stays mechanical.

- Water and inputs: Bamboo typically uses ~30% less water than comparable crops. Mechanical (original) bamboo fiber avoids chemical-intensive steps; bamboo viscose and recycled PCW often involve de-inking or solvent stages that create contaminated wastewater.

- Processing emissions: Mechanical bamboo production emits less process CO₂ than chemical-intensive routes. Recycled PCW cuts virgin fiber demand and diverts waste, but de-inking and repulping cost energy and reduce fiber strength by ~5–10%.

- End-of-life and function: Recycled PCW scores high on circularity and landfill diversion. For tissue, septic-safe rapid disintegration and grams-per-roll determine downstream impacts and plumbing compatibility.

Material choices and specs that change the balance — applying Top Source Hygiene data

Top Source Hygiene gives private-label buyers the knobs to tune environmental outcomes: material selection, certifications, product specs, and logistics all matter. Use these levers deliberately.

- Available materials: Top Source Hygiene offers Bamboo Pulp and Recycled Pulp options alongside its 100% Virgin Wood Pulp range. Pick the fiber that matches your LCA priority.

- Certifications and safety: Ask for FSC-certified bamboo or recycled options and OBA-Free finishes. Top Source Hygiene lists FSC and OBA-Free compliance as key for EU/North American markets and guarantees OBA-Free across core products.

- Product specs that affect impact: Ply (2–5 ply), GSM per ply (13–22 g/m²), and roll widths (102–132 mm) change grams-per-roll and embodied carbon. Higher GSM and more ply raise per-roll emissions but may reduce rolls used per use.

- Logistics and freight: Top Source Hygiene optimizes 40HQ packing with payloads around 7–9 tons. Use space-saving compression, coreless designs and heavier bundles to lower per-roll shipping emissions.

- Buying checklist for private-label brands: Weight your priorities: CO₂ sequestration and water use, processing intensity (mechanical bamboo vs viscose/de-inking), required certifications (FSC, OBA-Free, septic-safe), and freight efficiency. For example, choose mechanically processed bamboo or locally sourced recycled PCW with verified low-PFAS testing if chemical risk matters most.

If you need a quick sourcing decision: pick bamboo when your buyers prioritize low CO₂ and softness and you can control processing and freight. Pick recycled PCW when circularity, landfill diversion, price stability and local sourcing are the priority.

The Texture Gap: Why Bamboo Wins on Softness and Absorbency

Bamboo’s cellulose fibers and viscose processing give a silkier hand and stronger moisture-wicking than recycled synthetics.

Why bamboo fibers feel softer and wick moisture better

Start at the fiber level. Bamboo delivers cellulose-based filaments that behave very differently from polyester-derived recyclates; that difference explains the tactile and functional gap.

- Cellulose structure: Bamboo is cellulose-based; its microscopic fiber geometry produces a smooth, silky hand compared with the plastic-like feel of recycled PET.

- Viscose/rayon processing: Converting bamboo to viscose yields long, continuous cellulose filaments that amplify softness and drape in finished sheets and rolls.

- Moisture dynamics: Bamboo’s cellular pores absorb and release moisture faster, improving breathability and moisture-wicking versus hydrophobic recycled synthetics.

- Natural freshness: Bamboo carries inherent antimicrobial traits that help finished products stay fresher and resist odor between uses.

- Trade-offs: Viscose-style processing uses solvent chemistry with environmental concerns, while recycled synthetics avoid that chemistry but shed microplastics during washing.

For product teams, that means bamboo starts with a material advantage you can preserve or lose depending on processing choices.

Turning bamboo’s raw benefits into better paper: relevant specs and production choices

You need two things: keep the long cellulose fibers intact, and apply finishing specs that convert fiber performance into perceived softness and real absorbency on the roll.

- Raw material option: Top Source Hygiene lists Bamboo pulp as an available raw material for eco-targeted projects alongside Virgin Wood Pulp and Recycled Pulp.

- Embossing: Point-to-point CNC embossing (floral, dot, custom) increases absorbency by about 30% while boosting perceived softness.

- Ply & GSM control: Target ply density of 13–22 g/m² per ply and offer 2–5 ply configurations to balance hand-feel with required wet-strength.

- Brightness & chemistry: Aim for natural brightness of 85–92% using fiber selection, and keep products OBA-Free to protect sensitive skin.

- Plumbing compatibility: Design for rapid disintegration and septic-safe behavior so higher-absorbency fibers don’t create downstream issues.

- Packaging & compression: Use controlled mechanical compression and protective secondary packaging so roll fluffiness survives shipping and the tactile benefit reaches the end user.

Buyers should specify Bamboo pulp, CNC embossing, GSM targets, OBA-Free brightness, and septic-safe testing up front — those choices lock in the softness and absorbency that justify a premium.

Factory-Direct OEM Toilet Paper Experts

How Does the Chemical De-inking of Recycled Paper Affect Safety?

De-inking removes inks but leaves trace BPA/PFAS, creates toxic sludge and worker exposures; choosing virgin pulp, OBA-free production and strict certifications lowers those risks.

How de-inking changes recycled pulp and where safety risks arise

Chemical de-inking combines mechanical scrubbing with caustic and oxidative chemistry to separate inks and coatings. That process reduces visible contamination but creates by-products that affect finished products, wastewater, sludge and worker health.

- Process overview: Recycling mills use mechanical pulping plus chemical stages — caustic soda, hydrogen peroxide and sodium silicate — to strip inks and adhesives and float contaminants for removal.

- Product residue risk: Recycled pulp can retain trace contaminants. Studies report BPA from thermal receipts and office waste at widely varying levels (examples include reported values up to 9,641 µg/kg) and average post-consumer PFAS around 213 ng/g.

- Persistent chemicals: PFAS can appear in finished tissue unless manufacturers monitor fluorine/PFAS closely. Certification programs use total fluorine as a proxy; Green Seal and BPI treat 100 ppm total fluorine as a control threshold.

- Sludge and wastewater: De-inking produces toxic sludge that can contain metals (aluminum, copper) and PAHs, plus wastewater with high chemical oxygen demand (COD) and suspended solids that harm aquatic life if not treated.

- Occupational hazards: Workers face exposures to paper dust, fungal spores, formaldehyde, solvents, asbestos traces and other bioaerosols without adequate ventilation, dust controls and medical surveillance.

- Material trade-offs: Aggressive de-inking and mechanical scrubbing weaken fibers (about 5–10% loss in fiber strength). Adding modest post-consumer recycled content (for example 10%) can raise lifecycle carbon footprint roughly 16% because of extra sorting, transport and processing.

How material choices and specs reduce de-inking safety issues

You limit contaminants by removing the need for de-inking, cutting additive chemistry, and enforcing specs and third-party checks. Use clear material rules and operational controls to meet hygiene and plumbing requirements.

- Avoiding de-inking: Specifying 100% Virgin Wood Pulp eliminates chemical de-inking steps and the linked residue, sludge and worker-exposure hazards. Top Source Hygiene uses premium long-fiber virgin pulp for this reason.

- Chemical safety spec: OBA-Free production removes optical brightening agents from the supply chain, cutting an additive class that can irritate sensitive skin and complicate contaminant testing.

- Septic and plumbing safety: Rapid Disintegration (septic-safe design) reduces plumbing risk and lowers the chance of concentrated contaminants building up in drains or septic systems.

- Certifications and testing: Require ISO 9001, FDA and EU hygiene compliance; add FSC when relevant. Use total-fluorine or PFAS testing to verify limits (Green Seal/BPI use 100 ppm total fluorine as a reference).

- Operational controls: Maintain strict GSM and ply specs (13–22 g/m² per ply), control brightness through fiber selection (natural brightness 85–92% via fiber, not OBAs), and perform pre-shipment visual verification to catch batch contamination.

- Commercial trade-off note: Recycled content lowers material cost and supports circular claims, but meeting sanitary-product safety requires rigorous de-inking controls, ongoing PFAS/BPA monitoring and wastewater management — factor those costs into sourcing decisions.

Carbon Sequestration: The Science of Bamboo’s Rapid Growth Cycle

Bamboo sequesters carbon fast—high annual uptake and quick biomass turnover make it a strong feedstock for longer-lived, lower-emission paper products.

How Bamboo’s Growth Cycle Captures Carbon

Bamboo’s biology drives rapid carbon uptake: culms shoot up quickly, biomass accumulates fast, and stands can reach carbon density equilibrium in years rather than decades. That speed changes how much carbon a managed stand captures on an annual basis and how product choices convert that sink into stored carbon.

- Rapid biomass accumulation: Studies report total ecosystem carbon storage between 94–392 tC/ha, with average sequestration around 24.31 tCO₂/ha per year.

- Fast growth timeline: Many large bamboo species build biomass faster than fast-growing trees and reach carbon density equilibrium in years instead of decades.

- Species variation: Dendrocalamus strictus led comparative trials with the highest above-ground culm biomass (89.48 t/ha); Bambusa tulda also ranks high—species choice matters for per-hectare carbon stock.

- Sustainable harvest cycle: Culms can be selectively harvested and replaced within a year, enabling continuous carbon uptake under active management.

- Product lifespan effect: Durable bamboo-derived products can store carbon 30+ years and substitute for higher-emission materials, extending sequestration benefits beyond the field.

- Management caveat: Overstocked or abandoned stands drop sequestration potential—planned utilization and stand management are essential to maintain high uptake rates.

Translating Bamboo’s Carbon Advantages into Product Specifications

To turn bamboo’s sequestration into credible product claims, link biological performance to clear specs, verifiable certifications, and supply-chain documentation. Below are the practical product-level choices that map directly to the ecological advantages.

- Bamboo pulp option: Top Source Hygiene lists Bamboo Pulp alongside Virgin Wood Pulp and Recycled Pulp—use the Bamboo Pulp SKU when you want the rapid-renewal narrative built into the feedstock.

- Certification & claims: Pair Bamboo Pulp with FSC certification and Top Source Hygiene’s 100% OBA-Free processing to support verified sustainability and consumer-safety claims.

- Technical balancing: Specify ply and GSM to meet functional and environmental goals—use 2–5 ply products with 13–22 g/m² per ply (the product manual standard) to balance softness, strength and septic-safe rapid disintegration.

- Lifecycle messaging: Emphasize that durable bamboo products can lock carbon for 30+ years and substitute for higher-emission materials like wood, PVC or metal; quantify substitution benefits when you have cradle-to-gate LCA numbers.

- Supply-chain fit: Document Hebei-based manufacturing traceability, batch color consistency and 40HQ MOQ logistics (Top Source Hygiene’s 40HQ loading strategy) to back chain-of-custody and carbon-related claims in B2B contracts.

Keep claims specific: cite species or yield data when available, state the applied certification (FSC, OBA-Free) and attach the Hebei factory traceability records or pre-shipment visual verification. That combination turns a strong biological case into a defensible product story for buyers and regulators.

Which Material Offers the Best Price Stability for Private Label Sourcing?

Recycled pulp delivers the most predictable short-term cost; bamboo can reduce cost-per-use but shows higher short-term price swings.

Understanding price stability: the market drivers that matter

Price stability in paper sourcing means predictable landed cost over the buying cycle, not just the lowest unit price today. Predictability comes down to the inputs and the supply chain that feeds your factory lines.

- Input consistency: Stable feedstock volumes and quality reduce spot-price shocks. Recycled pulp uses local post-consumer waste, which tends to be steady in many markets.

- Transport exposure: Materials that cross borders carry freight, tariff and FX risk. Bamboo is mostly sourced from Asia and so faces greater international logistics volatility.

- Scale of production: Larger, mature supply chains price more predictably. Recycled pulp benefits from established collection and re-pulping networks; bamboo supply chains remain smaller.

- Regulation and contamination risk: Recycled streams require de-inking and bring chemical-contaminant monitoring, which adds processing steps and potential cost shifts.

- Demand growth patterns: Rapidly rising demand for a material (bamboo right now) can push spot prices up until capacity expands.

Quick cost view: recycled toilet paper typically runs about 15–30% cheaper upfront than bamboo alternatives, making short-term budgeting easier. Bamboo can still beat recycled on cost-per-use because rolls are often thicker, longer, or stronger, which reduces usage frequency.

Practical risk levers buyers can use:

- Contract length: Lock multi-quarter prices to avoid spot spikes.

- Container economics: Use larger 40HQ orders to fix freight-per-roll—Top Source Hygiene optimises 40HQ payloads at 7–9 tons.

- Material mix: Split SKUs across recycled, virgin, and bamboo to balance volatility and margin.

- Inventory cadence: Hold buffer stock on higher-volatility lines (bamboo) and use shorter lead-time replenishment for stable lines (recycled).

Material options in our catalog: 100% Virgin Wood Pulp, Bamboo Pulp and Recycled Pulp

Top Source Hygiene lists three practical material choices. Each fits a clear commercial strategy: cost predictability, premium positioning, or a hybrid approach for market segmentation.

- Materials available: 100% Virgin Wood Pulp, Bamboo Pulp, Recycled Pulp.

- Key specs that drive cost and quality: OBA‑Free safety, septic‑safe rapid disintegration, ply options 2–5, GSM 13–22 g/m² per ply, widths 102–132 mm, bundle weights 780g–5000g.

- Logistics & contracts: Standard MOQ and pricing cadence is 1 x 40HQ container; 40HQ payload optimisation is 7–9 tons; lead times are in-stock 10–15 days and production 20–25 days; payment T/T 30% deposit, 70% balance.

Use-case mapping to Top Source Hygiene SKUs:

- Lowest cost per meter / freight efficiency: TSH-3396 (5‑ply, 5000g coreless). Best when you prioritise freight value and volume.

- Bulk / industrial: TSH-3082 and TSH-JRT08. High-density solid rolls and jumbo commercial formats suit warehouses and institutional buyers.

- North America / plumbing-sensitive markets: TSH-2559 (2‑ply/3‑ply) — emphasise OBA‑Free, septic-safe rapid disintegration and FDA/EU hygiene compliance.

Sourcing guidance, straight talk:

- Choose recycled pulp when you need immediate price predictability and lower upfront cost. It reduces landed-cost volatility because feedstock is local and mature.

- Choose bamboo pulp if you target premium eco-conscious buyers and accept short-term price swings. Bamboo can lower cost-per-use but currently trades with greater freight and capacity risk.

- Choose 100% virgin wood pulp to guarantee consistent premium quality, clear margin planning, and hotel/retail positioning—use models like TSH-4010 for hospitality and TSH-2269 for premium wide-format needs.

If you want predictable margins, plan orders around 1 x 40HQ cycles, use the payload efficiencies (7–9 tons) and stick to the stated lead times and payment terms. That combination reduces surprise costs and keeps your private-label pricing stable.

Can FSC Virgin Bamboo Outperform FSC Recycled Standards in Marketing?

FSC virgin bamboo can command premium positioning for softness and single-origin stories; recycled appeals to eco-budget buyers. Test markets and back claims with supply-chain proof.

How FSC Labels and Claim Framing Affect Buyer Perception

FSC branding gives both virgin and recycled products a baseline of supply-chain credibility. The differentiator comes from the message you build on top of that certification and the audience you target.

- FSC baseline: The FSC mark validates chain-of-custody; it doesn’t automatically make one claim superior. Buyers start with the label, then judge the story.

- Virgin bamboo message: Emphasize purity, single-source traceability, natural softness and moisture performance. This resonates with premium hospitality and European buyers who pay for tactile quality.

- Recycled message: Emphasize circularity, waste diversion, and price value. This lands with eco-budget shoppers, high-volume retailers, and private-label programs focused on cost and waste reduction.

- Buyer segments: Premium hospitality and quality-focused European consumers prefer virgin-fiber narratives; price-sensitive distributors and some retail chains favor recycled credentials.

- Key marketing levers: Third-party certification, documented sourcing traceability, demonstrable price-premium tolerance, and independent lab or case-study evidence drive buyer trust.

- Research gap: Public sources lack direct comparative metrics on conversion or willingness-to-pay for FSC virgin bamboo versus FSC recycled. Run split-market tests before committing a large private-label program.

Positioning should match the buyer profile: sell softness and single-origin to margin-tolerant buyers, sell circularity and cost to volume buyers. Use certificates and trace docs to close procurement teams.

Which Top Source Hygiene Specs Support a Credible FSC Virgin Bamboo Claim

Private-label buyers demand hard specs, not marketing adjectives. These product and supply-chain points from the Top Source Hygiene product bible help you make credible, testable FSC virgin bamboo claims.

- Material option: Offer a Bamboo Pulp SKU within your product palette so the on-pack claim matches composition. Top Source lists Bamboo Pulp as a supported material for custom series in Europe.

- FSC chain-of-custody: Provide documented FSC CoC certificates and supplier letters for B2B contracts. Buyers expect traceable paperwork, not just a logo on the box.

- OBA-Free: State “OBA-Free” to support skin-safety and premium hygiene claims. Top Source guarantees 100% OBA-Free across core lines.

- Rapid Disintegration / Septic Safe: Cite septic-safe test standards and North American/European compliance to address plumbing concerns for key markets.

- Ply & GSM controls: Publish measured ply and GSM ranges (Top Source: 13–22 g/m² per ply). Use those numbers to compare softness and wet-strength against recycled alternatives.

- Batch Color Consistency & Verification: Offer batch color tolerance specs and Pre-Shipment Visual Verification (photos/videos) to reassure private-label buyers about repeatability.

- Packaging formats: List available formats—Individual Wrap (hotel-grade) and Direct Bundle (value retail)—so buyers can align premium claims with premium packaging.

- Logistics efficiency: Use 40HQ loading metrics (payload typically 7–9 tons) and space-saving compression data to explain landed-cost trade-offs for premium bamboo versus recycled options.

- MOQ & lead times: State sourcing realities: MOQ 1×40HQ container, In-stock dispatch 10–15 days, production 20–25 days. Procurement teams factor these into price and availability decisions.

Give procurement and merch teams concrete specs and certificates: composition, GSM, OBA status, septic tests, FSC CoC, and shipment photos. Those items turn a premium virgin-bamboo claim into a verifiable buying decision.

Final Thoughts

While generic recycled rolls lower upfront cost, Top Source Hygiene’s 100% Virgin Wood Pulp and OBA‑Free, septic‑safe specs are the practical way to protect your brand from contamination claims, plumbing failures and costly returns. Recycled feedstock can carry BPA/PFAS and needs chemical de-inking that raises energy, wastewater and residue risk; choosing our Hebei-made virgin or certified bamboo preserves softness and reduces those liabilities while keeping freight and traceability predictable.

Don’t guess on quality—verify it: request a Sample Kit and PFAS/BPA test or ask for a custom quote for a private‑label 1×40HQ trial (we provide FSC CoC, pre‑shipment photos, lead times and T/T terms to lock price). Contact our sales or engineering team to specify ply, GSM, embossing and packaging so you can prove performance before you scale.