Recycled Toilet Paper can be the difference between meeting sanitation standards and facing costly operational downtime, employee complaints, and regulatory fines.

This guide serves as an SOP for procurement and quality teams: it starts with a core safety assessment for daily personal care, then walks through de-inking and contaminant-removal methods (including BPA control), explains fiber and whiteness trade-offs that affect feel, outlines FSC recycled standards for verifiable sourcing, models the cost and feasibility of 100% recycled content, and ends with an ROI playbook for marketing circular tissue to public-sector buyers. Each chapter provides specific test criteria, acceptance thresholds, and contract language you can use to specify, test, and accept recycled tissue with confidence.

How Safe is Recycled Toilet Paper for Daily Personal Care?

Measure PFAS and BPA, set clear acceptance thresholds, and verify each lot to protect users and avoid supply or regulatory disruption.

Measure and quantify chemical contaminants (PFAS, BPA): laboratory methods and sampling protocol

Set a testing protocol that pairs bulk fluorine screening with targeted chemical assays. Use PIGE or total fluorine assays to screen for bulk fluorine and run LC‑MS/MS for targeted PFAS (include diPAPs). Test for BPA with LC‑MS or GC‑MS and require labs to report method detection limits (MDLs) and minimum quantification limits (MQLs). Independent tests have shown fluorine in some recycled products around 10–35 ppm, so treat non‑detectable results near common lab LODs (~1 ppm) as the preferred outcome.

Collect composite samples from at least five rolls per production lot and prepare both whole‑roll extracts and pulp extracts to get complementary matrices for analysis. Use ISO/IEC 17025‑accredited labs and require full method details on the Certificate of Analysis (COA). Define supplier action levels up front: for example, require investigation or corrective action when total fluorine or any PFAS are quantifiable above agreed thresholds (a practical trigger is >10 ppm fluorine or any PFAS detectable by LC‑MS/MS), and reject lots with unexplained high results.

Define material and product specifications to reduce exposure

Specify raw materials that limit contamination risk: prefer 100% Virgin Wood Pulp or validated Bamboo Pulp over mixed recycled furnish when chemical residues matter. Require all tissue to be OBA‑free and ban intentional PFAS‑containing coatings, surface finishes, inks or release agents. Demand supplier declarations that adhesives and processing aids contain no BPA or fluorinated chemistries.

- Ply and GSM: require 13–22 g/m² per ply and target configurations of 2–5 ply to balance softness and wet strength.

- Brightness: specify 85–92% brightness achieved through fiber selection rather than aggressive chemical whitening.

- Septic performance: require rapid disintegration and septic‑safe certification for North American and EU plumbing.

- Documentation: demand raw material declarations and signed supplier statements that confirm no added fluorinated finishes or BPA in adhesives.

Manufacturing controls and contamination prevention during production

Control incoming feedstock and process chemistry to reduce contamination risk. Screen recycled input streams with periodic PFAS and BPA spot tests before batching and quarantine any suspicious loads. Ban PFAS‑containing process aids, adhesives, inks and release agents and specify PFAS‑free grades for embossing inks and wrappers.

When you accept recycled pulp, implement targeted decontamination steps — enhanced de‑inking, activated carbon adsorption, or advanced oxidation — and validate PFAS reduction by post‑process testing. Enforce precise ply‑bonding and point‑to‑point CNC embossing to reduce the need for surface coatings that could introduce contaminants. Maintain batch IDs, material lot records and retain samples for 6–12 months to enable root‑cause follow up.

Practical user guidelines to minimize personal exposure during daily use

Advise customers to choose OBA‑free virgin pulp or certified bamboo options for users with sensitive skin or frequent mucosal contact. In higher‑risk settings (clinical areas, hospitality), prefer individually wrapped rolls to reduce surface contamination and cross‑contact risks.

- Handling: package high‑risk SKUs as individually wrapped rolls and provide clear dispenser hygiene instructions.

- Use: instruct users to avoid prolonged direct contact with irritated skin and to wash hands after use; handwashing remains the most effective exposure control.

- Substitution: switch away from a recycled SKU when supplier tests show PFAS or BPA above procurement acceptance limits.

- Communication: label B2B shipments with material type (virgin/recycled/bamboo), OBA status, and septic‑safe certification for easy specification checks at procurement.

Procurement verification checklist and acceptance testing for recycled tissue lots

Require a COA that includes a PFAS panel (LC‑MS/MS), total fluorine (PIGE) and BPA results with full method details and MDLs. Insist on ISO 9001 plus applicable FDA or EU hygiene compliance statements and request third‑party lab reports for chemical screens. Specify acceptance criteria up front: prefer non‑detectable PFAS and trigger investigation if total fluorine exceeds a set limit (a practical threshold is >10 ppm).

- Sampling frequency: test every lot for high‑risk SKUs; for lower‑risk SKUs use a quarterly regime tied to supplier history.

- Pre‑shipment controls: require photos/videos of finished goods, batch color consistency data, and retention of control samples for audit testing.

- Contract clauses: include right‑to‑audit, mandatory remedial testing, and clear recall terms if post‑market monitoring reveals contamination.

De-inking Science: The Process of Removing BPA and Toxins

Control de-inking and targeted water treatment to reduce PFAS/BPA risks while protecting fiber strength and production yield.

Primary de-inking workflow and key process parameters

Start pulping at 3–5% solids to free ink particles with minimal fiber damage; set rotor speed and specific energy based on furnish type and log freeness (°SR) after pulping. Run multi-stage drum or pressure screens with 0.5–2.0 mm holes to remove sticks, plastics and large ink lumps before any washing or flotation step.

Use counter-current washers at 50–70°C and dose NaOH where adhesives require saponification (0.5–2.0% o.d.s), holding pulp 5–20 minutes to displace dissolved contaminants. For flotation, target pH 9–10, apply anionic collectors at 0.1–0.3% o.d.s and frothers at 50–200 ppm, and tune air flow/energy to reach >70% ink detachment on the first pass. For chlorine-free brightening, dose H2O2 at 0.5–2.0% o.d.s, keep pH 10–11 and temperature 60–90°C, and control peroxide residual to protect fiber strength. Monitor drain turbidity, reject mass fraction and freeness after each stage and adjust chemical dosing to balance brightness and yield.

- Action: Run a 1–2 ton bale pulp trial. Log ink removal %, drain turbidity (NTU), and brightness (ISO) for each process setpoint and iterate flotation reagent suite and washer retention times.

Targeted removal of BPA and PFAS: chemical, adsorptive and membrane strategies

Expect BPA as trace organics and PFAS—commonly diPAP precursors—in recycled furnish. Conventional de-inking removes hydrophobic ink particles but does not reliably remove dissolved organics or polar fluorinated compounds, so add dedicated unit processes for chemical contaminants. Use powdered activated carbon (PAC) at 10–200 mg/L in wash effluent or whitewater with ≥30 minutes contact to remove neutral and some polar organics; install granular activated carbon (GAC) beds for continuous polishing of return streams.

For ionized PFAS, deploy strong-anion exchange resins on concentrated streams and plan regeneration and resin life-cycle costs. Use UV/H2O2 AOP for BPA and some PFAS precursors with H2O2 at 50–200 mg/L and engineered UV fluence, but expect limited efficacy on fully fluorinated PFAS unless you add high-energy or catalytic steps. Apply nanofiltration or reverse osmosis to reject >90% of PFAS mass; capture the RO concentrate and manage it as hazardous concentrate—either send to certified disposal or design thermal destruction above 1,000°C for high PFAS loads. Protect membranes by placing PAC or GAC upstream to limit fouling and lower PFAS loading.

- Analytical controls: Use LC-MS/MS for targeted PFAS species, GC-MS for BPA, and combustion ion chromatography (CIC) to measure total fluorine for mass balance; expect routine PFAS reporting at ng/g or low-ppb levels.

- Action: Pilot PAC + GAC polishing on a whitewater loop. Measure PFAS (ng/g) and BPA pre- and post-treatment, record contact times and carbon dosages, then scale based on removal efficacy and cost per kg removed.

Process monitoring, product targets and compliance controls (2026 standards)

Set internal quality targets to support B2B claims: strive for non-detectable specific PFAS by LC-MS/MS where feasible and total fluorine below 1–10 ppm in finished tissue; set BPA targets below analytical detection (e.g., <1 ng/g) or to client-defined limits. Sample at batch level for each 40HQ production run and perform routine whitewater and finished-sheet testing—use ISO 17025 laboratories for trace PFAS/BPA analyses and retain certificates of analysis (COAs) for every container.

Require supplier certificates for virgin pulp (OBA-free) and ban recycled content when clients demand low-PFAS profiles. If tests exceed acceptance criteria, escalate by increasing washer/float efficiency, adding PAC/GAC polishing or quarantining affected stock for reprocessing or certified disposal. Maintain chain-of-custody documentation, lab reports and pre-shipment verification (photos, COAs) to support audits and regulatory reviews. Align testing and documentation with FDA and EU hygiene guidance effective in 2026.

- Acceptance matrix: Verify pulp supplier COAs, require OBA-free declarations, and reject bales that fail quick-screening for fluorine or thermal-paper markers.

- SOP: Implement a laboratory testing SOP that triggers process adjustments or batch hold when PFAS, total fluorine or BPA exceed client thresholds; test frequency: per production day or per container depending on risk.

- Action: Use the supplier acceptance matrix plus ISO 17025 lab verification before release. Quarantine, reprocess or dispose stocks that exceed limits and log corrective actions for audit trails.

OEM Toilet Paper — Custom, Cost-Effective

Why Does Recycled Content Often Feel Different Than Virgin Pulp?

Shorter, more damaged recycled fibers plus residual chemicals and finishing choices drive measurable losses in softness, tensile strength, and perceived quality — so specify tests and thresholds upstream.

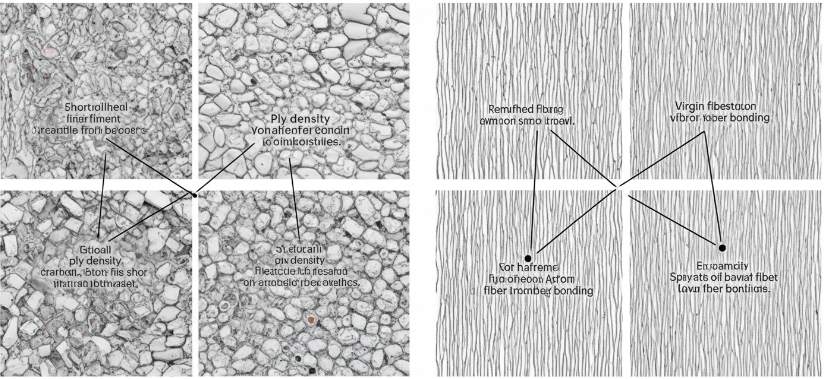

Fiber length and composition — how short recycled fibers change softness and strength

Recycled mechanical and deinked fibers arrive shorter and more fibrillated than long-fiber virgin wood pulp, which lowers tensile strength and changes hand-feel. Short fibers reduce wet strength and cushioning because they form fewer long bonds per sheet; manufacturers compensate with ply architecture, embossing, or chemical wet-strength agents, but those choices trade off bulk and absorbency.

For technical control, hold each ply in the 13–22 g/m² range to balance softness and wet performance when using recycled furnish. Require supplier lab reports that use ISO 1924-2 for tensile, the ISO 12625 series for tissue properties, and ISO 536 for grammage, and accept only lots that meet your tensile and wet-strength thresholds or an agreed performance-equivalence target.

- Specify target tensile (N/m) and wet-strength minima rather than an unspecified recycled percentage; require ISO 1924-2 and ISO 12625-series test results on each batch.

- If recycled content reduces strength, restore hand-feel by increasing ply count or blending in a defined fraction of long-fiber virgin pulp; state minimum virgin-fiber fraction or equivalent tensile performance on the spec sheet.

- Require supplier certificates showing ply GSM (13–22 g/m² per ply) and pre-shipment sample rolls for tactile verification.

Residual chemicals and surface residues — PFAS, BPA and their impact on feel and specification

Independent testing finds PFAS signatures in some recycled toilet papers, with total fluorine measured in the 10–35 ppm range in certain brands, and trace BPA appearing in recycled paper streams. These residues can come from thermal receipts, coated food packaging, or legacy coatings and can affect both perceived safety and regulatory compliance for institutional buyers.

Procurement teams must treat chemical residues as a specification item: demand third-party screening, define acceptance criteria, and require chain-of-custody documentation. Where your risk tolerance for PFAS or BPA is zero, specify alternative raw materials (for example bamboo or verified virgin OBA-free pulp) for critical SKUs to avoid double-recycling contamination.

- Require third-party analysis for total fluorine and targeted PFAS plus BPA on incoming recycled pulp batches; include lab reporting limits and method detection limits in the procurement contract.

- Set acceptance criteria: non-detect or below lab reporting limits for PFAS/BPA, and define corrective actions or rejection for any batch that exceeds those limits.

- Demand certificates of analysis and chain-of-custody traceability from the supplier; document remediation steps for any out-of-spec detection.

- For critical or sensitive accounts, specify bamboo or verified virgin wood pulp (OBA-free) to eliminate recycled PFAS routes entirely.

Processing and finishing variables that change hand‑feel — embossing, lamination, calendering and compression

Finish processes drive how customers perceive recycled versus virgin rolls. CNC point-to-point embossing can raise absorbency by roughly 30% while preserving a textured feel; high-pressure ply lamination prevents layer separation and holds a quilted profile. Conversely, heavy calendering or high nip pressure will flatten bulk and boost smoothness at the cost of perceived softness and absorbency.

Packaging and handling also change the final feel: mechanical compression during bagging reduces bulk and fluffiness, so specify allowable post-pack bulk density or a compression-test protocol. Lock emboss pattern, ply-bonding method, calender settings, and perforation tolerances into the technical specification and require pre-shipment tactile verification plus septic/rapid-disintegration testing for market compliance.

- Manufacturing specs: target natural brightness 85–92% for virgin-based (OBA-free) grades; control calender roll pressure and nip settings to balance surface smoothness vs bulk.

- Embossing and bonding: lock the emboss pattern and ply-bonding method in the spec; note that CNC embossing increases absorbency ~30% and high-pressure lamination prevents ply separation.

- Perforation and edge quality: require clean perforation tolerances for consistent tear performance and a no-fray edge standard.

- Packaging protocol: define allowable post-pack bulk density or provide a compression-test protocol to preserve intended hand-feel after transport.

- Operational QA: require pre-shipment tactile verification (photos and sample rolls) and report results from rapid-disintegration/septic tests to confirm field performance.

FSC Recycled Standards: Verifying Your Sourcing Claims for B2B

Confirm certificates, mill scope, lab data, and shipment traceability to convert an FSC recycled claim into contract-level supplier accountability.

Validate FSC chain-of-custody and certificate scope at product and mill level

Require supplier FSC Chain-of-Custody (CoC) numbers and transaction certificates for each shipment and verify them directly in the Global FSC Certificate Database. Ask the supplier to state the exact claim on product labels and invoices — “FSC Recycled”, “FSC Mix”, or “FSC Controlled Wood” — and reject ambiguous wording. Confirm each certificate explicitly covers the mill named on the shipment documents and the product type (toilet paper / tissue), and review certificate expiry dates and recent audit history before accepting material.

Demand mill-of-origin documentation that links bale lots to the container: mill name, mill license or registration, bale receipts, and a clear material-flow statement (mass-balance or percentage recycled content). Require the supplier to provide per-shipment production documents — commercial invoice, packing list, bill of lading — plus the FSC transaction certificate that ties specific bale lots to the dispatched 40HQ container.

- Verify CoC and transaction certificate numbers in the Global FSC Certificate Database before issuing payment.

- Insist the exact FSC claim appear on labels, invoices, and the packing list.

- Confirm certificate scope matches mill, product type (toilet paper), and review recent audits and expiry dates.

- Collect mill-of-origin evidence: bale receipts, mill license, and material-flow (mass-balance or % recycled) statements.

- Require FSC transaction certificate linked to the specific 40HQ shipment manifest and bill of lading.

Specify laboratory testing protocols for recycled-content risks (PFAS, BPA) and fiber verification

Mandate third-party ISO/IEC 17025–accredited laboratory testing for targeted PFAS using LC‑MS/MS methods that include diPAPs, and measure total fluorine via combustion ion chromatography (CIC). Require BPA screening using validated LC‑MS/MS or GC‑MS methods and demand the method detection limits (MDLs) and reporting limits appear on each certificate of analysis (COA). Record lab MDLs so you can set defensible acceptance criteria tied to the lab’s capability.

Define a sampling plan for container shipments: collect 10 sub-samples across the 40HQ (front/middle/rear and top/bottom), combine into a 10–20 g composite per lot, and retain split samples for dispute resolution. Set commercial acceptance benchmarks at non-detect or at the laboratory MDL; note industry data shows total fluorine detections in recycled toilet paper commonly around 10–35 ppm, so include that range in risk assessments. Require fiber composition verification (microscopy or fiber-length analysis) to confirm declared recycled percentage versus virgin long-fiber pulp and include GSM per ply (13–22 g/m²) and brightness (85–92%) on the COA.

- Use ISO/IEC 17025 labs for PFAS (LC‑MS/MS) and total fluorine (CIC); include diPAP targets.

- Require BPA analysis (LC‑MS/MS or GC‑MS) with MDLs and reporting limits on the COA.

- Sample 10 sub-locations per 40HQ, pool to 10–20 g composite, and retain split samples.

- Set acceptance to non-detect or lab MDL thresholds; log measured fluorine values (industry ~10–35 ppm) for trend analysis.

- Verify fiber via microscopy or fiber-length analysis and list GSM (13–22 g/m² per ply) and brightness (85–92%) on the COA.

Embed contractual controls and on-shipment traceability to enforce recycled claims

Insert contract clauses that grant supplier audit rights, require third-party verification, and define corrective action plans tied to certificate or test failures. Require pre-shipment visual verification and loading evidence — photos and videos showing container loading, pallet labels, and batch identifiers — plus a color-consistency report for each 40HQ to detect material mixing before shipment. Specify that mill lot numbers, FSC transaction certificate, COA, and laboratory test reports must accompany each bill of lading and commercial invoice; use HS code 4818.1000 on customs paperwork to align logistics and classification.

Define sampling and testing frequency up front: test the first shipment from any new supplier, then move to quarterly testing or per-40HQ checks for ongoing suppliers, and spell out penalties for non-compliance. Lock logistics and MOQ terms to support traceability: require 40HQ container standard (typical payload 7–9 tons), set MOQ = 1 x 40HQ, and require the supplier to provide pre-shipment COA and an OBA-free declaration before final payment release.

- Add audit, third-party verification, and corrective-action clauses tied to certificate or lab failures.

- Require photos/videos of loading, batch IDs, and a color-consistency report for each 40HQ prior to sealing.

- Mandate that mill lot numbers, FSC transaction certificate, COA, and test reports travel with the bill of lading; classify under HS code 4818.1000.

- Set testing cadence: first shipment tested, then quarterly or per 40HQ; define penalties for breaches.

- Specify logistics terms: standard 40HQ loading, 7–9 ton payloads, MOQ = 1 x 40HQ, and require pre-shipment COA and OBA-free declaration before final payment.

Is 100% Recycled Content Financially Viable for Your Brand?

A repeatable landed-cost model and mandatory PFAS/BPA testing decide whether recycled tissue delivers margin or regulatory risk for your channels.

Calculate unit economics: cost-per-meter and landed-cost model for 100% recycled vs virgin

Build a deterministic model from three inputs: product geometry (GSM per ply 13–22 g/m², plies, roll width), pack/roll weights (for example TSH-2559 = 10 rolls / 1800 g; TSH-3396 = 5000 g / 28 rolls), and container throughput (40HQ payload 7–9 tonnes). Convert weight-to-length with: meters per roll = roll_mass_grams / (width_meters × GSM_total_gpm2). Use that meters-per-roll to derive meters-per-container given payload and average roll mass.

Produce a landed-cost per 1,000 meters by summing raw-materials, conversion (embossing/ply-bonding premium), packaging, freight/insurance, port clearance (HS code 4818.1000), import duty, and compliance/testing overhead. Add a margin buffer for private-label guarantees and test-failure contingency. Run sensitivity scenarios for recycled pulp swings of ±10–30%, freight volatility, and a test-failure case (reject/reework costs). Example worked calculation below shows the method you must replicate with your supplier quotes.

- Example assumptions: 2-ply with 16 g/m² per ply (GSM_total = 32 g/m²), roll width 0.105 m, TSH-2559 pack weight 1,800 g (per roll = 180 g), container payload = 8,000 kg.

- Meters per roll = 180 g / (0.105 m × 32 g/m²) = 53.6 m. Rolls per container ≈ 8,000,000 g / 180 g ≈ 44,444 rolls. Meters per container ≈ 44,444 × 53.6 m = 2,382,000 m.

- Cost stack example (per 40HQ): recycled pulp at $1,000/ton × 8 t = $8,000; conversion & packaging ~ $860/ton × 8 t = $6,880; freight/insurance/port = $2,500; duties/clearance (~5%) = $870; testing/compliance buffer = $1,000. Total landed ≈ $19,250. Cost per 1,000 m = $19,250 / 2,382 ≈ $8.08 per 1,000 m.

- Price setting: add margin and channel markups. With a wholesale margin buffer of 20% target wholesale = $9.70 / 1,000 m. Translate to retail using local markups: SEA (retail +30%) ≈ $12.6; GCC (retail +60%) ≈ $15.5; North America (retail +40%) ≈ $13.6; Europe (retail +50%) ≈ $14.6 per 1,000 m.

- Run sensitivity: if recycled pulp spikes +30% (to $1,300/ton), your cost per 1,000 m rises roughly 12–18% depending on conversion share. If freight doubles, landed cost per 1,000 m increases by the freight delta divided by meters-per-container. Keep a test-failure reserve equal to at least one container’s testing/rework cost per quarter.

Evaluate quality and regulatory risk: chemical screening, septic performance, and consumer safety

Require explicit chemical declarations and testing from any recycled pulp supplier. Run XRF to quantify total fluorine and confirm values below your acceptance threshold, and use LC‑MS to identify PFAS species (report diPAPs and perfluoroalkyl acids as PFOA/PFOS equivalents). Order targeted BPA assays where feedstock history includes thermal receipts or printed food-wrap sources. Flag batches with total fluorine >10 ppm or any detectable diPAP conversion products for hold-and-investigate; industry work has found samples between 10–35 ppm, so treat values above 10 ppm as elevated.

Validate physical performance required for market claims: verify ply density and tensile strength consistent with long‑fiber performance, brightness in the 85–92% range, and rapid disintegration tests for septic-safe claims used in North America and Europe. Mandate OBA‑free certification and require supplier QC documentation that explicitly states no optical brightening agents. Assess exposure pathways (skin contact, mucosal proximity), document liability scenarios, and prepare recall and customer-communication playbooks given heightened PFAS regulatory scrutiny by 2026. If recycled supply shows persistent contamination, shift to bamboo pulp or blended strategies to reduce chemical risk while preserving a recycled claim option.

- Required tests: XRF (total fluorine), LC‑MS for PFAS (report diPAPs and PFOA/PFOS equivalents), targeted BPA assays, septic disintegration and tensile strength tests, and OBA verification.

- Action thresholds: flag fluorine >10 ppm; reject or quarantine lots with conversion‑product signatures; require rework or alternative supply if detection persists.

- Material alternatives: bamboo pulp for low‑PFAS/BPA risk; blended recycled/virgin formulations to balance cost, softness, and safety.

Structure sourcing and go-to-market protections: MOQ, packaging, testing clauses, and margin controls

Write supplier contracts that force accountability. Insist on pre-shipment visual verification, container-level third-party chemical testing, and batch color-consistency guarantees. Use a 1×40HQ trial MOQ for validation, then scale; Top Source Hygiene’s commercial terms already support a 1×40HQ minimum for private label and custom packaging. Choose packaging by channel: Individual Wrap for hospitality and Direct Bundle for mass retail to control price positioning and handling costs, and use mechanical compression to increase container density and lower landed cost per meter.

Embed lead times and payment terms into project timelines: in-stock dispatch 10–15 days, production 20–25 days, and T/T 30% deposit / 70% balance to protect cash flow. Build pricing tiers: premium for certified PFAS-free or bamboo lines, parity pricing for blended recycled with transparent labeling, and an explicit testing/failure reserve (set aside 2–5% of COGS). Operationalize QC by requiring supplier ISO 9001, periodic lab audits, and at least two contingency suppliers (one recycled, one virgin) to preserve supply continuity and protect margins.

- Contract clauses: mandatory third‑party chemical testing per container; pre-shipment photos/videos; color/brightness consistency guarantee; container-acceptance sampling plan.

- MOQ & logistics: 1×40HQ trial order; private label allowed at 1×40HQ; optimize bundles for 40HQ payload 7–9 tonnes to minimize landed cost.

- Financial protections: T/T 30% deposit; 70% balance before shipment; create a testing/failure reserve equal to 2–5% of COGS and price premium tiers for certified low-risk materials.

- QC & contingency: require ISO 9001, schedule periodic independent lab audits, and maintain alternate virgin pulp supplier relationships to switch quickly if recycled contamination risks threaten contracts or margins.

The ROI of Circularity: Marketing Recycled Tissue to Public Sectors

Quantify landed cost and operational KPIs to prove recycled tissue delivers lower total cost of ownership and measurable carbon reductions for public tenders.

Quantify ROI: landed-cost model, container economics, and pilot KPIs

Calculate landed cost using a single formula: (FOB container + ocean freight + import duties + inland logistics) / total rolls, and classify product under HS Code 4818.1000 when estimating duties. Plan orders around a 40HQ container with a realistic payload of 7,000–9,000 kg and prioritize high-density SKUs such as TSH-3396 or TSH-3082 (both available in 5,000g/28 bundles) to drive down cost per meter and lower freight per usable roll.

Model per-unit economics with the technical inputs procurement uses day one: ply GSM (13–22 g/m² per ply), roll widths (102–132 mm), bundle weights (780g–5,000g), and the trade-offs between coreless versus cored lengths and dispenser compatibility. Run a 1×40HQ trial order, capture real-use metrics, and calculate ROI by combining freight savings, reduced waste-disposal costs, and procurement rebates to estimate break-even months.

- Pilot KPIs to track: cost per meter, break-even months, maintenance/cleaning cost change, landfill diversion rate, toilet-plumbing incident rate (disintegration performance).

- Operational inputs: bundle weight, roll width, GSM per ply, and dispenser fit for on-site testing.

- Action step: execute one 40HQ trial, instrument restrooms for usage, and compare direct OPEX and disposal savings against baseline virgin-fiber spend.

Mitigate chemical and compliance risk: PFAS/BPA testing, material controls, and thresholds

Require third-party lab screening for PFAS (report fluorine and diPAPs) and BPA with results reported in ppm; independent tests have shown fluorine in the 10–35 ppm range, so set acceptance thresholds that match buyer risk appetite. For high-sensitivity public contracts, target <10 ppm fluorine and document rejection or remediation steps when suppliers exceed thresholds.

Prefer pre-consumer recycled fiber with a documented chain-of-custody for institutional tenders or mandate bamboo pulp for the strictest health-risk environments. Specify product-level safety: OBA-free declaration, septic-safe rapid disintegration, ISO 9001 and applicable EU/FDA hygiene compliance, plus tensile and absorbency test results that confirm dispenser and plumbing compatibility.

- Testing protocol: third-party PFAS (fluorine/diPAP) and BPA screening, report in ppm; include lab certificate with each shipment.

- Supplier controls: set <10 ppm fluorine target for sensitive contracts; require remediation plan and re-test for batches >10 ppm.

- Feedstock policy: prefer pre-consumer recycled fiber with chain-of-custody or accept bamboo pulp for high-sensitivity sites.

- Contract clauses to include: pre-shipment test certificates, right-to-audit mills, quarterly batch testing for new suppliers and monthly testing for high-volume suppliers, plus traceability requirements for failed batches.

Procurement playbook: technical specs, packaging logistics, and contract clauses to protect margin

Define technical bid specs that buyers and QA teams can score objectively: recycled-content percentage, ply (2–5), GSM range, roll dimensions and formats (coreless for storage efficiency; individual wrap for hygiene-critical sites), and explicit dispenser compatibility (call out models like TSH-JRT08 for jumbo dispensers). Require space-saving compression, reinforced 5-ply export cartons, and loading-efficiency targets to maximize 40HQ utilization and keep landed cost low.

Protect commercial margins with clear commercial terms: MOQ = 1×40HQ, T/T payment (30% deposit, 70% before shipment), pre-shipment visual verification (photos/videos), and a price-adjustment clause tied to pulp indices or freight shifts. Insist on acceptance testing on delivery—visual batch inspection, batch color consistency, rapid-disintegration test, tensile strength, and an on-site dispenser trial before full acceptance.

- Technical bid checklist: recycled-content %, ply (2–5), GSM 13–22 g/m² per ply, roll widths 102–132 mm, bundle weights 780g–5,000g, coreless vs cored options.

- Packaging & logistics: choose Format A (Individual Wrap) or Format B (Direct Bundle) per site; require compression, reinforced export cartons, and loading-efficiency KPI for 40HQ (7,000–9,000 kg payload).

- Commercial protections: MOQ 1×40HQ, payment T/T 30% deposit + 70% before shipment, pre-shipment photos/videos, and a price-adjustment clause indexed to pulp/freight.

- Acceptance tests on delivery: visual batch inspection, color consistency, rapid-disintegration, tensile strength, and dispenser trial before full acceptance.

- Bid scoring matrix: weight total cost of ownership, contamination-risk mitigation, supplier transparency (pre-shipment photos/videos), and mandatory sample-approval checkpoint before mass delivery.

Conclusion

Strategic sourcing of recycled tissue requires a balance of environmental circularity and chemical rigor. By adhering to 100% OBA-free standards, strict de-inking protocols, and payload optimization, procurement teams can protect both user health and institutional margins.

Frequently Asked Questions

Is recycled toilet paper sanitized and safe to use?

Recycled toilet paper has mixed safety considerations. Studies detect trace contaminants—BPA and PFAS (including diPAPs)—but detected levels are generally low. PFAS can appear twice (from initial manufacture and during recycling). Health impacts from skin contact are unclear, though PFAS and BPA are associated with health risks. Many advocates weigh these small chemical risks against environmental benefits (forest preservation, reduced energy). Lower‑risk alternatives noted in the research include bamboo, which is typically BPA‑ and PFAS‑free but usually more expensive.

What is the difference between pre-consumer and post-consumer waste?

The provided research does not define or compare pre‑consumer and post‑consumer waste.

Does recycled paper contain BPA or harmful ink residues?

Yes—studies have found trace BPA in some recycled paper products and multiple studies confirm PFAS in toilet paper (commonly diPAPs that can convert to persistent PFAS). Levels detected are generally low and are thought to be introduced inadvertently via contaminated inputs or processes, but these chemicals are linked to various health concerns.

Why is recycled toilet paper often less white than virgin pulp?

The provided research does not explain why recycled toilet paper is often less white than virgin pulp.

What are the best certifications for recycled paper products?

The provided research does not list or evaluate certifications for recycled paper products.

Is it cheaper to manufacture recycled paper than virgin wood pulp?

The research notes environmental benefits of recycled paper (forest preservation and reduced energy use) but does not provide a direct comparison of manufacturing costs between recycled and virgin wood pulp.