B2B procurement teams often face a steep hurdle when sourcing hygiene products: the 40,000-roll minimum. While this volume seems high, it stems from the physical reality of shipping low-density paper goods across global supply chains. Understanding MOQs requires looking past the raw numbers to see how container dimensions and manufacturing setups dictate the final price on your invoice.

We examine the math behind 2026 procurement planning, from the 76.4 cubic meters of a 40HQ container to the $200-$500 printing plate fees that drive custom packaging limits. This guide explains why the one-container benchmark provides the lowest landed cost and how you can negotiate smaller batches by bundling 2-ply and 3-ply SKUs or adjusting lead times to fit factory schedules.

The Economic Order Quantity (EOQ) for Tissue

The Economic Order Quantity (EOQ) is a formula that determines the ideal order volume to minimize total inventory costs. For 2026 procurement planning, tissue buyers use the square root of twice the annual demand multiplied by order costs, divided by holding costs, to find the balance between shipping frequency and warehouse fees.

The EOQ Formula and Tissue Procurement Variables

Calculating the most efficient order size for tissue products requires identifying three primary variables within the paper industry: Annual Demand (D), Ordering Cost (S), and Holding Cost (H). Annual demand represents the total sheet or case volume required for the 2026 fiscal year. Because paper products occupy significant volume relative to their weight, these calculations are essential for preventing overstocking.

Ordering costs include fixed administrative fees, inspection costs, and invoice processing per shipment. Holding costs involve storage expenses such as warehouse rent, insurance, and specific climate requirements like humidity control to prevent paper degradation. Procurement teams reach the optimization goal at the exact point where the cost of placing an order equals the cost of carrying that inventory in the warehouse.

Applying EOQ to Bulk Paper Logistics and Storage

Logistics managers apply the mathematical logic of the square root of (2DS / H) to determine if a 40HQ container aligns with ideal inventory levels. If the EOQ suggests a quantity significantly lower than a full container, the business must weigh the freight savings of a bulk shipment against the increased depreciation and space constraints of low-density paper goods. For 2026, buyers must also adjust these inputs based on factory lead times, which often range from 20 to 25 days for facilities with 2,860-ton monthly capacities.

While the formula provides a baseline for steady-state operations, it assumes constant demand. The hygiene market often experiences seasonal spikes, such as flu seasons or regional events, which require manual overrides of the EOQ results. Effective inventory management balances these mathematical ideals with the practical realities of high-volume, low-density commodity storage.

Why “One Container” (40HQ) is the Sourcing Sweet Spot

The 40HQ container serves as the primary sourcing benchmark because it maximizes volume for lightweight tissue products, offering 76 cubic meters of space. This capacity allows for the lowest per-unit landed cost by spreading fixed shipping and customs fees across approximately 25 EUR-pallets or 28.5 tons of cargo.

| Metric | 40′ High Cube (40HQ) | 20′ Standard Container |

|---|---|---|

| Usable Internal Volume | 76.4 m³ | 33 m³ |

| Maximum Payload | 28,620 kg | 21,700 kg |

| Pallet Capacity (EUR) | 25 Pallets | 11 Pallets |

Maximizing Volumetric Efficiency for Lightweight Paper Goods

Tissue products occupy significant volume while remaining relatively light. The 76.4 m³ internal capacity of a 40HQ container provides more than double the room of a 20ft unit, which only offers 33 m³. This extra space accommodates the bulkiness of 2-ply and 3-ply toilet rolls, ensuring that the container reaches its physical limits before hitting weight restrictions.

Standard internal dimensions, including a height of 2,700 mm and length of 12,032 mm, allow logistics teams to optimize stacking patterns. By aligning product dimensions with these specific measurements, we minimize empty air space. A single 40HQ fits up to 25 EUR-pallets (800×1200 mm), giving inventory managers a reliable planning block to calculate SKU counts and stock levels accurately.

Landed Cost Reduction Through Fixed-Fee Amortization

Shipping a full 40HQ reduces the per-unit cost by amortizing fixed expenses. Documentation, port handling, and customs entry fees remain largely the same regardless of the container size. Choosing one large container instead of multiple smaller shipments avoids doubling these administrative and handling costs. This strategy ensures the most efficient use of capital for high-volume paper commodities.

The 28,620 kg maximum payload respects 2026 global road weight limits while maximizing product density. Major carriers such as Maersk, ONE, and Hapag-Lloyd prioritize 40HQ containers in vessel bay plans and rail stacking due to their standardized ISO dimensions. This global uniformity leads to more predictable lead times and smoother transit through international transport hubs.

Impact of Custom Packaging on MOQ (Plate Costs)

Custom packaging MOQs are driven by the need to amortize fixed setup costs. Printing plates for offset or flexographic designs typically cost between USD 200 and USD 500 per set. By spreading these costs over a 40HQ container or a minimum of 10,000 units, the per-unit price remains competitive.

The Economics of Fixed Setup and Plate Amortization

Manufacturing custom-branded paper products involves a significant one-time setup for offset or flexographic cylinders. These plate sets usually cost between USD 200 and USD 500 depending on the design complexity. Color separation plays a major role in this financial structure; a standard CMYK design requires four distinct plates, while adding a specific Pantone spot color necessitates a fifth plate, further increasing the initial investment.

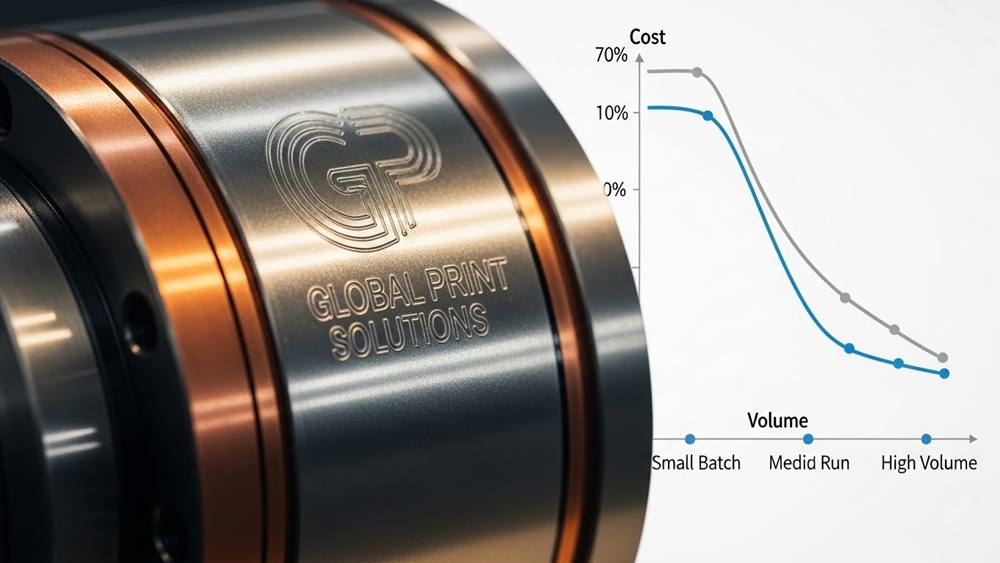

These fixed costs create a sharp price gap based on order volume. For instance, a small run of 500 units might carry a total cost of USD 1.00 per unit because the plate fees represent a huge portion of the expense. When production scales to high-volume runs of 10,000 units or more, those same plate fees dilute across the order, allowing the per-unit rate to drop to approximately USD 0.15. Suppliers establish minimum order quantities at these specific levels to ensure the setup cost becomes a negligible fraction of the final price.

Technical Drivers of High-Volume Requirements

Industrial flexographic lines used for 2-ply and 3-ply tissue products are built for speed and continuous operation. To optimize press utilization and minimize material waste during calibration, factories often require between 10,000 and 50,000 units per design. Beyond printing, custom cutting dies for non-standard box sizes or specific facial tissue windows add secondary tooling costs. These hardware requirements inflate the minimum threshold needed to make the production run financially viable for the converter.

Complexity increases for brands managing multi-SKU portfolios. Since each unique graphic, language variant, or seasonal design requires its own dedicated plate set, the MOQs compound across the entire product range. While digital printing provides a plate-free alternative for small batches, it remains a niche solution for 2026 mass production due to its higher variable costs. Most large-scale procurement still relies on traditional plate-based methods to achieve the lowest possible landed cost per unit.

Scale Your Brand with China’s Premier OEM Toilet Paper Expert

Negotiating MOQs: When Can You Go Smaller?

Suppliers typically require a 40HQ container to cover machinery setup and labor costs. You can negotiate smaller batches by offering higher per-unit pricing, bundling different SKUs like 2-ply and 3-ply rolls, or leveraging regional flexibility in markets like Africa and South America where logistics vary.

Strategic Trade-offs for Small Batch Orders

Factories often set high volume requirements to maintain profitability against fixed operational costs. To secure orders below the standard 500-unit threshold, buyers can adjust the price-volume balance. Increasing the per-unit price compensates for the loss of economies of scale, making it viable for a manufacturer to run a smaller production line. This approach ensures the supplier meets their margin targets even without high-volume efficiency.

Another effective method involves SKU bundling. Instead of ordering a single product type in massive quantities, you can consolidate different items, such as facial tissues and kitchen towels, to meet the total container threshold. This strategy satisfies the factory’s total volume needs while allowing you to manage diverse inventory levels. Using market data as a justification for trial orders also helps. Presenting a small initial batch as a proof-of-concept for long-term retail partnerships encourages suppliers to take a short-term risk for future gains.

Logistics flexibility serves as a final bargaining chip. By extending production lead times to 25 days or more, you allow the factory to slot your small run between larger, high-output cycles. This minimizes the disruption to their primary production schedule, making them more likely to accept a lower minimum requirement.

Regional and Technical Constraints on Minimums

Minimum order quantities are rarely arbitrary; they tie directly to material efficiency and machinery setup. For instance, adjusting a production line for 5-ply versus 2-ply paper involves labor efficiency losses and machine downtime. Suppliers require a volume that justifies these fixed costs. At a baseline, maintaining a minimum of 75 units or a $700 total value often ensures that the run remains profitable after accounting for raw material procurement and factory setup time.

Regional factors also play a significant role in MOQ flexibility. Top Source Hygiene offers specific variations for buyers in South America and Africa, where local commercial infrastructure and shipping logistics differ from standard global routes. These exceptions allow businesses in developing markets to access quality products without the burden of massive upfront inventory commitments.

Compliance with international standards like ISO 9001 and FSC also impacts these limits. These certifications require rigorous setup and quality control procedures for every batch. Small runs become economically unviable under these standards unless a surcharge is applied to cover the mandatory administrative and technical oversight. Understanding these technical constraints allows buyers to negotiate from a position of data-driven reality rather than just asking for discounts.

Inventory Risk vs. Procurement Savings

Balancing procurement involves weighing immediate unit-price savings against a 20–30% annual inventory carrying cost. While large MOQs reduce the price per roll, they tie up capital and increase obsolescence risks. Success in 2026 requires calculating the Total Cost of Ownership (TCO) to ensure discounts outpace storage and insurance expenses.

| Metric Type | Financial Impact | Strategic Focus |

|---|---|---|

| Hard Savings | Direct P&L Reduction | Unit Price & Volume Tiers |

| Carrying Costs | 20–30% Annual Value Tax | Capital & Storage Efficiency |

| Cost Avoidance | Mitigated Risk Expense | Resilience & Buffer Optimization |

Hard Savings vs. Cost Avoidance in Paper Sourcing

Hard savings represent immediate unit price drops that appear directly on the profit and loss statement. For instance, moving from $15 to $11 per unit through volume tiers provides a clear $4 reduction per roll. Procurement teams track these metrics to demonstrate tangible value to stakeholders. These savings depend on negotiating higher volume commitments or consolidating suppliers to leverage economies of scale.

Cost avoidance focuses on reducing the probability of stockouts, emergency air freight, and spot-buy premiums. While these benefits do not always show up as a lower price on an invoice, they protect the organization from operational disruptions. Current strategies in 2026 emphasize optimized buffers rather than pure price-chasing to maintain supply resilience. Frameworks from Tradogram and Veridion classify risk mitigation as a critical secondary metric that supports long-term financial stability.

The 20–30% Carrying Cost Tax on Bulk MOQs

Inventory carrying costs typically range from 20% to 30% of the total inventory value annually. This percentage covers capital ties, warehouse space, insurance, and potential shrinkage. When buyers evaluate a 5–10% discount on a 40HQ container, they must consider the duration the stock remains in the warehouse. If the extra paper sits for more than four months, the carrying costs often neutralize the initial procurement savings.

Regulated paper products introduce additional layers of risk. Shelf-life and hygiene compliance standards increase the danger of obsolescence for slow-moving SKUs. Gainfront methodology suggests using a Total Cost of Ownership (TCO) model to compare the negotiated discount against the formula of extra units multiplied by unit cost and a 25% annual rate. This calculation ensures that procurement decisions prioritize net profitability over superficial price reductions.

Mixed Container Strategies: 2-Ply vs. 3-Ply Consolidation

Mixed container strategies use 2-ply (single wall) corrugated for light, cost-sensitive loads and 3-ply (double wall) for heavy consolidation. While 2-ply handles loads up to 32 kg with 275 psi strength, 3-ply provides superior vertical compression (350-600 psi) essential for maximizing 40HQ container density and vertical stacking.

Structural Performance of Single-Wall vs. Double-Wall Board

2-ply Regular Slotted Containers (RSC), commonly known as single-wall board, establish a baseline burst strength of 1896 kPa (275 psi) for boxes with combined dimensions under 30 inches. This rating increases to 2413 kPa for larger dimensions, yet remains limited by its single-medium architecture. For 2026 logistics cycles, these units typically support Edge Crush Test (ECT) ratings between 32 and 48 lb/inch, making them suitable for lighter tissue products where cost efficiency outweighs extreme stacking requirements.

3-ply or double-wall configurations integrate two fluted mediums and three liners to achieve significantly higher compression thresholds. These structures reach Mullen ratings from 2413 kPa (350 psi) up to 4137 kPa (600 psi). The structural advantage is evident in ECT comparisons, where 3-ply options reach 82 lb/inch. Choosing the correct flute profile further refines performance; A-flute sections with a 4.70 mm height prioritize top-to-bottom stacking strength, while C-flute profiles balance vertical support with internal cushioning for delicate cargo.

Consolidation Rules for High-Density Mixed Loads

Optimizing mixed tissue SKUs requires strict adherence to palletization standards to reduce Minimum Order Quantity (MOQ) barriers while maintaining load integrity. Stability during transit depends on achieving a pallet surface occupancy of 80% or higher. When individual units exceed 32 kg (70 lbs), logistics protocols mandate 3-ply corrugated walls reinforced by 13 mm x 0.5 mm polyester banding. For exceptionally heavy units surpassing 363 kg, steel banding replaces polyester to prevent structural shifts.

Vertical pressure management in a 40HQ container relies on dynamic stacking factors. Mixed loads should maintain a 1+1 or 1+2 ratio, ensuring the bottom layers do not collapse under the weight of upper tiers. Maximum gross weights are capped at 1000 kg per load unit, with a height limit of 1000 mm. Engineers often specify horizontal flute alignment within outer sleeves to provide lateral reinforcement, protecting the contents from side-impact forces during sea freight movement.

MOQ Impact on Private Label Brand Strategy

MOQs dictate the scale and speed of private label growth by balancing production efficiency against cash flow. High thresholds reduce per-unit costs but increase inventory risk, while low MOQs allow brands to test niche markets and iterate quickly without heavy upfront capital commitments.

Balancing Production Efficiency with Financial Risk

Suppliers enforce minimum order quantities to recover fixed costs associated with machine setups, fabric cutting, and material sourcing. These operational requirements ensure the manufacturer reaches a break-even point by spreading overhead across a specific volume of units. While reaching these targets achieves economies of scale, high MOQs tie up significant capital in physical stock. This commitment increases the risk of product obsolescence, especially in trend-sensitive categories like beauty or fast fashion.

Financial barriers often prevent startups from entering the private label space due to the compounding costs of ingredients and packaging. For example, packaging suppliers frequently set MOQs between 5,000 and 10,000 units. If an ingredient supplier requires a 20kg minimum for a formula that only uses 2kg per batch, the brand must absorb the cost of the excess 18kg. These upfront investments, paired with ongoing storage costs, necessitate a lean inventory strategy to maintain healthy cash flow.

Strategic SKU Scaling and Market Testing

Brands use varying MOQ levels to diversify their product portfolios without overextending resources. Low-MOQ partnerships enable rapid market entry for premium lines, such as products featuring vegan actives or specialized ingredients. By utilizing flexible manufacturers that offer scalable packaging, brands can apply custom labels to small batches—sometimes as small as 20kg lots—before committing to mass production based on consumer data.

Effective category managers align demand forecasting with Economic Order Quantity (EOQ) models to optimize safety stock and lead times. To meet supplier requirements while maintaining variety, brands often use aggregated SKU ordering. This strategy involves combining multiple related products into a single 40HQ container shipment to satisfy volume demands. This approach allows veterans to leverage bulk efficiency while newer brands prioritize low-MOQ entities to preserve liquidity during the initial testing phases.

Final Thoughts

Success in high-volume paper procurement depends on aligning order quantities with shipping realities. While the 40HQ container stands as the global standard for minimizing landed costs, the true value lies in how well a business balances these bulk volumes against warehouse fees and capital flow. Buyers who master the math behind plate costs and container density gain a significant edge, turning logistical constraints into a tool for better pricing and steady supply chains.

Managing a private label brand or a large-scale distribution network in 2026 requires more than just chasing the lowest unit price. It involves a strategic mix of SKU bundling, understanding regional logistics, and calculating the total cost of ownership. By viewing the 40,000-roll benchmark as a flexible target rather than a rigid barrier, procurement teams can build resilient inventory strategies that support both aggressive growth and long-term financial stability.

Frequently Asked Questions

What is the standard MOQ for private label tissue products in 2026?

The standard minimum order for private label toilet paper sits at 10,000 rolls. For custom OEM runs or bamboo products, manufacturers often require one 40GP container, which holds roughly 50,000 rolls, to ensure production efficiency.

Why is a 40HQ container considered the ideal sourcing unit?

A 40HQ container provides a 76 m³ internal volume, offering 9 m³ more space than a standard 40ft unit. This high-cube design allows for maximum stacking of lightweight, bulky tissue—up to 68 CBM without pallets—which lowers the total shipping cost per unit.

Is it possible to mix 2-ply and 3-ply rolls in a single container?

Yes, buyers can group different plies or part numbers on the same purchase order. Logistics teams manage this by leveling layers with empty boxes, using at least two polypropylene bands per pallet, and ensuring all mixed loads are clearly labeled for arrival.

How do custom plate costs impact small batch orders?

Custom plate preparation typically costs $50 per setup. For a single unit, setup fees and quality control can push costs to $150, but increasing the order to 100-500 units amortizes these fixed expenses, dropping the per-unit cost to approximately $1.50.

Can e-commerce brands secure lower MOQs for market testing?

E-commerce startups can often negotiate pilot runs between 10 and 100 units per SKU. While standard production usually starts at 200–1,000 units, using paid samples or tiered pricing structures allows for smaller initial validation orders.

What are the financial implications of storing a 40HQ container?

Storing a 40ft container in a port or depot yard costs between $40 and $80 daily. If an order sits for 30 days, charges reach $1,200 to $2,400. Once moved to a warehouse, the 60–70 pallets inside incur additional monthly fees ranging from $900 to $3,150.

SEO

Title: B2B MOQ Explained: Why 40,000 Rolls is the Global Standard

Description: Procurement teams can reduce paper costs by balancing 40HQ container volume, plate fees, and inventory carrying risks for 2026 supply chains.

URL: b2b-tissue-sourcing-moq-logistics-optimization

Keywords: tissue procurement