Choosing the wrong sourcing model can trap a brand at a 10% margin floor or waste up to $25,000 on unvalidated custom R&D. While white labeling offers a rapid market entry for roughly $1,700, the transition to private label or ODM models is the primary driver for capturing the 40-60% profit margins and proprietary brand equity required for long-term scalability.

This guide defines the hierarchy of brand control, moving from simple factory-owned designs to complex Bill of Materials (BOM) ownership. We analyze the operational benchmarks utilized by manufacturers like Top Source Hygiene, examining how BRCGS Food Safety Issue 9 compliance and strict AQL testing protocols determine your ability to scale production without sacrificing technical integrity.

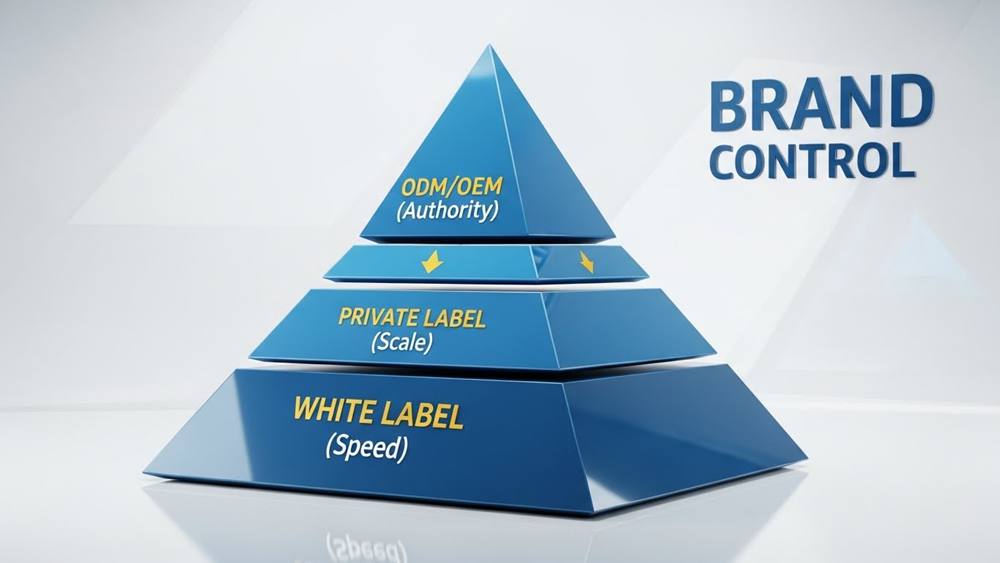

Defining Your Level of Brand Control

Brand control scales with technical involvement, ranging from selecting white-label goods to dictating every variable via BRCGS-compliant specifications and Bill of Materials (BOM) ownership.

| Control Model | Specification Owner | Primary Focus |

|---|---|---|

| White Label | Manufacturer | Speed to market; factory-owned designs. |

| Private Label | Shared / Hybrid | Partial customization; brand-defined packaging. |

| OEM/ODM | Brand Owner | Full technical control; BRCGS compliance. |

The Hierarchy of Specification Ownership

Brand authority stems from who defines the product’s safety and quality parameters. When a business moves from white label to OEM, it moves from buying a finished item to owning the intellectual and safety framework of the goods.

- BRCGS Food Safety Issue 9 (Clause 3.6.1): Requires brands to define allergen standards within product specifications to protect consumers.

- BRCGS Clause 3.6.2 (Change Control): Mandates formal specification updates before process changes to prevent production deviations.

- BRCGS Agents & Brokers Issue 3 (Clause 3.6): Covers process settings, monitoring checks, pallet configuration, and loading restrictions.

- Supply Chain Standards: Includes BRCGS Storage & Distribution Issue 4 for supplier approval and returns management.

Brand owners establish true authority by owning the safety control points and packing configurations. If the manufacturer makes a process change without a formal update, the brand’s technical integrity is compromised.

Technical Parameters for Quality Enforcement

You enforce standards through measurable metrics and detailed documentation rather than vague quality expectations. These parameters allow for objective inspections at the factory level.

- Bill of Materials (BOM): Distinguishes between custom components and off-the-shelf (OTS) items to secure the supply chain.

- Control Limits: Sets upper and lower process variations, such as GSM (Grams per Square Meter) and ply counts (2-ply to 5-ply) for paper goods.

- Regulatory Baselines: Adheres to ISO 9001, FDA, and FSC certifications for global consistency and sustainability.

- Inspection Protocols: Defines testing frequency, acceptance criteria, and corrective actions for non-conforming goods.

Effective specifications enable traceability from design to delivery. By embedding these update processes into the manufacturing roadmap, strategists ensure scalability without sacrificing quality when shifting between suppliers.

White Label: The Fastest Route to Market

White labeling uses pre-developed products to eliminate R&D, allowing brands to launch immediately by leveraging a manufacturer’s existing certifications and production capacity.

White labeling involves selling standardized products manufactured by a third party under your brand name. It bypasses the R&D, prototyping, and testing phases that consume time and capital. Companies focus entirely on marketing and distribution while the manufacturer manages the technical infrastructure.

Standardized Catalog Sourcing: The 3-Step Process

Manufacturers maintain catalogs of generic formulations that require no custom engineering. This eliminates the need for in-house production equipment and development trial-and-error. The execution follows a predictable flow:

- Selection: You pick a product from the manufacturer’s existing, proven lines.

- Branding: You apply custom graphics, labels, and packaging to the generic item.

- Distribution: The product enters the market under your private brand.

Compliance and Logistics: Speed Without Sacrificing Quality

White label lead times beat OEM and ODM because the factory skips custom prototyping. Quality assurance is built-in through the manufacturer’s existing certifications. You inherit their compliance framework, which is essential for regulated industries like supplements or food.

- Facility Certifications: Manufacturers typically maintain GMP, ISO 9001, FDA, and HACCP standards.

- BRCGS Compliance: Standards like BRCGS Issue 9 enforce allergen controls and strict Bill of Materials (BOM) accuracy.

- Order Flexibility: Low Minimum Order Quantities (MOQs) allow for rapid market testing and lower inventory risk.

- End-to-End Logistics: Factories often handle coding, pallet configuration, and international hygiene compliance.

This model shifts the heavy lifting to the supply chain. While customization is limited, the trade-off is a near-instant market presence with a product that already meets global safety and quality benchmarks.

Private Label: Balancing Customization and Scale

Private labeling trades proprietary IP for speed, using pre-vetted formulas to hit market in 4-8 weeks with MOQs as low as 500 units.

Brands use private label manufacturing to skip the expensive R&D phase. You bypass the trial-and-error of formulation by adopting proven product templates. This model focuses your capital on branding and distribution rather than chemical engineering or material science.

The Strategic Framework: Speed to Market and Risk Mitigation

Standardized infrastructure eliminates the 12-24 week wait time typical of custom development. By utilizing existing production lines, you move from concept to shelf in a fraction of the time.

- Lead Times: 4-8 weeks for standard setups vs. 12-24 weeks for custom R&D.

- Development Costs: Avoids the $5,000-$25,000 initial fees associated with custom chemical formulation.

- Customization: Limited to aesthetics like logos, pump styles, and box designs.

- Infrastructure: Uses established SOPs and NDAs to maintain brand consistency.

Operational Metrics: MOQs, Compliance, and Cost-Efficiency

Scalability depends on rigorous technical specifications. You gain 20-40% per-unit cost efficiency by piggybacking on the manufacturer’s existing volume for raw materials and packaging components.

- MOQs: 500 units for private label vs. 3,000-5,000 units for custom SKUs.

- Quality Protocols: AQL (Acceptance Quality Limit) testing, stability testing, and batch traceability.

- Compliance Standards: CGMP-certified systems, FDA registration, and ISO 9001.

- Safety Frameworks: BRCGS Food Safety Issue 9 standards, including Clause 3.6.2 for change control.

- Technical Specs: Detailed Bill of Materials (BOM) and allergen standards required in product specs.

Reliable suppliers manage these metrics through strict control plans. BRCGS protocols mandate specification updates before any process changes occur. This prevents deviations during volume ramps, ensuring the product you sell at unit 5,000 matches the pilot run.

Build Your Global Toilet Paper Brand with 30 Years of OEM Expertise

ODM (Original Design Manufacturer): High-Level Innovation

ODMs use pre-existing R&D to launch finished designs in 1–3 months. Brands gain marketing rights while the factory retains technical IP and engineering responsibility.

The Co-Engineering Advantage: Leveraging Manufacturer R&D

ODMs take full responsibility for hardware and software integration. They apply Design-for-Manufacturability (DFM) optimization to ensure the product functions reliably at scale. Because the factory owns the underlying technology platforms, they slash development cycles. You launch a market-ready product in weeks rather than the year or more required for custom OEM builds.

The factory typically retains the intellectual property rights for the core design. You pay for the right to brand and market the product, effectively white-labeling a sophisticated piece of engineering. This model allows startups and established brands to function like massive tech firms without maintaining a costly internal R&D department.

Technical Validation: Timelines, MOQs, and Global Certifications

Moving from a concept to a final technical drawing takes three to six months in a standard ODM cycle. This includes rigorous stage-gate prototyping where the factory evaluates functionality, appearance, and environmental durability before mass production. Success depends on hitting specific technical benchmarks and meeting regional safety requirements.

- Electronics MOQ: 500 to 5,000 units depending on customization levels.

- Paper/Bulk MOQ: One 40-foot high-cube container.

- Safety Certifications: CE, UL, and FCC for electronics; FDA or FSC for materials.

- Testing Standards: EMC testing, vibration resistance, and humidity/temperature cycling.

- Quality Management: ISO 9001 compliance and BRCGS-aligned change control.

Factories use these standardized testing protocols to maintain high inventory turnover, often cycling stock 8 to 12 times per year. You get a reliable product because the factory has already ironed out the production kinks on their own dime.

Cost vs. Exclusivity: The Strategic Trade-off

White label offers fast, $1,700 entry with low differentiation. Private label and ODM require $5,000+ investments but secure 40-60% margins through brand-exclusive designs and custom molds.

| Model | Startup Cost | Standard MOQ | Profit Margin | Exclusivity |

|---|---|---|---|---|

| White Label | ~$1,700 | 50 – 500 units | 10% – 30% | Low (Shared Designs) |

| Private Label | $5,000+ | 1,000+ units | 40% – 60% | High (Brand Specific) |

| ODM | Variable | ~1,000 units | 30% – 50% | Moderate |

Market Positioning: Speed to Entry vs. Long-Term Differentiation

White label models prioritize speed-to-market using mass-produced designs. This route risks high competition because brands share identical aesthetics. Private label and ODM models provide a competitive moat through moderate customization, such as adjusted formulas or custom packaging, justifying premium pricing.

The choice depends on your scale. Low-exclusivity models minimize risk for new entrants. High-exclusivity models align with veteran strategies for building loyalty. Top Source Hygiene uses this by offering 2-ply to 5-ply customizations, allowing brands to differentiate in the commoditized paper market.

Brand control relies on strict product specifications. Frameworks like BRCGS Food Safety Issue 9 (Clause 3.5.4.4) mandate that specifications control both product and processing. These specs ensure consistency by defining the bill of materials (BOM), monitoring frequencies, and critical limits. Without these, production scaling often leads to quality deviations.

Financial Metrics: Analyzing MOQs, Startup Costs, and Profit Margins

White label requires minimal capital. For example, 500 mouse casings at $3 per unit plus a $200 design fee brings startup costs to roughly $1,700. Margins here stay thin, usually between 10% and 30%. In contrast, private label demands MOQs of 1,000+ units and initial investments of $5,000 or more. This includes specialized expenses like $2,000 to $2,500 for custom molds.

- Profitability Gap: Private label skincare or paper products achieve 40-60% margins, while ready-stock reselling yields 10-30%.

- Unit Cost Comparison: Private label cosmetics cost $1.50-$8.00 per unit at 1,000 MOQ. White label dropshipping costs $5.00-$25.00 per unit for 0-MOQ access.

- Operational Standards: Manufacturers like Top Source Hygiene set a 40-foot high-cube (40’HQ) container as the standard MOQ for efficiency.

- Regulatory Compliance: BRCGS Issue 3, Clause 3.6 requires specifications to cover bill of materials, process settings, and packing configurations.

Control plans define the quantitative limits for process variation. They link monitoring methods directly to corrective actions. Effective specifications integrate inspection protocols and acceptance criteria, enabling traceability from design to delivery. This reduces defect risks as you shift between suppliers or scale production facilities.

MOQ Differences Across Sourcing Models

MOQs scale with customization, ranging from 50 units for white-label goods to over 10,000 for bespoke OEM solutions to offset specialized tooling and production setup costs.

The Customization Curve: Why Volume Requirements Vary

White label MOQs sit at the industry low—often 50 to 100 units—because factories pull from existing, generic inventory. They only need to swap a label or print a logo, which does not disrupt the main assembly line. These products are pre-manufactured and ready for basic branding updates.

Private label models require moderate volume increases. These orders demand unique packaging or minor material adjustments that interrupt the standard factory flow. Manufacturers set higher thresholds here to cover the labor costs of resetting machines for these specific variations.

OEM and ODM models demand the highest volumes, often starting at 1,000 to 10,000 units. These projects involve proprietary R&D, custom molds, and specific regulatory compliance testing. Factories cannot justify the engineering hours or machine downtime for these bespoke builds without a guaranteed high-volume run.

Industry Benchmarks and Manufacturer-Specific Standards

While thresholds vary by factory and product category, paper and hygiene manufacturing follow these specific volume benchmarks to maintain production efficiency:

- ODM Standards: 1,000 to 5,000 units for semi-custom designs.

- OEM Customization: 3,000 to 10,000+ units for full custom specs.

- Logistical MOQ: One 40-foot high-cube (40’HQ) container for global paper supply.

- Production Lead Time: 20 to 25 days following custom sample approval.

Shipping economics dictate these numbers as much as production costs. Top Source Hygiene sets a standard MOQ of one 40-foot high-cube container to maximize shipping efficiency and keep landing costs low. Some manufacturers offer flexibility for emerging retail sectors in regions like Africa or South America, but high-volume orders remain the standard for maintaining 20–25 day lead times.

Case Study: Moving from White Label to ODM Success

Brands launch with white label to test markets cheaply, then scale via ODM for semi-custom features that drive a 30% sales increase and better brand differentiation.

Phase 1: Market Validation via White Label Agility

Most brands start with white label models to bypass high startup costs and R&D delays. This phase focuses on rapid validation using generic, pre-developed products from manufacturer catalogs.

- MOQ: Approximately 100 units to test product-market fit.

- R&D Investment: Zero capital required for formula or design development.

- Speed-to-Market: Rapid entry by selecting off-the-shelf items.

- Identity: Partial custom packaging to establish basic brand recognition.

This strategy eliminates upfront engineering risks. You prove the demand first before committing to proprietary designs.

Phase 2: Scaling Brand Value through ODM Innovation

Generic products eventually lead to price wars and commoditization. Transitioning to an ODM model allows you to leverage a manufacturer’s existing IP to create unique variations without the massive timelines of full OEM development.

- Scaling: 1,000 unit MOQs unlock semi-custom features and full packaging control.

- Growth Metrics: ODM models typically drive a 30% surge in product sales.

- Efficiency: High-capacity designs, like jumbo rolls, reduce maintenance costs by up to 15%.

- Quality Compliance: BRCGS Issue 9 standards (Clause 3.5.4.4) ensure specifications control processing consistency during production shifts.

The shift to ODM creates 20% higher guest satisfaction by addressing specific commercial pain points that generic products ignore. Manufacturers manage the technical specifications and change controls, allowing you to focus on market expansion.

Final Thoughts

Low-entry white labeling buys you speed, but proprietary specifications buy you market defensibility. Scale starts with generic goods, but brand longevity depends on owning the technical Bill of Materials.

Audit your category’s saturation level immediately. If competitors offer identical products, transition to a Private Label model with BRCGS-compliant specifications to secure 40% higher margins and exclusive shelf presence.

Frequently Asked Questions

What is the difference between white label and private label?

Private label products provide exclusive control over design, ingredients, and packaging for one specific brand. White label products are pre-made items sold to many retailers. You gain speed to market but lose product exclusivity.

Is ODM more expensive than simple private labeling?

ODM costs more because it involves custom engineering and design fees. While private labeling focuses on rebranding existing inventory, ODM requires the factory to modify production setups or develop semi-custom components for your brand.

Which sourcing model has the lowest Minimum Order Quantity (MOQ)?

White label sourcing offers the lowest entry point, with MOQs ranging from 0 to 100 units. This avoids the high volume requirements of ODM (~1,000 units) or OEM (3,000+ units), which must cover the costs of custom tooling and mold development.

How do I decide between white label and custom ODM?

Choose white label if your budget is under $50,000 and you need to launch within three months. Opt for ODM if you have over $50,000, a longer development window, and need specific functional features that existing market products lack.

Can I start with white label and move to private label later?

Yes. Start with white label to validate demand and generate cash flow. Once the brand is established, move to private label contracts to secure exclusive formulations and higher margins. This path reduces initial risk while allowing for future scaling.

Does the factory own the Intellectual Property (IP) in a white label relationship?

In white label deals, the manufacturer retains ownership of core technology and patents. They license these rights to you for resale. You must explicitly define ownership of any product improvements or custom branding elements in your contract to prevent disputes.