A rigorous 4. Cost & ROI Analysis in B2B sourcing prevents the margin erosion common in volatile alternative fiber markets. Relying on unpredictable supply chains for niche materials often destroys a distributor’s annual net profit during market shifts.

We utilize 100% Virgin Wood Pulp benchmarks from the Hebei Paper Industrial Hub to establish a predictable procurement strategy. This evaluation proves how a 2,860-ton monthly output and maximized 9-ton 40HQ payloads protect dealer margins against global shipping fluctuations.

Global Pulp Market Trends: Why Wood Pulp Prices are More Predictable

Mature eucalyptus-based supply chains and centralized Asia-Pacific demand provide a foundation for pricing stability. B2B buyers benefit from standardized regulatory frameworks and large-scale manufacturing to maintain predictable procurement costs.

Market Fundamentals and Structural Supply Dynamics

Hardwood pulp remains a reliable commodity for high-volume B2B procurement. Industry data shows a 4.5% CAGR for hardwood pulp from 2026 through 2033, creating a baseline for long-term price forecasting that smaller, niche fibers lack.

The global supply relies heavily on bleached eucalyptus kraft pulp (BEKP). This material serves as a pricing anchor because of its rapid growth cycles and massive plantation infrastructure. This established system reduces the risk of sudden supply shocks that typically drive price volatility in other sectors.

- Regional Concentration: The Asia Pacific region commands nearly 43% of the global market, which centralizes demand signals and makes trend forecasting more accurate.

- Regulatory Standardization: Frameworks like the EU Deforestation Regulation (EUDR) and China’s Forest Certification Scheme create a uniform cost floor for compliant manufacturers.

- Global Volume: Market pulp reached 71 million metric tons in 2023, reflecting a mature supply chain capable of absorbing minor market shifts.

Manufacturing Scale in the Hebei Paper Industrial Hub

Predictability at the regional level stems from specialized industrial hubs. Top Source Hygiene operates within the Mancheng paper production base in Hebei, utilizing local supply depth to insulate partners from broader market fluctuations. This proximity to raw material processing stabilizes the cost of 100% Virgin Wood Pulp rolls.

Large-scale operations allow for fixed-cost distribution across high output volumes. We maintain a production capacity of 2,860 tons per month, ensuring that inventory remains available for 40HQ container orders without the lead-time volatility seen in smaller mills.

- Capacity: 2,860 tons per month production output.

- Logistics Optimization: 40HQ container payloads are maximized to 9 tons (approx. 9,000kg) to secure the lowest landed cost per unit.

- Quality Standards: 100% OBA-free (No Optical Brightening Agents) and batch color consistency to meet international hygiene regulations.

- Fiber Sourcing: Direct access to premium long-fiber wood pulp from the Hebei industrial hub.

Our logistics teams in Hebei focus on maximizing container space. By hitting the 9-ton payload limit for a 40HQ, we effectively neutralize minor freight rate increases, protecting the profit margins of our B2B distributors and wholesalers.

The “Premium Tax” of Bamboo: Is the Higher Cost Justified for B2B?

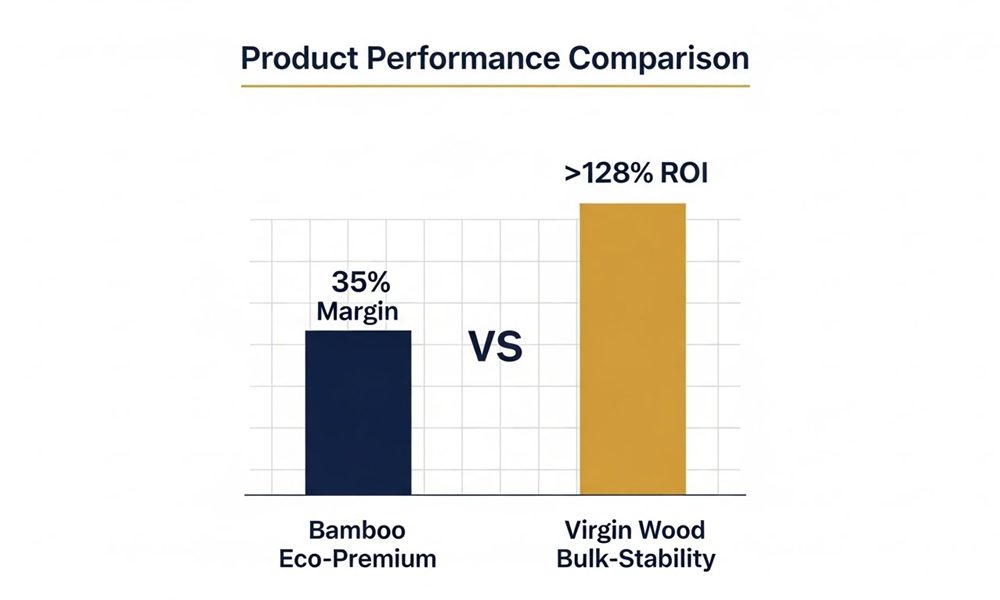

Bamboo’s premium is justified for high-end hospitality and healthcare. While unit margins stay tighter at 35%, carbon-neutral sourcing secures high-volume institutional contracts and premium retail positioning through 2026.

Strategic Value Drivers for Ethical B2B Sourcing

Boutique hotels and zero-waste retail chains use bamboo to provide verifiable environmental credentials to their guests. For these segments, the paper is a branding tool rather than just a utility. Market data shows that B2B partners often accept a lower 35% contribution margin to secure high-volume supply for eco-conscious institutional clients, prioritizing long-term contract stability over immediate per-unit profit.

Superior ergonomic design and minimalist packaging justify the price increase over standard wood pulp alternatives in the North American market. Clients in this region increasingly value “plastic-free” individual wraps and high-ply density, which are standard features in premium bamboo lines. These attributes allow distributors to command higher price points in the luxury amenity sector.

- Target Segments: Boutique hotels, dental practices, and high-end wellness centers.

- Financial Strategy: High-volume commitments at 35% margins to maintain factory utilization.

- Product Differentiation: Minimalist American design and carbon-neutral supply chain credentials.

Deploying 100% OBA-Free Bamboo Pulp for Sensitive Skin

Top Source Hygiene provides specialized bamboo pulp options that remain 100% OBA-Free. This ensures no optical brightening agents reach the end user, a critical requirement for healthcare providers and skin-care retail brands. Our factory in Hebei maintains strict fiber purity, avoiding the chemical additives common in lower-tier recycled alternatives.

Bamboo pulp projects must meet EU hygiene compliance and North American septic-safe standards. The material is engineered for rapid disintegration in plumbing systems, preventing the clogs often associated with non-wood fibers. To maintain operational viability and competitive pricing, we focus on volume-based strategies targeting a minimum of 500 units per client.

- Safety Standard: 100% OBA-Free (No fluorescent whiteners).

- Plumbing Compliance: Rapid disintegration technology for septic-safe performance.

- Logistics Optimization: 40HQ container loading to minimize the landed cost per unit.

- MOQ Target: Factory utilization requires a baseline of 500 units for specialized bamboo projects.

Custom Toilet Paper OEM & Wholesale Solutions

How Wood Pulp’s Scale (2,860 Tons/Mo) Lowers Your Unit Cost

We spread fixed overhead across 2,860 tons monthly, slashing unit costs through labor scalability and high-volume procurement that smaller mills cannot match.

Fixed Cost Distribution and Labor Scalability

Production costs per ton decline sharply as mill capacity increases. We spread heavy infrastructure investments, including onsite logistics and specialized machinery, across our total monthly tonnage to minimize the capital cost assigned to every individual roll.

The most significant savings happen in labor efficiency. Data shows that when a pulp operation doubles its capacity, personnel requirements often only rise by 30%. We leverage this scalability to keep our labor-cost-per-ton well below industry averages for smaller-scale facilities.

- Infrastructure ROI: Capital costs for onsite roads and railways are amortized over high-volume output.

- Resource Utilization: Modern chip-making and screening systems reduce wood conversion waste compared to older, smaller mills.

- Efficiency Thresholds: Maintaining a high output meets the minimum efficient scale required for global 2026 market competitiveness.

Hebei Hub Capacity and 40HQ Payload Optimization

Strategic location matters. We operate two advanced factories within the Hebei Paper Industrial Hub, maintaining a consistent 2,860-ton monthly output. This volume ensures supply chain stability for global distributors and gives us massive leverage when procuring raw virgin wood pulp.

Logistics efficiency directly impacts your bottom line. We use mechanical compression during the bagging process to increase product density. This allows our loading teams to maximize 40HQ container payloads, typically reaching 7,000kg to 9,000kg per shipment.

- Payload Range: 7,000kg–9,000kg (7–9 Tons) per 40HQ container.

- Compression Tech: High-density packing that maintains paper fluffiness while reducing cubic volume.

- Direct Sourcing: Buying from the Hebei source eliminates intermediary markups and hidden trading fees.

- Landed Cost: Maximizing container space ensures the lowest possible freight cost per unit for international importers.

Analyzing the Profit Margins for Private Label Wood vs. Bamboo

Bamboo pulp delivers 26-35% gross margins via eco-branding premiums, while 100% virgin wood pulp relies on 9-ton 40HQ payload efficiency to protect high-volume distributor margins.

| Financial Metric | Bamboo Pulp Private Label | 100% Virgin Wood Pulp |

|---|---|---|

| Gross Margin Range | 26% – 35% | 30%+ (Market Average) |

| Sustainability Premium | 8% – 15% Retail Markup | Standard Market Pricing |

| ROI Potential | Exceeding 128% | High-Volume Stability |

| Landed Cost Factor | Higher shipping per unit (Imported) | Optimized via Hebei Industrial Hub |

Unit Economics and Market Value for Pulp Selection

Material selection directly dictates the ceiling of your net margin. Bamboo pulp is often 15-25% cheaper to source than high-grade hardwoods in specific regions. This initial cost advantage provides a buffer for private label owners to absorb higher international shipping fees while maintaining a healthy bottom line.

Private labels capitalize on eco-conscious consumer behavior by applying an 8-15% price premium on bamboo products. This markup occurs without increasing production overhead because the value lies in the sustainable branding rather than complex manufacturing changes. These lines demonstrate a potential ROI exceeding 128% due to the high perceived value in North American and European markets.

Traditional 100% virgin wood pulp offers a different financial advantage: predictability. While bamboo markets are still maturing and prone to supply shocks, wood pulp prices remain stable. This protects distributors from sudden margin compression during the 2026 fiscal cycle. Large-scale distributors often favor wood pulp for mass-market retail where price consistency is more critical than niche sustainability premiums.

Improving Margins through 40HQ Payload and Compression Logistics

Logistics efficiency is the primary driver of the landed cost per roll. Shipping “air” kills margins in the tissue industry. We use mechanical compression technology to minimize roll bulk without sacrificing the paper’s softness. This allows us to pack more product into every cubic meter, significantly lowering the freight cost distributed across each unit.

- Payload Optimization: Loading 9 tons per 40HQ container ensures the lowest possible freight cost per roll.

- Scale Efficiency: Our 2,860-ton monthly manufacturing capacity allows for bulk raw material procurement.

- Direct B2B Pricing: Eliminating intermediaries through our source factory model protects dealer margins against retail price fluctuations.

- Regional Advantage: Our location in the Hebei Paper Industrial Hub reduces domestic transport costs to Tianjin Xingang Port.

We strictly protect dealer cash flow by providing pre-shipment visual verification. Distributors receive photos and videos of the finished goods and the loading process before the 70% balance payment. This transparency ensures that the payload meets the 9-ton efficiency target, guaranteeing that the projected unit margins remain intact once the container arrives at its destination.

Logistical Efficiency: Why Wood Pulp Packaging Saves Shipping Costs

Wood pulp products utilize mechanical compression and high-density bundling to maximize 40HQ container space, reducing wasted volume by 30% and lowering landed costs for international distributors.

Mechanical Compression and Volumetric Density

Shipping air is the fastest way to kill margins in the paper industry. We use mechanical compression technology during the bagging process to solve this. This equipment physically reduces the bulk of each roll without compromising the signature fluffiness of the 100% virgin wood pulp fibers.

- Volumetric Efficiency: High-density bundling allows for 40% more compact shipping compared to loose-packed alternatives.

- Stacking Strength: Reinforced 5-ply export cartons and heavy-duty poly bundles prevent product deformation even when stacked to the ceiling of a container.

- Overhead Reduction: Improved cubic meter utilization translates directly to 30% savings in storage and transportation costs.

40HQ Payload Optimization at the Hebei Industrial Hub

Our factory is located in the Hebei paper industrial hub, which provides a massive logistical advantage. By loading containers directly at the source, we bypass the mid-tier handling fees that usually accumulate at third-party warehouses. Our team focuses on maximizing every inch of a 40HQ container to ensure the lowest possible freight cost per unit.

- Payload Specs: We maximize 40HQ container payloads to reach between 7,000kg and 9,000kg (7-9 tons) of finished goods.

- Port Proximity: Strategic location near Tianjin Xingang Port reduces inland transit times to 10-15 days for in-stock inventory models like the TSH-2559.

- Retail Packaging: Consolidated master poly bundles (Format B) are optimized specifically for high-volume supermarket distribution and immediate retail floor readiness.

For regions like Africa and Southeast Asia, where price sensitivity is high, these loading efficiencies are the difference between a profitable shipment and a loss. Models like the TSH-3082 are specifically engineered for these high-payload 9-ton configurations, giving distributors a distinct edge in their local markets.

Frequently Asked Questions

Why does bamboo toilet paper cost more than wood pulp options?

Bamboo tissue typically carries a 20–50% price premium because the industry lacks the massive, centuries-old infrastructure of wood pulp. Specialized machinery is required for processing bamboo fibers, and smaller production scales prevent manufacturers from reaching optimal cost efficiencies. Additionally, international shipping costs from primary growing regions in Asia add a significant logistical layer to the final retail price.

How do regional factors influence wood pulp manufacturing expenses?

Manufacturing costs depend heavily on local labor, energy, and wood availability. Latin American producers lead in efficiency with costs averaging $321 per ton. In contrast, regions with high labor costs or strict environmental regulations face much higher overhead. These structural differences mean a mill in the United States or Europe operates at a significant cost disadvantage compared to plantation-based operations in the global south.

What are the profit margins for private label toilet paper?

Private label margins are slim, generally representing about one-sixth of the margin seen in national brands. Because these products compete primarily on price rather than brand equity, manufacturers must focus on extreme operational efficiency and high-volume sales. Success requires accurate cost accounting and the ability to maintain steady factory utilization rates above 85% to stay profitable.

Can hotels save money through bulk wood pulp procurement?

Hotels can reduce per-unit costs by 30% by switching to bulk ordering for 100% Virgin Wood Pulp rolls. Consolidating orders into 40HQ containers minimizes freight and handling expenses per roll compared to retail-style purchases. This strategy can increase overall profit margins for hospitality groups by up to 25% while ensuring consistent product quality for guests.

What drives the volatility of raw pulp prices in 2026?

Prices are highly sensitive to mill capacity shocks and energy costs, which currently average $100 per metric ton. In 2026, volatility is driven by environmental logging restrictions and demand shifts in major Asian markets. Supply chain delays and higher chemical costs—averaging $60 per ton—create a price floor that keeps global wholesale markets tight.

What are the standard lead times for Top Source Hygiene orders?

Production lead time is strictly 20-25 days for a 40HQ container. For in-stock items from our “Big 10” inventory, dispatch to Tianjin Xingang Port occurs within 10-15 days. Buyers should also account for ocean freight times, which typically range from 7 to 25 days depending on the specific destination port.

Final Thoughts

Predictable ROI in the 2026 paper market requires the infrastructure of a 2,860-ton monthly output rather than the volatile pricing of smaller, decentralized mills. We utilize 100% Virgin Wood Pulp to ensure OBA-Free safety and batch consistency, shielding your brand from the quality complaints that destroy dealer margins. This large-scale manufacturing model provides the price floor and supply security necessary for high-volume wholesale stability.

Validate our fiber performance by requesting a sample kit of the TSH-2559 global favorite or our high-efficiency TSH-3396 solid rolls. We provide full pre-shipment visual verification for every 40HQ container to guarantee your 9-ton payload targets are met before you pay the balance. Contact our Hebei-based export team today to receive a landed cost analysis and a tailored quote for your private label project.