Bleached vs. Natural (Health) choices are the frontline control between procurement decisions, skin-sensitivity incidents, and costly product recalls or regulatory fines. Purchasing teams, quality managers, and compliance officers face tight margins and rising scrutiny over chemical residues and allergen complaints, and a mis-specified tissue product can trigger warranty claims, customer churn, and failed audits.

This guide serves as a technical SOP for product teams and compliance professionals: it examines whether unbleached brown tissue reduces skin risk, explains ECF versus TCF bleaching standards, explores why whiteness drives hygiene perception, and—at the core—compares dioxin and chemical residues with detection limits, exposure scenarios, and pass/fail thresholds. You will find actionable metrics, supplier-checklist items, testing protocols, and FAQ answers so teams can set defensible specifications, design acceptance tests, and justify claims during procurement and regulatory review.

Is Unbleached Brown Tissue Truly Safer for Sensitive Skin?

Verifying chemical and construction profiles reduces allergy risk, prevents plumbing failure, and protects brand liability for sensitive-skin markets.

Verify chemical profile: OBA‑free, chlorine‑free processing and additive absence

Treat the product specification as a chemical checklist rather than a marketing claim. Require the technical data sheet (TDS) to state explicit “no chlorine bleach” or “TCF/unbleached” processing and an OBA‑free declaration; then validate that claim with supplier documentation. Ask for Safety Data Sheets (SDS) and a Certificate of Analysis (COA) that lists limits for optical brighteners, fragrance/lotions, formaldehyde, and any PFAS screening results.

Mandate analytical evidence before volume buy: run residual chlorine and dioxin screening with TEQ reporting or accept third‑party lab reports, and include a fragrance/allergen panel if the SKU could be scented. Require a written manufacturing process summary and batch photos from the mill; reject any batch that lists softeners, perfumes, dyes, or preservative chemicals on the COA or process summary.

- Processing spec: insist on “no chlorine bleach” / TCF or unbleached statement and explicit “OBA‑free” on the TDS.

- Documentation: obtain SDS and COA showing numerical limits for optical brighteners, fragrances, formaldehyde and PFAS screening if relevant.

- Analytical checks: run residual chlorine and dioxin (TEQ) screening or accept accredited third‑party lab results; include allergen panel for scented options.

- Supplier action: require a written manufacturing process summary, batch photos, and immediate rejection of batches that list softeners, perfumes, dyes, or preservatives.

Specify fiber and construction metrics that reduce mechanical and chemical irritation

Define raw material and sheet construction to control both abrasion and chemical exposure. Specify 100% virgin long‑fiber wood pulp or bamboo pulp for lint‑free, soft contact; avoid mixed recycled waste in sensitive‑skin SKUs because recycled streams increase particulate and residue risk. Use the product bible targets: 2–4 ply with 13–22 g/m² per ply to balance surface softness and wet tensile strength.

Specify mechanical features that reduce irritation and improve function: point‑to‑point embossing (targets ~+30% absorbency), high‑pressure ply bonding to prevent delamination, and precision perforation to avoid frayed edges. Set acceptance criteria for tensile and wet‑tensile performance and run tactile panels and residue tests on sensitive‑skin cohorts before bulk purchase.

- Fiber spec: require 100% virgin long‑fiber wood pulp or bamboo pulp; exclude mixed recycled content for sensitive‑skin SKUs.

- Ply & GSM: specify 2–4 ply at 13–22 g/m² per ply to balance softness and wet strength.

- Design: require point‑to‑point embossing (~+30% absorbency), high‑pressure bonding, and precision perforation to prevent fraying.

- Performance checks: set numeric tensile and wet‑tensile targets, run tactile assessments, and perform tissue residue tests on sensitive‑skin panels prior to approval.

Confirm disintegration performance and regulatory/dermatological compliance

Protect plumbing and meet market requirements by demanding rapid disintegration evidence that aligns with North American and European septic standards. Specify the test method (slosh box or equivalent ISO protocol) and require passing results on file. For regulatory compliance, request ISO 9001 certification, FDA ingredient compliance statements, EU hygiene and REACH declarations, and any available dermatological patch test reports.

Control packaging and procurement risk: prefer individually wrapped hotel SKUs for high‑hygiene channels and confirm that compression during bagging does not compromise sheet integrity or cause additive transfer. Mandate third‑party lab reports and small‑batch dermatological patch testing with eczema/dermatitis cohorts before approving large or private‑label orders.

- Septic/plumbing: require rapid disintegration test results using slosh box or equivalent ISO method that meet NA/EU standards.

- Regulatory: collect ISO 9001, FDA ingredient statements, EU hygiene/REACH declarations, and dermatological patch test reports.

- Packaging: specify individual wrap versus bundle by channel and verify compression does not damage sheets or introduce additives.

- Procurement step: require accredited third‑party lab reports and small‑batch patch testing (including eczema/dermatitis cohorts) before volume or private‑label approval.

The Chlorine Myth: Understanding ECF vs. TCF Bleaching Standards

Require AOX/dioxin limits, OBA-free certification, and batch brightness/tensile verification to control chemical risk and protect compliance and brand claims.

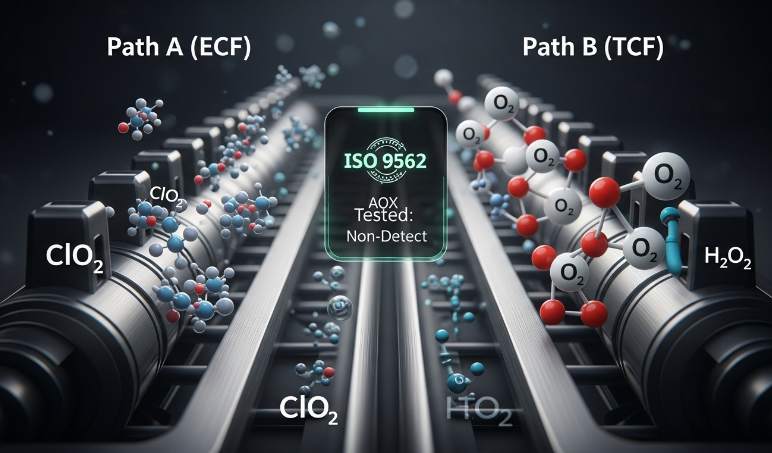

ECF vs TCF: chemical agents, expected by-products, and lab tests to request

ECF uses chlorine dioxide; TCF uses oxygen-based oxidants such as hydrogen peroxide, ozone, or pure oxygen. Ask the mill to list every bleaching agent, concentration, and stage where it applies so you can map byproduct risk and effluent control. Specify AOX screening (ISO 9562) to quantify chlorinated residuals and require high-resolution dioxin/furan testing (EPA Method 1613 or equivalent) for each supplied pulp batch; insist on recent lab reports tied to the batch number.

Also require an OBA-free declaration and a certificate of analysis proving no optical brightening agents; confirm the mill measured natural brightness rather than using fluorescent whitening. Put AOX and dioxin acceptance criteria into the purchase specification and demand third-party verification before shipment. Require process-control logs for bleaching stages and effluent treatment so you can verify consistent ECF or TCF implementation across large orders.

- Request mill disclosure of bleaching chemicals and concentrations, linked to lot numbers.

- Require AOX (ISO 9562) and dioxin/furan (EPA 1613 or equivalent HRGC/HRMS) reports for each pulp batch.

- Obtain an OBA-free certificate of analysis and proof of natural brightness method.

- Include AOX/dioxin acceptance limits in the contract (non-detect or mutually agreed threshold) and require third-party lab confirmation pre-shipment.

- Require process control logs for bleaching stages and effluent treatment for audit and corrective-action traceability.

Material and performance trade-offs: brightness, fiber strength, absorbency, and disintegration metrics

Specify target brightness and fiber performance up front. Top Source achieves natural brightness of 85–92% through fiber selection rather than aggressive whitening; list brightness to ISO 2470-1 in the technical spec. Set GSM per ply at 13–22 g/m² and require tensile and wet-strength ranges; request tensile test reports performed to TAPPI standards and tied to the final product construction so you can verify wet performance for real-world use. Note that bleaching chemistry affects fiber strength: peroxide-based processes cut strength more than chlorine-dioxide ECF variants, so accept that brightness gains can trade off with tensile properties.

Quantify absorbency and embossing effects in the spec. Require capillary-rise or absorbent-gram tests and confirm point-to-point embossing delivers roughly a 30% absorbency gain where claimed. For North American and European markets, demand septic/flushability validation with documented disintegration tests and plumbing compatibility statements. Make acceptance conditional on lab-measured brightness (ISO 2470-1), GSM, tensile strength, and disintegration results for the production batch.

- Specify brightness (ISO 2470-1) target: 85–92% natural brightness via fiber selection.

- Set GSM per ply: 13–22 g/m²; require TAPPI tensile and wet-strength test reports per batch.

- Require quantitative absorbency/capillary-rise data and verification that point-to-point embossing increases absorbency by ~30% where used.

- Require septic/flushability validation and disintegration testing for NA and EU markets; link acceptance to those results.

- Make batch release conditional on lab-measured brightness, GSM, tensile strength, and disintegration metrics.

B2B procurement checklist and verification steps for 2026 contracts

Build a document-driven sourcing workflow. Request AOX and dioxin test reports, an OBA-free declaration, a fiber-source certificate confirming 100% virgin wood pulp or the specified alternative, ISO 9001, FDA and EU hygiene certificates, and batch color-consistency records. Define sampling and testing protocols: require a pilot-run sample roll set, run plumbing and dispenser tests in-field, and send samples to an independent lab for brightness (ISO 2470-1), AOX (ISO 9562), and contaminant screening.

Set formal quality gates inside the contract. Spell out acceptance criteria (brightness range, GSM per ply 13–22 g/m², OBA-free status, septic-safe verification), require pre-shipment visual verification and container-loading photos of the 40HQ, and add remedial clauses for out-of-spec batches that mandate rework, rejection, or replacement plus a supplier corrective action plan with root-cause analysis. Adjust region-specific checks: in North America prioritize septic-safe and OBA-free lab proof; in Europe add FSC or equivalent sustainability certification; in the Middle East require luxury spec confirmation (5-ply, wider widths) alongside bleaching documentation.

- Documents to request: AOX report (ISO 9562), dioxin report (EPA 1613 or equivalent), OBA-free declaration, fiber-source certificate (100% virgin wood pulp if required), ISO 9001, FDA/EU hygiene certificates, batch color-consistency records.

- Sampling protocol: require a pilot-run sample roll set, perform in-field plumbing and dispenser tests, and send samples to an independent lab for ISO 2470-1 brightness, ISO 9562 AOX, and contaminant screening.

- Quality gates: define contractual acceptance criteria (brightness range, GSM per ply 13–22 g/m², no OBA, septic-safe evidence) and require pre-shipment photos/video of loaded 40HQ.

- Region-specific checks: North America — prioritize septic-safe and OBA-free proof; Europe — add sustainability/FSC or equivalent; Middle East — confirm luxury specs (5-ply, wider widths) plus bleaching documentation.

- Action step: include remedial clauses for out-of-spec batches and require supplier corrective action plans with root-cause analysis and timeline for resolution.

Factory-Direct Toilet Paper OEM Solutions

Why Does Whiteness Remain the Top Metric for Hygiene Perception?

Control brightness and supply-chain handling to protect perceived hygiene, reduce complaints, and retain premium pricing for B2B customers.

Quantifying visual whiteness: target metrics and sampling protocol

Set a natural brightness target of 85–92% and meet it through fiber selection, not optical brightening agents. Use a calibrated spectrophotometer to record CIE L*a*b and ISO brightness values; take three readings per roll and sample five rolls per lot to build a reliable lot average.

Accept or reject lots using defined numerical gates: lot average brightness ≥85% and inter-roll ΔE ≤2. For 40HQ shipments, sample at least 0.5–1% of total rolls or a minimum of five rolls, whichever is greater, and record results in the lot report for traceability.

- Measurement method: use a calibrated spectrophotometer; document CIE L*a*b and ISO brightness readings.

- Sampling: three readings per roll × five rolls per lot; scale cadence to 0.5–1% for full-container loads.

- Acceptance criteria: lot average ≥85% brightness; inter-roll ΔE ≤2; reject or rework if out of spec.

Material and process controls that produce whiteness without optical brighteners

Specify 100% long-fiber Virgin Wood Pulp as the primary raw material and offer Bamboo Pulp as an eco alternative for targeted SKUs, and record “OBA-free” explicitly in supplier contracts. Avoid adding optical brightening agents; achieve the 85–92% natural brightness through pulp selection and pulping control rather than fluorescent whiteners.

Adopt oxygen- or peroxide-based delignification and consider TCF or carefully controlled ECF processes when you need bleaching performance while maintaining an OBA-free claim. Target sheet construction at 13–22 g/m² per ply and offer 2–5 ply variants to balance perceived whiteness and tactile softness. Require Certificates of Analysis for chemical residuals, run UV/fluorescence scans to confirm OBA absence, and insist on ISO 9001, FDA, and EU hygiene compliance in supplier documentation.

- Raw material: 100% long-fiber Virgin Wood Pulp; Bamboo Pulp option for eco-series; contractually state “OBA-free.

- Bleaching policy: use oxygen/peroxide-based methods or TCF; accept ECF only with documented controls and low byproduct profiles.

- Sheet spec: maintain 13–22 g/m² per ply; offer 2–5 ply SKUs to balance whiteness and feel.

- Verification: require COA for residuals, run UV/fluorescence OBA checks, and demand ISO 9001, FDA, and EU hygiene certificates (2026 standards).

Packaging and supply-chain controls that preserve perceived whiteness at point of use

Package hotel-grade rolls in individual white paper or plastic wrap and use neutral or white bundle packs for retail to reinforce a clean visual cue at shelf. Enforce “Batch Color Consistency” in contracts and require pre-shipment spectrophotometer reports plus photographic or video proof of palletized loads before releasing final payment.

Control storage and transport to prevent yellowing and surface damage: limit warehouse humidity to under 60% RH, use opaque inner wraps to block UV exposure, and set mechanical compression parameters to avoid surface abrasion. Label export cartons with HS Code 4818.1000 and include color acceptance data and a pre-shipment quality checklist in shipping documentation to reduce field discoloration complaints.

- Packaging: individual white wrap for hospitality; neutral/white bundles for retail.

- Pre-shipment: require spectrophotometer reports and video/photos of pallet loads before balance payment.

- Storage & transport: keep RH <60%, use opaque inner wrap, and control compression to prevent surface abrasion.

- Logistics: mark export cartons HS Code 4818.1000 and attach color acceptance and quality checklists to shipping documents.

Dioxin and Chemical Residues: A Technical Safety Comparison

Set enforceable internal limits and testing workflows so buyers and operations avoid dioxin risk, maintain OBA-free integrity, and protect brand claims.

Contaminant profile and recommended internal limits for dioxins and chlorinated residues

Target the full dioxin family when you evaluate tissue: 7 PCDDs, 10 PCDFs and the 12 dioxin-like PCBs used in WHO TEQ calculations. Report PCDD/F plus dl‑PCB results as pg WHO-TEQ per g (dry weight). Track AOX as mg Cl/kg and record optical brightening agents (OBAs) as presence/absence in screening. Use TEF-based summation to convert individual congeners into a single WHO‑TEQ metric for pass/fail decisions.

- Internal acceptance: target non-detect or <0.1 pg WHO-TEQ/g (dry) for PCDD/F + dl‑PCBs; treat ≥0.1 pg WHO-TEQ/g as a hold condition.

- Reject or remediate finished lots at ≥0.5 pg WHO-TEQ/g; document remediation steps and retest to confirm compliance.

- AOX guideline: set an internal action level (example) <0.5 mg Cl/kg in finished tissue; treat persistent upward AOX trends as process failure and investigate whitewater or bleaching chemistry.

- OBAs: require zero use. Specify “OBA‑free” in supplier contracts and accept only non‑detect in screening assays; capture supplier declaration on every lot COA.

Sampling and sample‑preparation protocol for representative toilet-tissue testing

Use composite sampling to represent a production batch reliably: collect 10 random rolls across pallet positions for each finished‑goods lot, combine material until you produce at least a 200 g homogenized test sample on a dry‑weight basis. Record roll positions and lot identifiers to support traceback if results exceed action levels.

Prepare the composite by cutting and shredding rolls to a uniform matrix, measure moisture and convert to dry weight for reporting. Extract with validated methods—accelerated solvent extraction (ASE) or Soxhlet—using hexane:dichloromethane 1:1. For ASE, employ conditions similar to 100°C, 1,500 psi and three cycles. Spike the sample with 13C‑labelled dioxin congeners before extraction (isotopic‑dilution). Clean up extracts through multilayer silica/acidified silica, alumina and activated carbon fractionation, then concentrate the final extract to roughly 5–10 µL for HRGC‑HRMS analysis.

- Sampling: 10 random rolls per batch → composite ≥200 g (dry).

- Homogenize: cut, shred, mix; record moisture and calculate dry weight.

- Extraction: ASE or Soxhlet; solvent hexane:DCM 1:1; ASE example 100°C, 1,500 psi, 3 cycles.

- Internal standards: spike with 13C‑labelled congeners prior to extraction.

- Cleanup and concentration: multilayer silica/alumina/activated carbon; final extract 5–10 µL for instrument injection.

Analytical measurement and QA/QC: HRGC‑HRMS workflow and acceptance criteria

Quantify PCDD/F and dl‑PCBs using high‑resolution gas chromatography coupled to high‑resolution mass spectrometry (HRGC‑HRMS) and apply isotopic‑dilution for each analyte. Calibrate with a multi‑point curve across the expected working range—an example range equals 0.1–10 pg/µL equiv.—and verify linearity with R2 ≥ 0.995. Aim for method detection limits below 0.05–0.1 pg WHO‑TEQ/g; set method quantitation limits through laboratory validation.

Build a QA/QC suite: include solvent blanks, method blanks, matrix spikes, laboratory control samples, and duplicate analyses. Target recoveries for labelled standards should fall between 60% and 120%. Report individual congeners and the summed WHO‑TEQ, and include MDL/MQL, recovery percentages, measured instrument resolution, and full chain‑of‑custody with sample handling notes in every report.

- Method: HRGC‑HRMS with isotopic‑dilution quantitation.

- Calibration: multi‑point (example 0.1–10 pg/µL), verify R2 ≥ 0.995.

- Sensitivity: MDL target <0.05–0.1 pg WHO‑TEQ/g; establish MQL by validation.

- QA/QC elements: solvent & method blanks, matrix spikes, LCS, duplicates; recoveries 60–120% for labelled standards.

- Reporting: list congeners, summed WHO‑TEQ, MDL/MQL, recovery %, instrument resolution, and chain‑of‑custody documentation.

Manufacturing controls to prevent formation and carryover of chlorinated residues

Control inputs: specify 100% virgin wood pulp or certified bamboo pulp for OBA‑free product lines and prohibit post‑consumer recycled pulp in those SKUs. Require supplier certificates that declare bleaching chemistry and material origin. Do not accept elemental chlorine bleaching; prefer TCF or peroxide‑based brightening for product lines where buyers accept bleached stock.

Manage process water and effluent: implement closed‑loop whitewater where feasible, deploy activated carbon polishing on discharge streams, and measure AOX regularly to detect changes. Track key process parameters—peroxide dosage, pH, temperature during brightening stages, residence time and filter/adsorbent change intervals—to spot conditions that increase dioxin or AOX formation. Require a COA for every pulp lot and periodic third‑party mill audits to verify bleaching practice and chemical controls.

- Raw material spec: 100% virgin wood pulp or certified bamboo; ban post‑consumer recycled pulp in OBA‑free lines.

- Bleaching policy: require TCF or peroxide‑based brightening; forbid elemental chlorine bleaching in contracts.

- Whitewater/effluent: closed‑loop whitewater, activated carbon polishing, routine AOX monitoring.

- Process controls: track peroxide dosage, pH, temperature, residence time, and filter replacement intervals.

- Supplier verification: lot COA, mill declaration of bleaching chemistry, and periodic third‑party audits.

Out-of-spec response workflow: confirmation, quarantine, root cause, and corrective actions

When a finished‑goods lot exceeds action levels, quarantine the lot immediately and stop container loading. Notify quality and operations within 24 hours and document the lot number, pallet positions, retained samples and photographs. Hold retained samples for confirmatory analysis and split a portion to an accredited third‑party lab for confirmation within seven calendar days.

Trace back to pulp lot, bleaching batch, process logs, chemical dosing records and recent filter or adsorbent changes to identify root cause. Select corrective actions based on findings: rework with a validated treatment, replace the pulp lot, upgrade polishing media, or arrange secure destruction consistent with local hazardous‑waste rules. Issue a corrective action report, provide COA and laboratory findings to customers as required, and keep chain‑of‑custody and pre‑shipment photos on file for buyer assurance.

- Immediate: quarantine affected lot, stop loading, notify quality and operations within 24 hours.

- Confirmatory testing: split retained sample; send to accredited third‑party lab for confirmation within 7 days.

- Traceback: map pulp lot, bleaching batch, process logs, chemical dosing, and recent filter/adsorbent changes.

- Corrective actions: rework with validated process, replace pulp lot, upgrade polishing media, or destroy per hazardous‑waste rules.

- Customer/documentation: issue CAP, supply COA and lab reports, retain chain‑of‑custody records and pre‑shipment photos.

Does Unbleached Paper Possess Superior Natural Absorbency?

Measure fiber type, ply density, and embossing metrics—not color—to predict absorbency and control commercial risk.

Mechanisms of absorbency: fiber morphology, ply density, and embossing effects

Long, 100% virgin wood pulp fibers form larger capillary channels that raise liquid uptake and wet tensile strength; when you evaluate samples, require the fiber source and average fiber length on the spec sheet so you can correlate structure with performance. Specify ply density in the 13–22 g/m² per ply range: higher per-ply GSM increases liquid holding capacity but slows disintegration, so pick a target that balances absorbency with septic-safe collapse.

Ask suppliers for point-to-point CNC embossing pattern samples and wet-spread measurements—CNC embossing typically increases apparent absorbency by about 30% by creating micro-reservoirs and more surface area. Use a standard gravimetric absorbency test (condition sample, submerge 10 seconds, remove, blot 3 seconds, record mass gain as g absorbed per g paper) and track ancillary metrics such as capillary rise (mm/s), static contact angle, and wet tensile strength (N/ply) to quantify usable performance.

- Require fiber source and average fiber length on sample reports.

- Specify ply density (13–22 g/m² per ply) and target wet tensile (N/ply).

- Run gravimetric absorbency: 10s submerge, 3s blot — report g/g.

- Compare embossing patterns and measure wet spread to validate the claimed ~30% uplift.

Material and processing controls that affect natural absorbency in unbleached tissue

Specify OBA-free and chlorine-free processing to preserve native fiber porosity and avoid trace dioxin residues associated with older chlorine bleaching methods; require the words “chlorine-free” or “TCF/ECF declared” on the supplier spec and confirm absence of optical brightening agents. Consider bamboo pulp for targeted grades: hollow bamboo fibers increase moisture retention and add natural antimicrobial traits, but insist on a fiber-composition percentage for any blended product so you can model absorbency versus cost.

Prohibit lotions, fragrances, softeners, and dyes in your spec sheet to prevent hydrophobic films that reduce wettability. Ask suppliers to deliver brightness by fiber selection (85–92% natural brightness) and to provide batch color-consistency records plus third-party disintegration/collapse test reports that meet North American and European septic standards before you accept a container.

- Require OBA-free and explicit “chlorine-free” declaration.

- Request fiber-composition breakdown (e.g., % bamboo, % hardwood, % softwood).

- Ban lotions, fragrances, softeners, and dyes on technical specs.

- Validate brightness (85–92%) via batch color records and OBA absence.

- Obtain third-party disintegration/collapse test reports for NA and EU septic standards.

Quantifiable performance metrics and B2B sourcing specifications to verify absorbency claims

Write clear KPIs into your RFQ: absorbency (g water per g paper), wet tensile strength (N), ply density (g/m² per ply), and disintegration time against accepted septic standards. Ask suppliers to include product specs that list core material (100% virgin wood pulp or bamboo), OBA-free declaration, embossing type, roll widths (102–132 mm), and ply count (2–5 ply) so you can compare apples-to-apples across offers.

Demand documentation: ISO 9001, FDA or EU hygiene compliance, independent lab absorbency and disintegration reports, plus pre-shipment visual verification (photos/videos). Use logistics parameters—HS code 4818.1000, MOQ 1 x 40HQ, lead times 10–25 days, and container payload 7–9 tons—to calculate landed cost per absorbed-meter and set acceptance tests on arrival.

- RFQ KPIs: absorbency (g/g), wet tensile (N), ply density (g/m²), disintegration time (seconds/minutes against standard).

- Supplier specs required: core material, OBA-free statement, embossing pattern, roll widths 102–132 mm, ply count 2–5.

- Documentation: ISO 9001, FDA/EU hygiene compliance, third-party lab reports, pre-shipment photos/videos.

- Logistics: HS code 4818.1000, MOQ 1×40HQ, lead times 10–25 days, container payload 7–9 tons for cost modeling.

- On-arrival QA: random-sample gravimetric absorbency, brightness check (85–92%), embossing integrity, rapid-disintegration spot test before acceptance.

How Does Balancing “Clean” Image vs. “Eco” Authenticity Affect Market ROI?

Authentic eco claims increase willingness-to-pay and long-term loyalty while honest hygiene cues lift short-term conversion—measure both to find the profitable mix.

Compute ROI: cost-per-use and sensitivity analysis for hygiene vs. eco claims

Calculate physical yield per roll with this formula: length (m) = roll_mass (g) / (GSM_total (g/m²) × width (m)), where GSM_total = GSM_per_ply × plies. Use measured GSM from incoming QC rather than nominal specs; small deviations in GSM or width change usable meters materially. For example, a TSH-3396 bundle at 5000g/28 gives per-roll mass = 5000 ÷ 28 ≈ 178.6 g. If you set GSM_per_ply = 16 g/m² and plies = 5, GSM_total = 80 g/m²; at a width of 105 mm (0.105 m) length ≈ 178.6 ÷ (80 × 0.105) ≈ 21.3 m per roll—use that to convert price-per-roll to cost-per-meter.

Compute landed cost-per-meter as: (factory unit price + freight allocation) ÷ total meters per 40HQ. Use container payload ranges (7,000–9,000 kg) to estimate total meters: total_meters = payload_grams ÷ (GSM_total × width). Run a sensitivity matrix that models margin when adding a hygiene premium (individual wrap, sealed roll, premium labeling) versus an eco premium (unbleached, recycled/bamboo pulp, reduced plastic). Use MOQ = 1×40HQ as the pilot case and model scenarios across ±10–30% price elasticity. Track conversion lift, average order value, and return rate per SKU in a 12-week pilot and convert those deltas into incremental ROI and payback period (weeks to recover added cost per container).

Specify materials, certifications and test parameters that shift distributor acceptance and pricing

Choose materials with clear commercial trade-offs: 100% Virgin Wood Pulp delivers premium softness and tensile strength; Bamboo Pulp supports an eco premium and offers natural antimicrobial properties and high moisture handling; Recycled Pulp suits price-sensitive eco positioning but can reduce wet-strength and alter tactile profile. Call out expected performance changes in wet-strength and hand-feel so distributors can match SKUs to channel expectations.

Require these regional specs and verifiers to protect distributor trust and pricing: OBA-Free, rapid disintegration meeting North American/European septic standards, ISO 9001, and FDA/EU hygiene compliance; add FSC or equivalent chain-of-custody for European eco positioning. Test targets to include brightness 85–92%, disintegration times per septic test, GSM per ply between 13–22 g/m², and quantified wet-strength values. Keep claims verifiable—label claims such as “OBA-Free,” “Septic Safe,” or “100% Virgin Wood Pulp” must match third-party certificates and lab reports. Define a region-by-region spec sheet (materials + certifications + allowed claims) and use it for pre-shipment verification and marketing approvals.

- Material checklist: Virgin Wood, Bamboo, Recycled — note wet-strength and tactile trade-offs for each.

- Mandatory certificates: ISO 9001, FDA/EU hygiene, OBA-Free documentation; add FSC for EU eco SKUs.

- Test parameters: brightness 85–92%, GSM per ply 13–22 g/m², septic/disintegration benchmarks, wet-strength metrics.

- Control process: attach lab reports and third-party certificates to every commercial spec sheet.

Optimize packaging and messaging mix to protect margin while preserving authenticity

Trade packaging formats against channel economics: Format A—individual wrap for hospitality and premium retail increases willingness-to-pay but raises per-roll packaging cost; Format B—direct bundle optimizes supermarket and club volumes. Use coreless solid rolls to lower freight per usable meter and increase space efficiency in a 40HQ. Account for container logistics: plan payloads between 7,000–9,000 kg, apply mechanical compression for higher cubic yield, set MOQ = 1×40HQ, and use lead times of 10–15 days for in-stock dispatch or 20–25 days for production runs.

Map messaging to channel willingness-to-pay: push hygiene cues (individual wrap, “hotel-grade”, 5-ply, 165 mm width) into GCC and hospitality where buyers accept premiums; allocate eco cues (unbleached, minimal plastic, bamboo, FSC) to Europe and specialty retailers. Run an A/B packaging experiment at distributor level using one container pilot: vary wrap type, label claims, and imagery (eco-visual vs hygiene-visual); measure sell-through, reorder rate, and margin impact. Calculate the freight + packaging cost delta per roll when switching from standard film to reduced plastic or paper-only wrap and fold that delta into MSRP tests so authenticity choices reflect true ROI.

- Packaging options: individual wrap (Format A) vs direct bundle (Format B); coreless solid rolls for freight efficiency.

- Logistics plan: 40HQ payload 7,000–9,000 kg; lead times 10–15 days (stock) or 20–25 days (production).

- A/B pilot: one container with controlled label/visual and wrap variations; measure sell-through and reorder within 12 weeks.

- Costing: quantify per-roll freight + packaging delta for each wrap option and include in MSRP sensitivity runs.

Conclusion

Proper installation and wiring reduce safety risks, keep operations compliant with OSHA standards, and extend equipment life. It also minimizes unplanned downtime and lowers long-term maintenance costs.

Start by auditing your fleet’s current setup or contact us to request a certified lighting catalog and sample. Our team will help match specifications to your compliance and operational needs.

Frequently Asked Questions

Is unbleached toilet paper objectively safer than bleached white?

Yes — unbleached tissue is generally safer for sensitive skin than conventional bleached alternatives, but the difference depends on overall composition and manufacturing. Unbleached products avoid chlorine bleach, which can leave trace dioxins and trigger irritation; the safest options combine unbleached paper with chemical‑free processing, hypoallergenic materials (for example bamboo) and freedom from fragrances, dyes, lotions or formaldehyde.

What chemicals are used in the modern bleaching process?

The research content identifies chlorine bleach as a primary bleaching agent in conventional products and notes that bleaching can leave trace amounts of potentially harmful dioxins; no other specific bleaching chemicals are listed in the provided material.

Why do health-conscious consumers prefer unbleached brown tissue?

Health-conscious buyers prefer unbleached tissue because it avoids chlorine bleach and the associated trace dioxins, and because top choices are manufactured without harsh preservatives, fragrances, dyes or formaldehyde. Additionally, unbleached options made from naturally soft, hypoallergenic fibers like bamboo offer antimicrobial properties and better moisture retention, reducing dryness and irritation.

Does bleaching affect the softness or strength of the paper fibers?

The provided research does not supply mechanistic data on how bleaching changes softness or strength. It emphasizes that softness and suitability for sensitive skin are strongly influenced by fiber choice (for example bamboo) and by processing that avoids harsh chemicals; therefore bleaching alone is not presented as the sole determinant of softness or strength in the source material.

How to market bleached white paper as a “safe” choice to consumers?

Based on the research content, position bleached white paper as safe by clearly addressing the main consumer concerns: disclose the bleaching and processing method, state whether chlorine bleach is used or avoided, and emphasize the absence of harsh preservatives, fragrances, dyes or formaldehyde. Highlight hypoallergenic properties and fiber selection (e.g., naturally soft fibers) and be transparent about processing so customers can compare chemical exposure risks.

Are there specific global certifications for TCF paper?

The provided research content does not list specific global certifications for TCF (Totally Chlorine Free) paper. The material emphasizes chlorine‑free or unbleached status as desirable, but it does not name third‑party certification programs or labels.