B2B procurement teams face a shifting landscape as basic hygiene products evolve into “active care” solutions that blend sanitation with skincare. With the global feminine hygiene market projected to reach $91.2 billion by 2035 and the incontinence sector scaling toward $20.85 billion, brand managers must prioritize dermatological benefits to capture the premium retail segment. Success in this category requires more than just adding ingredients; it demands a technical understanding of how infusions interact with substrate materials to protect the skin barrier while maintaining product performance.

This article details the industrial processes behind high-tier hygiene sourcing, from the gelling agents used to stabilize Aloe Vera and Vitamin E to the 40-45°C temperature controls required for consistent scent application. We examine the importance of maintaining a target pH of 5.5 to support the skin’s natural acid mantle and provide a roadmap for navigating international regulatory frameworks like MoCRA and REACH. By focusing on formulation stability and clinical validation, buyers can secure products that offer both superior comfort and long-term shelf-life reliability.

The Market for “Active Care” Hygiene Products

The hygiene market is shifting toward “active care” solutions that integrate skincare benefits like aloe vera and Vitamin E with traditional sanitation. Global valuations for feminine hygiene are projected to reach $91.2 billion by 2035, while the incontinence care sector scales toward $20.85 billion by 2030, driven by an aging population and a preference for organic, skin-safe materials.

Emerging Trends in Skin-Centric Hygiene Solutions

Consumers increasingly choose hygiene products that offer dermatological benefits beyond basic protection. This shift has led to higher demand for pads and liners infused with active ingredients such as aloe vera and Vitamin E, which help maintain skin barrier health. Sustainability serves as another primary driver, with biodegradable pads and reusable menstrual cups gaining significant market share as users move away from synthetic materials.

The transition toward organic materials reflects a broader focus on long-term dermatological health. By minimizing skin irritation through the removal of harsh chemicals and the addition of soothing agents, manufacturers align their products with the “active care” philosophy. These innovations cater to sensitive skin segments and respond to growing consumer awareness regarding the chemical composition of daily hygiene essentials.

Global Projections for Women’s Health and Incontinence Segments

The women’s hygiene market maintains a steady growth rate of 7.2%, positioning it to reach a projected valuation of $91.2 billion by 2035. Feminine hygiene products currently account for 45.3% of the total sector, with intimate washes making up approximately 20.1%. These figures highlight a robust appetite for specialized care products that provide both hygiene and comfort in premium retail environments.

Growth in the incontinence care segment is equally significant, with the market on track to reach $20.85 billion by 2030. This expansion is largely fueled by aging demographics and a rise in the adoption of home care solutions. Meanwhile, the broader sanitary product market remains on a strong trajectory toward $53.14 billion by 2031, with a heavy emphasis on enhanced absorbency and advanced skin protection features to meet the needs of active lifestyles.

Regional Market Leaders and Infusion Innovation

Industry leaders including Procter & Gamble, Unilever, and Kimberly-Clark are prioritizing the development of lotion-infused and scented products to capture the premium market. These organizations leverage advanced manufacturing techniques to incorporate moisture-retaining agents directly into product cores. This strategy allows brands to differentiate their offerings in a crowded landscape by focusing on the sensory and protective qualities of their materials.

Geographically, the United States remains a dominant force, with revenue exceeding $4.30 billion in the feminine hygiene sector alone. High growth rates are also evident in China at 6.3% and the UK at 5.2%. These regional markets show a clear trend of medical and skincare brands entering the hygiene space, further blurring the lines between personal care and clinical skin health. Steady investment in regional infrastructure ensures that these “active care” innovations reach a global consumer base effectively.

Formulating Skincare Infusions (Aloe Vera, Vitamin E)

Modern hygiene formulations integrate water-soluble aloe vera polysaccharides with lipid-based Vitamin E using advanced gelling agents to ensure dermal bioavailability. Success depends on managing electrolyte-induced emulsion instability and implementing robust preservation systems to maintain microbial safety throughout the global supply chain.

| Active Component | Formulation Objective | Technical Requirement |

|---|---|---|

| Aloe Vera Gel Extract | Dermal soothing and enzyme delivery | Electrolyte management for emulsion stability |

| Vitamin E (Tocopherol) | Antioxidant and anti-aging protection | Polymeric film integration for sustained release |

| Specialized Emulsifiers | Phase separation prevention | Balanced HLB for lipid-water systems |

Optimizing Aloe Vera Gel Solubility and Microbial Control

Skincare formulations in 2026 prioritize water-soluble aloe vera gel extracts containing essential polysaccharides, minerals, and enzymes while strictly excluding leaf exudate. These water-rich components provide the primary soothing mechanism for infused hygiene products but introduce significant formulation hurdles. High electrolyte levels naturally present in aloe vera can trigger the breakdown of emulsion stability in infused wipes and tissues, leading to liquid migration or ingredient settling during storage.

Manufacturers protect these botanical extracts by using robust preservation systems. Because aloe vera is highly susceptible to bacterial growth, stabilization requires broad-spectrum antimicrobial agents that remain effective within the 2026 supply chain environments. Choosing the correct preservative ensures the active polysaccharides remain bioavailable and safe for sensitive skin contact throughout the product shelf life.

Sustained Delivery of Vitamin E Antioxidants

Formulations utilize oil-based Vitamin E, specifically Tocopherol, to provide anti-aging benefits and environmental protection for the skin barrier. Integrating these lipids into paper-based substrates requires a delivery vehicle that prevents the oil from soaking too deeply into the fibers, which would reduce its effectiveness on the skin. Research indicates that polymeric films used in paper infusions successfully release approximately 30% of Vitamin E acetate within 12 hours of contact, providing a sustained protective effect.

Standard dosage ratios for 2026 high-tier hygiene products align with 400 IU of Vitamin E per 60 ml of active solution. This concentration maximizes antioxidant efficacy without compromising the tactile feel of the tissue or wipe. By controlling the release rate, chemists ensure that the antioxidant protection persists long after the initial application, shielding the skin from oxidative stress and mechanical irritation.

Stabilizing Emulsions for Active-Care Tissues

The combination of water-rich aloe and lipid-based Vitamin E requires specific gelling agents to maintain a consistent texture on paper substrates. Without these stabilizers, the different phases would separate, resulting in uneven application and reduced product performance. Top Source Hygiene and other OEM leaders use specialized emulsifiers to prevent phase separation between the cooling aloe gel and the protective Vitamin E oils, ensuring every tissue contains an identical ratio of active ingredients.

2026 testing protocols confirm that balanced infusions significantly improve product shelf life while ensuring the active ingredients remain bioavailable for the end user. These stabilizers also manage the viscosity of the lotion, allowing it to remain on the surface of the paper rather than being fully absorbed into the core. This surface-level positioning facilitates efficient transfer to the skin during use, meeting the high performance standards required for medical and luxury hygiene segments.

Scent Application: Core-Scenting vs. Sheet-Spray Tech

Scent application in modern skincare relies on two distinct industrial methods: core-scenting, which integrates fragrances into the base emulsion for uniform distribution, and sheet-spray technology, which applies mists post-formulation for rapid surface absorption and fragrance layering.

Core-Scenting: Internal Infusion for Fragrance Consistency

Manufacturers execute core-scenting by infusing fragrances directly into the lotion base during the primary production phase. This process ensures that aromatic compounds are distributed evenly throughout the entire volume of the product. To protect heat-sensitive ingredients, factories typically introduce these scents during the cooling phase after emulsification, specifically when the mixture stabilizes between 40-45°C. This timing prevents the degradation of delicate scent molecules, maintaining the integrity of the profile from production to consumer application.

The formulation phase blends signature scents with intensive moisturizing agents like shea butter, glycerin, and natural oils. This integration creates a lasting sensory experience where the fragrance is released gradually as the lotion is absorbed. This method supports a subtle release of floral, citrus, or vanilla notes that complement skin hydration without becoming overpowering. Luxury skincare lines increasingly use core-scenting to enhance emotional well-being while maintaining superior skin softness in 2026 market offerings.

Sheet-Spray Technology: Surface Delivery and Scent Layering

Sheet-spray technology utilizes a post-formulation application method where lightweight lotions or mists are applied to the surface of the paper or product. This technique is designed for rapid absorption on dry skin, offering an efficient solution for quick hydration. Because the delivery system creates a fine, even mist, the skin can absorb the moisturizing elements almost instantly without the heavy feel associated with traditional creams.

This application method is highly effective for on-the-go use, providing immediate comfort through tropical or spa-inspired scents such as coconut and bergamot. A significant advantage of this approach is that it allows consumers to layer scents effectively with other personal perfumes, extending the fragrance’s wear throughout the day. Standard industry practices for 2026 focus on using spray lotions to add aesthetic shimmer or light botanical oils to the skin surface without leaving a greasy residue.

Build Your Unique Toilet Paper Brand with 30 Years of OEM Expertise

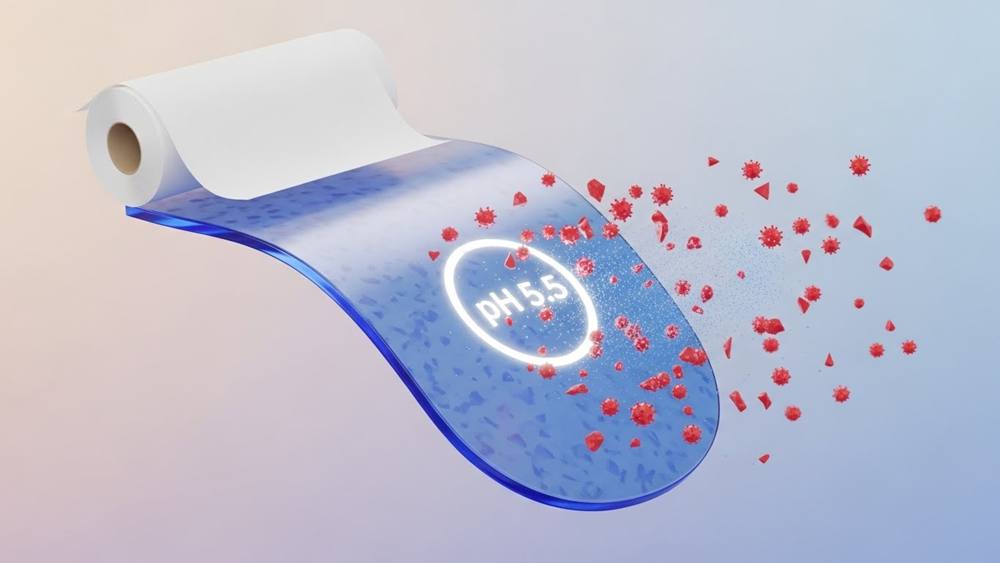

Dermatological Testing and PH Neutrality (Target 5.5)

Formulating hygiene products at a pH of 5.5 stabilizes the skin’s natural acid mantle, preventing moisture loss and protecting the cutaneous barrier against environmental pathogens and irritation.

Maintaining the Skin Acid Mantle at pH 5.5

Human skin functions optimally within a pH range of 4.5 to 5.5. This specific acidity maintains the integrity of the acid mantle, a thin film on the skin’s surface that acts as a primary defense mechanism. When hygiene products match this natural 5.5 pH level, they help prevent trans-epidermal moisture loss and stop environmental pathogens from colonizing the skin surface.

Modern hygiene solutions focus heavily on bio-compatibility. By aligning the product’s chemical profile with the skin’s biology, manufacturers ensure that frequent tissue or wipe use does not cause inflammatory responses. This approach is essential for users with sensitive skin who require consistent protection without the risk of disrupting their natural microbial balance.

Verification Protocols for Material Safety and Stability

Top Source Hygiene utilizes 100% virgin wood pulp free from fluorescent whiteners. This selection removes the risk of chemical-induced pH spikes that often occur with recycled or heavily bleached materials. By avoiding harsh bleaching agents, the base material remains inert and supportive of the final pH-neutral formulation.

Strict quality control measures involve multi-stage dermatological testing to confirm the stability of topically applied additives. Testing teams verify that lotions or infusions do not migrate or change chemical composition over time. Compliance with FDA and ISO 9001 standards ensures these pH-neutral formulations remain effective across diverse climates, maintaining safety and performance for global markets.

Managing Shelf Life and Fragrance Longevity

Lotion shelf life typically spans one to three years unopened, while opened products remain effective for six to twelve months. Fragrance longevity on the skin varies by formulation density, with light lotions lasting two to four hours and rich treatment creams persisting for up to eight hours.

Stability Standards for Unopened and Opened Products

Product stability depends largely on the base ingredients used during manufacturing. Water-based formulas maintain integrity for two to three years, while oil-based products often reach a four-year shelf life when unopened. Once users break the seal, the Period After Opening (PAO) standard dictates safety. Most commercial lotions require use within 6 to 12 months to ensure efficacy and prevent spoilage. Natural and organic infusions follow stricter timelines, usually expiring within three to six months due to higher microbial risks found in modern organic formulations.

Factors Influencing Fragrance Retention on Skin

Lotion density directly dictates how long a scent remains detectable after application. Light body lotions provide a shorter fragrance window of two to four hours. In contrast, rich treatment creams with higher emollient content extend scent retention up to eight hours. Hand lotions face the greatest challenge, often losing fragrance within one to three hours as frequent washing removes the carrier oils and scent molecules. Users can improve molecular adhesion and fragrance projection by applying scented products to skin that is already moisturized.

Preservation Strategies and Storage Optimization

Effective preservation prevents bacterial growth and maintains chemical stability throughout the product’s life. Manufacturers include stabilizers like phenoxyethanol and benzyl alcohol to protect water-based infusions in large containers. Packaging design also plays a role in longevity; airless pumps and specialized spatulas reduce contamination and limit the oxidation that degrades scent molecules. To protect active ingredients, store products in cool, dark environments. Avoiding high humidity in bathrooms prevents formula separation and maintains the intended scent profile over time.

Regulatory Compliance for Topical Additives (FDA/REACH)

Compliance for topical additives requires adherence to US FDA Modernization of Cosmetics Regulation Act (MoCRA) guidelines and European REACH standards. These frameworks mandate rigorous facility registration, safety substantiation, and the disclosure of potential allergens to ensure consumer protection and product stability in global markets.

FDA Framework and MoCRA Guidelines

Current FDA cosmetic regulations for lotions and scent infusions do not require premarket approval for the majority of ingredients. The exception remains color additives, which must undergo specific FDA certification before use. We manage safety by ensuring products are neither adulterated nor misbranded under customary conditions of use.

The Modernization of Cosmetics Regulation Act (MoCRA) represents a significant shift in oversight, introducing mandatory facility registration and adverse event reporting. These requirements, rolling out through 2026, ensure that manufacturers maintain updated records and provide transparency regarding the safety of their topical formulations.

Ingredient labeling demands precise accuracy, with components listed in descending order of concentration. Special attention is given to moisturizing agents and ingredients like petrolatum; if these substances involve drug-related claims such as “skin protection,” the product must comply with both cosmetic and over-the-counter drug labeling standards.

REACH and European Safety Standards

Entering the European market involves navigating REACH registration for any chemical substance exceeding one ton per year. This process provides the European Chemicals Agency with essential safety data for all topical additives, ensuring that raw materials do not pose long-term environmental or health risks.

EU Regulation (EC) 1223/2009 sets the benchmark for finished cosmetic products. This law mandates a formal safety assessment and the designation of a Responsible Person based in Europe to oversee product compliance. This individual ensures that the safety report remains accessible to authorities and reflects the latest toxicological data.

Scent infusions face specific scrutiny regarding allergens. European rules identify 26 scent allergens that must appear on packaging if their concentration exceeds 0.001% in leave-on products. This level of detail allows consumers with sensitivities to make informed choices and reduces the risk of contact dermatitis.

Restricted Ingredients and Safety Substantiation

Formulations strictly exclude prohibited substances to prevent skin penetration and systemic toxicity. We avoid materials such as Bithionol, which causes photocontact sensitization, and Chloroform, which is recognized as a carcinogen. These exclusions are vital for maintaining the “clean” or “luxury” status required by B2B buyers.

Safety protocols limit Hexachlorophene to levels below 0.1% and prohibit the use of zirconium complexes in aerosol-based scent applications. These restrictions specifically target risks related to lung toxicity and the formation of granulomas, ensuring that fragrance delivery systems remain safe for the respiratory system.

Safety substantiation through 2026 focuses on preventing adulteration during the manufacturing process. By conducting stability testing and verifying the purity of all additives, we ensure that infusions remain effective and non-irritating throughout their entire shelf life, regardless of global distribution conditions.

Marketing “Hypoallergenic” Status to B2B Buyers

Hypoallergenic formulations capture nearly 48.5% of the itchy skin relief market, with 2026 valuations expected to exceed USD 2 billion based on a 8.2% annual growth rate. Professional procurement teams prioritize these products to address rising skin sensitivities, leveraging clinical validation to justify premium pricing and meet strict international safety standards like MoCRA and the EU Cosmetics Regulation.

Projected Market Demand and Revenue Potential in 2026

Hypoallergenic formulations currently secure nearly half of the global itchy skin relief market. Projections indicate valuations will exceed USD 2 billion by 2026, supported by a steady 8.2% annual growth rate. Professional procurement officers increasingly favor fragrance-free options, which now represent over 52% of global sales in the sensitive skin body lotion segment. Market data shows that 68% of new cosmetic entries prioritize minimal-irritation profiles to address rising skin sensitivities caused by environmental factors. In Europe, 72% of manufacturers now integrate plant-based, dermatologically tested ingredients to meet strict regional transparency and safety standards.

Value Propositions for Boutique and Medical Brand Managers

Boutique owners leverage dermatologist-endorsed narratives to target the adult demographic, which controls nearly 60% of the high-margin skincare market. In the Asia-Pacific region, veteran brand managers focus on the pediatric and elderly segments, both of which exhibit double-digit growth in demand for specialized hygiene products. Hypoallergenic status serves as a critical differentiator in high-end retail, justifying premium price points for B2B clients. Pharmacy and drugstore channels maintain a 51% share of distribution, reinforcing the necessity for clinical trust within the B2B supply chain.

Overcoming Formulation Costs and Consumer Skepticism

While formulation costs impact 49% of smaller producers, B2B pitches emphasize that hypoallergenic status offsets these initial expenses through increased brand loyalty. Third-party clinical validation acts as a vital sales tool to counter the 46% skepticism rate among consumers regarding unverified skincare claims. Incorporating barrier-repair ingredients like ceramides and niacinamide helps brand managers align with the 2026 trend for therapeutic, active-care hygiene products. Regulatory compliance with the EU Cosmetics Regulations and FDA standards remains a non-negotiable requirement for securing successful international B2B partnerships.

Frequently Asked Questions

Is scented toilet paper safe for sensitive skin?

Experts generally do not recommend scented toilet paper for sensitive skin. The fragrances, dyes, and bleaching agents can cause contact dermatitis, redness, and itching. These chemicals also disrupt the natural pH balance of sensitive areas, which increases the risk of infections.

What are the benefits of aloe-infused toilet paper?

Aloe vera adds a soothing, moisturizing layer to the paper that reduces skin irritation and redness. This infusion creates a smoother tactile experience, benefiting premium retail markets and medical environments where patient comfort is a priority.

How do factories apply scents to the paper rolls?

Manufacturers typically apply fragrances or essential oils during the cooling phase of production once the mixture reaches 40-45°C. This specific temperature range protects heat-sensitive ingredients from breaking down and ensures the scent remains stable and evenly distributed.

Does lotion application affect paper absorbency?

Lotion reduces absorbency because the oils are often hydrophobic, coating the paper fibers and slowing down liquid intake. To solve this, factories use targeted application methods that deliver enough lotion for skin transfer while maintaining the functional ability to absorb moisture.

What is pH-neutral toilet paper and why should buyers care?

PH-neutral toilet paper maintains a level near 7.0, preventing the degradation of paper fibers and reducing skin irritation. Unlike standard paper bleached with chlorine, pH-neutral options often utilize hydrogen peroxide, making them safer for sensitive skin and more compatible with septic systems.

Are the scents used in toilet paper hypoallergenic?

Most fragrances used in toilet paper are not hypoallergenic and remain common triggers for skin inflammation and allergic reactions. For a product to be truly hypoallergenic, it must typically remain fragrance-free, dye-free, and processed without harsh chemicals like chlorine.

Final Thoughts

The shift toward active care means hygiene products now act as functional skin protection tools. Brands that use ingredients like aloe vera and Vitamin E meet a growing demand for dermatological health in daily routines. This movement pushes manufacturers to refine how they stabilize emulsions and manage pH levels to ensure safety and comfort for a diverse user base.

Procurement teams prioritize products that align with safety standards like MoCRA and REACH while offering verified hypoallergenic benefits. Businesses that invest in advanced scent application and shelf-life stability gain a competitive edge in the premium retail and medical sectors. Success in this evolving market relies on balancing technical formulation with transparent clinical validation to build long-term trust with consumers.