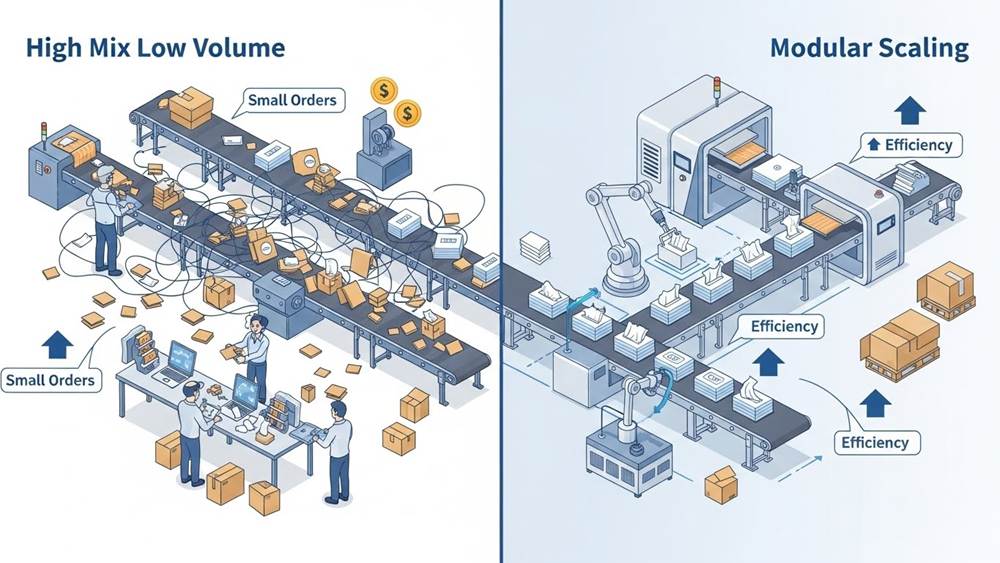

For B2B startups and SMEs, the path to importing high-volume paper goods is often blocked by the “High Mix Low Volume” (HMLV) dilemma—a cycle of low initial capital, high per-unit costs, and the daunting requirement of massive upfront tooling. Scaling successfully requires moving beyond the traditional OEM mindset and adopting modular strategies that allow for industrial-grade quality without the prohibitive entry costs of mass production.

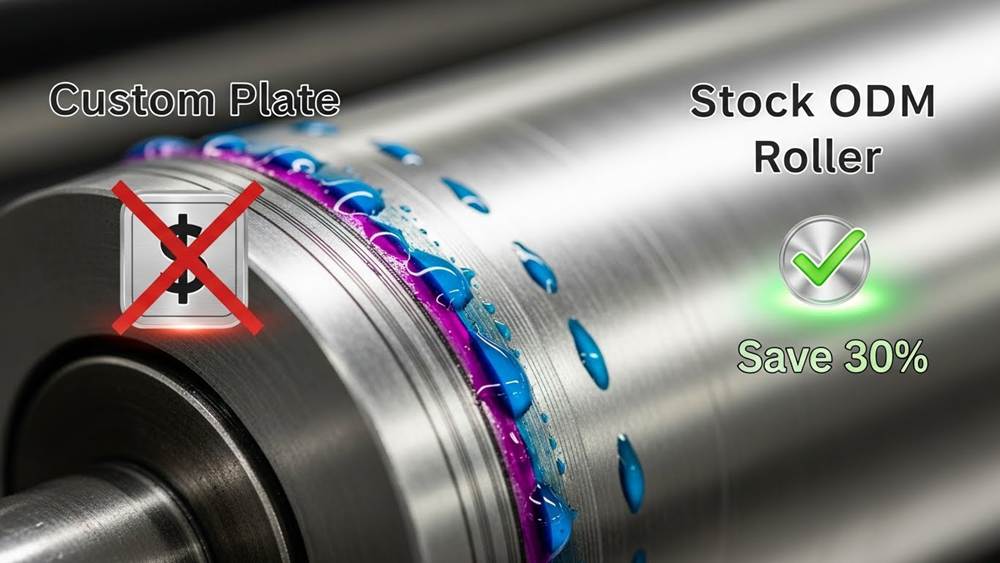

This article provides a technical roadmap for small business sourcing, covering everything from the Six M’s framework to the logistics of transitioning from LCL to FCL at the critical 15 CBM inflection point. You will learn how to bypass custom plate charges using stock ODM designs to reduce costs by up to 30%, manage cash flow with the standard 30/70 deposit model, and optimize container utilization to reach 90% volume density while maintaining agile 15-25 day production lead times.

The SME Dilemma: High Volume Product, Low Initial Capital

Small businesses face a High Mix Low Volume (HMLV) challenge where low initial capital forces smaller production runs with higher per-unit costs. To overcome this, SMEs must transition from custom, high-setup processes to modular strategies that allow for lower per-unit pricing without the massive upfront tooling costs of traditional mass production.

Understanding HMLV vs. LMHV Cost Dynamics

High Mix Low Volume (HMLV) manufacturing presents a significant hurdle for small-to-medium enterprises (SMEs) due to the inverse relationship between batch size and operational overhead. In HMLV environments, SMEs encounter elevated setup costs and extended lead times, primarily because limited order scales require frequent design changeovers. This lack of continuity prevents the realization of economies of scale, making these businesses more vulnerable to demand fluctuations compared to established Original Equipment Manufacturers (OEMs) who operate on massive, predictable cycles.

The fundamental economic conflict lies in the gap between HMLV flexibility and the efficiency of Low Mix High Volume (LMHV) lines. While LMHV processes utilize streamlined, repetitive automation to drive down per-unit costs through massive initial investments, SMEs often face “minimum charges” for raw materials, such as single metal sheets or specialized paper grades. This discrepancy forces a capital-efficient approach where production must be optimized to find micro-economies of scale—buying only what is needed for specific runs—without the financial backing required for large-scale industrial infrastructure.

To bridge this gap, SMEs must identify ways to access high-capacity manufacturing lines without the requisite capital for traditional minimum order quantities. For instance, while global production centers like Top Source Hygiene output nearly 2,860 tons monthly, an SME’s strategy involves leveraging modular automation and flexible quality checks rather than bespoke lines. This allows for rapid design validation and the use of 40-foot high-cube (40’HQ) container capacities through consolidated or modular sourcing rather than individual high-investment runs, reducing the barrier to entry for high-volume paper goods.

The Six M’s Framework for Capital-Efficient Sourcing

A technical roadmap for capital-efficient sourcing begins with decoupling high-volume standard components from custom elements. By utilizing the Six M’s framework—specifically Method and Machine—SMEs can replace dedicated, expensive dies with flexible tools like 5-axis laser cutters or reprogrammable robotics. This modular approach allows for rapid changeovers, reducing the time from design to production from months to mere days or weeks while minimizing the initial tooling expenses that often drain SME capital reserves before a product even reaches the market.

Material sourcing strategy is the next pillar of the framework, focusing on cash flow optimization through targeted raw material procurement. Instead of falling into the “overstock” trap of bulk purchasing to achieve nominal discounts, SMEs should focus on sourcing materials that fulfill immediate production requirements. This opportunistic sourcing allows for finding economies of scale on a per-job basis while avoiding the immobilization of capital in unused inventory that may not meet future design iterations or shifting market compliance standards.

Finally, maintaining global standards such as ISO 9001 and FDA compliance is essential for ensuring that even small initial batches are viable for international retail and hospitality sectors. By utilizing production lines that already meet FSC-certified or other sustainability criteria, SMEs can achieve high-tier quality benchmarks without the need for bespoke, capital-intensive quality control setups. This focus on “Measurement” (final product checks over process stability) enables competitiveness in specialized niches where low volume is the norm but precision and safety certifications remain non-negotiable.

LCL (Less than Container Load) vs. FCL Strategy

LCL is the most cost-effective solution for small shipments between 2–13 CBM, while FCL becomes the optimal strategy once volume exceeds 15 CBM. FCL offers a 4–7 day speed advantage and significantly lower risk of damage due to reduced handling and single-seal containment.

The Volume Inflection Point: When to Transition from LCL to FCL

Shipping strategies for industrial paper products are primarily dictated by cubic meter (CBM) thresholds and specific cost structures. LCL is the optimal choice for shipments ranging between 2–13 CBM, utilizing a pay-per-CBM model that effectively minimizes capital waste for low-volume orders. This model allows smaller enterprises to maintain inventory flow without the significant upfront cost of a full container load.

The 15 CBM mark represents the critical inflection point where FCL’s fixed-rate container pricing distributes logistics costs more efficiently than LCL consolidation and deconsolidation fees. While LCL technically permits a weight-to-volume ratio of up to 10 tons (20,000 lbs) per CBM—making it ideal for high-density goods—paper products are volume-heavy and typically reach container volume limits long before hitting the 67,200 lbs gross weight maximum of a 40-ft container.

Top Source Hygiene’s standard Minimum Order Quantity (MOQ) of one 40-foot HQ container is strategically designed to align with the high-turnover requirements of veteran-tier distributors. Conversely, LCL shipping options support the novice tier’s cash-flow constraints, allowing for initial market entry and testing before committing to the full-scale containerized volume required for stabilized demand.

Operational Risk and Transit Efficiency: Speed vs. Security Trade-offs

Beyond direct shipping costs, operational efficiency serves as a primary differentiator between shipping modes. FCL shipments typically achieve a 4–7 day speed advantage over LCL because they bypass the time-consuming consolidation at origin and deconsolidation at destination Freight Stations (CFS). This direct routing is essential for maintaining lean supply chains and responding to rapid market fluctuations.

For fragile paper products like facial tissues and napkins, LCL’s multiple handoffs significantly increase exposure to environmental contamination and physical damage. FCL offers the distinct security benefit of single-seal containment from the Mancheng factory directly to the destination, which drastically reduces the probability of theft, loss, and moisture-related quality degradation during transit.

Technical capacity modeling shows that once a business scales beyond the 15+ CBM mark, the transition to FCL provides a more secure and predictable logistics framework. By utilizing a 20-ft or 40-ft container, businesses can leverage superior unit economics and fixed-rate pricing while ensuring the structural integrity of the cargo through reduced handling and direct door-to-door or port-to-port delivery.

Using “Stock” Designs to Bypass Plate Charges and MOQs

Stock designs allow small businesses to bypass plate charges and high MOQs by utilizing pre-existing inventory or production setups. By choosing off-the-shelf ODM products, buyers can reduce unit costs by 10-30% and enter the market with lower capital, avoiding the fixed setup expenses associated with custom engraving and machine configuration.

| Cost Component | Stock Design Impact | Financial/Operational Benefit |

|---|---|---|

| Setup & Tooling | Utilizes existing factory molds and rollers | Elimination of upfront “Plate Charges” |

| Batch Efficiency | Aligns with standard manufacturing cycles | 10-30% reduction in per-unit costs |

| Procurement Speed | Bypasses custom sampling and engraving | Reduces lead times by 10+ days |

The Mechanics of Stock Designs: Eliminating Fixed Setup Costs

Factories enforce Minimum Order Quantities (MOQs) primarily to amortize fixed setup costs, which encompass machine configuration, raw material preparation, and labor scheduling. In high-volume environments, small production runs are economically unviable because the overhead costs per unit are typically 10-30% higher than standard batches. Custom designs exacerbate this issue by triggering “plate charges”—the capital required for engraving new printing rollers or creating custom screens. By selecting “stock” or Original Design Manufacturer (ODM) molds, buyers bypass these fixed recovery costs entirely.

Manufacturers like Top Source Hygiene leverage over 30 years of technical expertise to offer a library of standard specifications, ranging from 2-ply to 5-ply tissue products. These standard variants utilize existing production line configurations, ensuring quality stability and avoiding the variance risks associated with new machine setups. For a small-to-medium enterprise, this means accessing industrial-grade quality without the prohibitive entry costs of custom tooling.

Strategic Implementation: Lowering Entry Barriers via ODM

Small buyers can effectively negotiate lower MOQs by selecting “off-the-shelf” inventory or participating in residual production batches. This strategic choice allows for rigorous market testing without the capital tie-up of a full 40’HQ container. While trading volume for a slight per-unit premium is often necessary for smaller runs, this approach preserves cash flow for marketing and distribution. The use of standard factory variants—such as virgin wood pulp with existing embossing patterns—provides the necessary agility for scaling brands.

Operational efficiency is also gained through significantly reduced lead times. Utilizing stock designs typically enables a 15-25 day delivery window, as it avoids the 10-day delay usually required for custom plate manufacturing and sampling approvals. This streamlined procurement process allows e-commerce and CPG brands to react faster to market demand while maintaining a lean inventory model that minimizes the risk of overproduction or stockouts.

Build Your Unique Brand with Leading OEM Toilet Paper Manufacturing

Crowdfunding and Group Buying for Paper Products

Crowdfunding and group buying allow small businesses to aggregate demand to meet the high Minimum Order Quantities (MOQs) typical of paper manufacturers, such as the 40’HQ container standard. By validating market interest through pre-orders, SMEs can secure the capital needed for custom OEM branding while benefiting from factory-direct bulk pricing.

Market Validation and the RWW Framework for Paper Goods

The “Real-Win-Worth” (RWW) framework provides a disciplined approach for SMEs to evaluate paper product viability before committing to large-scale industrial runs. By launching campaigns based on proof-of-principle prototypes, developers can gather critical backer feedback to assess technical feasibility and regional compliance, such as FDA or EU hygiene standards. This strategic validation ensures the “worth” of the project by confirming demand for specific material attributes—such as 3-ply to 5-ply thickness or eco-friendly bamboo fibers—thereby mitigating the capital risk associated with unsold inventory and high-volume manufacturing commitments.

Aggregating Volume to Meet 40’HQ Container Thresholds

Meeting the 40-foot high-cube (40’HQ) container threshold is essential for achieving the unit-cost efficiencies required for competitive retail. Group buying models enable multiple small-to-medium enterprises to coordinate their purchasing power, reaching the standard MOQs required by major manufacturers like Top Source Hygiene. Incorporating value-added propositions, such as FSC-certified wood pulp or sustainable material certifications, can drive the 30% sales surges typically observed in green retail segments. To maintain backer trust, campaign timelines must be meticulously aligned with the 20-25 day production lead times and established global shipping routes, ensuring transparent communication regarding fulfillment schedules.

Leveraging 3PL Warehousing for “Direct to Consumer” (DTC)

3PL providers allow SMEs to scale DTC operations by outsourcing storage and fulfillment. By utilizing 3PL networks, brands can provide 2-day delivery, optimize shipping costs via DIM weight reduction, and maintain real-time inventory oversight through WMS integrations, effectively transforming bulk pallet-level imports into individual customer shipments.

WMS Integration and Systematic Inventory Management

Modern 3PL providers facilitate seamless DTC operations through advanced Warehouse Management System (WMS) integration. By establishing API or EDI connectivity between an e-commerce storefront and the warehouse system, small businesses gain real-time visibility into stock levels across the entire network. This connectivity ensures that inventory data is synchronized, preventing overselling and enabling automated replenishment alerts when stock dips below predefined thresholds.

During the onboarding phase, a technical SKU velocity analysis is conducted to determine the most efficient warehouse slotting strategy. For high-volume paper products such as facial tissues or toilet paper, items are positioned in high-accessibility zones to minimize pick times and optimize labor. This systematic approach, combined with the use of barcodes and RFID tags for quality checks upon receipt, ensures high accuracy in inventory logging and stock maintenance from the moment goods arrive at the facility.

The financial model for these services typically involves structured fees including monthly storage costs calculated per pallet position. Additionally, fulfillment costs are managed through pick and pack fees charged per order or per line item. This allows SMEs to transform fixed infrastructure costs into variable expenses that scale directly with their sales volume, providing a lean operational model for managing bulky paper goods without investing in private warehousing or equipment.

Fulfillment Economics: SLAs, DIM Weight, and Shipping Speed

Efficiency in DTC logistics is largely defined by the ability to provide 2-day ground delivery without the need for expensive air transit. By leveraging a 3PL’s nationwide warehouse coverage, brands can reach a broad consumer base within the standard shipping window. This geographical advantage is critical for maintaining competitiveness in the e-commerce landscape where shipping speed is a primary factor in customer satisfaction and conversion rates.

Shipping costs for paper products are often dictated by Dimensional (DIM) weight rather than actual weight, given their bulky nature. 3PL providers utilize box optimization strategies to select the most efficient packaging, significantly reducing the DIM weight and associated postage costs. This specialized handling ensures that lightweight but high-volume items are shipped at the lowest possible price point while maintaining product integrity throughout the last-mile transit process.

Operational performance is governed by strict Service Level Agreements (SLAs) that mandate specific targets for order accuracy, on-time shipping percentages, and returns processing cycles. To maintain product hygiene and stock freshness, 3PLs implement FEFO (First-Expired, First-Out) or FIFO (First-In, First-Out) inventory management protocols. These systematic rotations, often involving pallet-level movements via LTL carriers, ensure that inventory remains current and compliant with strict quality and hygiene standards.

Scaling Your Order Volume: The Roadmap from 1 Pallet to 1 Container

Scaling from one pallet to a full container requires a shift from LCL (Less than Container Load) to FCL optimization, focusing on Cubic Meters (CBM) and load density. By transitioning from palletized loads to floor loading, businesses can increase container utilization by over 15% and achieve volume utilization rates exceeding 90%, drastically reducing per-unit landed costs.

| Efficiency Metric | LCL / Palletized Logic | FCL / Floor Loading Logic |

|---|---|---|

| Volume Utilization | ~60% (due to height constraints) | 87.5% – 90.3% |

| Weight Utilization | Inconsistent | 98.2% – 99.4% |

| Dimensional Accuracy | Manual (2 min per unit) | Automated (<10 sec per unit) |

Navigating the CBM Transition: From LCL to FCL Logic

The transition from pallet-based pricing to Cubic Meter (CBM) calculations represents the most significant logistical shift for growing SMEs. As the standard unit for 20-ft and 40-ft container logistics, CBM allows for a more granular understanding of shipping costs. While a standard 20-ft container typically holds 10 standard pallets, focusing purely on pallet counts often leads to “shipping air”—unused space that increases per-unit landed costs. Transitioning to FCL logic requires aligning total order volume with these container benchmarks to maximize every square inch of available space.

To avoid carrier fees triggered by dimensional weight or overhang errors, technical teams must employ CBM calculators to determine exact fitment. Digital precision is critical; automated dimensioning systems can now capture length, width, and height with millimeter accuracy, ensuring that digital fingerprints are perfectly integrated into Warehouse Management Systems (WMS). Leveraging Top Source Hygiene’s 15-25 day production lead times further enables businesses to synchronize high-volume manufacturing output with global shipping windows, facilitating a seamless move from fragmented LCL shipments to consolidated FCL units.

Optimizing Load Density: Floor Loading and Cube Utilization

Maximizing ROI on freight spend necessitates an advanced look at load density. Standard 60-inch palletized stacks often leave up to 40% of a container’s vertical space unused because they cannot be easily double-stacked. Implementing floor loading strategies—where goods are loaded directly onto the container floor without pallets—can increase utilization by more than 15%. This method allows businesses to target benchmark volume utilization rates of approximately 90.3%, effectively turning the shipping container into a high-density mobile warehouse.

For businesses dealing with diverse product catalogs, balancing mixed-product loads is essential for achieving a 100% fill rate. By utilizing electronic pallet-building instructions, shippers can strategically combine heavy items, such as jumbo parent rolls, with lighter products like facial tissues. This balancing act ensures the container reaches its weight limit (99.4% utilization) and volume limit simultaneously. By employing automated systems to capture data in under 10 seconds, companies can maintain the speed of high-volume cross-docking operations while ensuring total compliance with international transport limits.

Cash Flow Management for High-Turnover Goods

Effective cash flow management for high-turnover paper goods involves balancing rapid inventory cycles with structured payment terms, typically utilizing a 30/70 deposit model and optimizing lead times (15–25 days) to ensure continuous supply without over-leveraging capital.

Liquidity Cycles and Inventory Optimization Strategies

For SMEs, the optimization of liquidity cycles begins with the implementation of ABC Analysis to prioritize high-volume commodities, such as toilet paper and jumbo rolls, over lower-frequency specialty items. This prioritization ensures that working capital is allocated where turnover velocity is highest. To further reduce the burden of warehousing costs, Just-In-Time (JIT) inventory management is recommended to minimize capital locked in slow-moving stock. Furthermore, Economic Order Quantity (EOQ) modeling should be meticulously tailored for 40-foot high-cube (40’HQ) containers to maximize shipping efficiency and reduce the total landed cost per unit. Ultimately, improving cash-to-cash cycle times requires a precise alignment of retail sales velocity with recurring replenishment schedules to maintain a continuous, self-funding supply chain.

Strategic Payment Terms and Logistical Lead Time Management

Navigating the technical financial constraints of the global paper trade requires strict adherence to standard T/T and L/C payment structures, which typically involve a 30% deposit upfront with the remaining 70% balance due upon shipping or completion. Effective cash flow forecasting must integrate manufacturing lead times of 15–25 days alongside geographic shipping variability; transit times can range from 7–14 days for North American routes to 25 days for regions such as Africa and South America. To mitigate financial risk, businesses should source exclusively from factories holding ISO 9001 and FSC certifications to prevent quality-related returns or inventory write-offs. By leveraging factory-direct pricing and eliminating intermediary markups, SMEs can directly improve their net profit margin per unit and maintain healthier liquidity levels.

Final Thoughts

For a startup or SME, the path to profitability in the competitive paper goods sector lies in the strategic bridge between operational flexibility and industrial scale. By leveraging modular sourcing, utilizing stock designs to bypass prohibitive plate charges, and precisely timing the transition from LCL to FCL at the 15 CBM inflection point, businesses can navigate the high-volume demands of the industry without a crippling initial capital drain. Success in this space is defined by a focus on unit economics and container utilization, transforming the logistical hurdles of bulky products into a sustainable competitive advantage.

Ultimately, scaling a paper import business requires a meticulous blend of technical logistics and disciplined financial oversight. Implementing robust inventory frameworks like ABC analysis and JIT replenishment, supported by 3PL-backed DTC fulfillment, allows emerging brands to achieve the efficiency of global OEMs while remaining agile. By mastering these micro-economies of scale and maintaining strict quality standards through certified factory-direct partnerships, SMEs can build the operational resilience necessary to evolve from niche market entrants into dominant, high-turnover distributors.